Taekwang Claims Affiliate and Holding Company Cash Support

Alleges Opaque Purchase Price Determination

Despite Injunction Dismissal, "Legal Review" Continues

Past Troubled Acquisition of Woori Home Shopping

Interpreted as Escalation for Checks and Balances

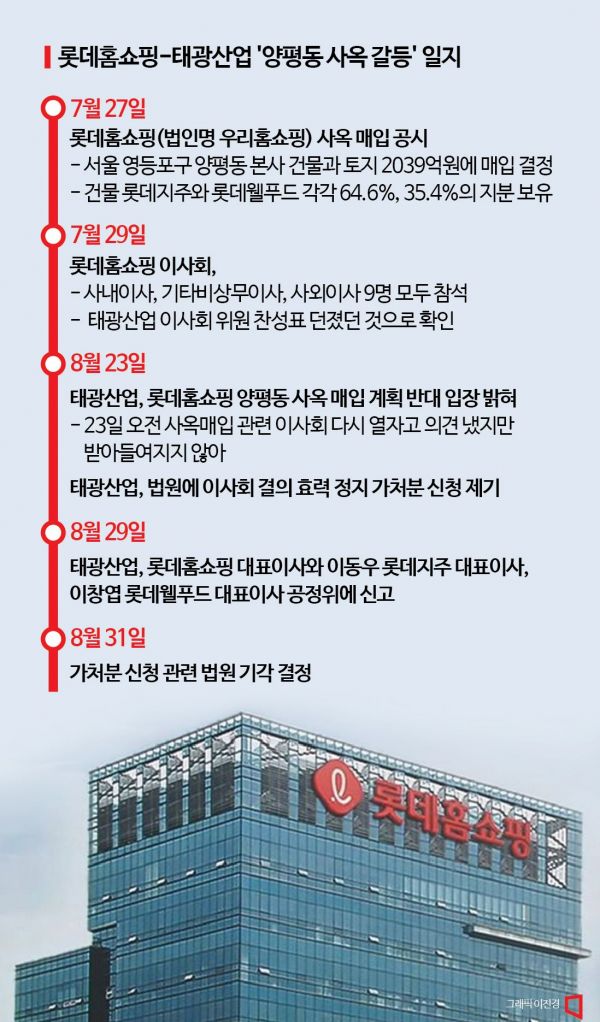

Lotte Homeshopping (corporate name Woori Homeshopping) is set to engage in a legal dispute with its second-largest shareholder, Taekwang Industrial, over the purchase of its Yangpyeong-dong headquarters. Taekwang Industrial has expressed its intention to go to court, claiming there were issues in the acquisition process of the Lotte Homeshopping headquarters. Despite the court dismissing Taekwang Industrial's injunction request last month to block the purchase, Taekwang Industrial is taking a tough stance, stating it will prove illegal activities through other means.

According to a comprehensive report by Asia Economy on the 5th, Lotte Homeshopping completed the payment and registration of the building related to the Yangpyeong-dong headquarters in Yeongdeungpo-gu, Seoul, on the 1st, with Lotte Corporation (holding 64.6% stake) and Lotte Wellfood (35.4%) as the parties involved. This marks the first time in over 10 years since 2010 that Lotte Homeshopping has become the owner of the building. This decision was made unanimously by all nine directors, including representatives from Taekwang Industrial, at the board meeting on July 29. Taekwang Industrial is the second-largest shareholder (44.89%) following Lotte Homeshopping (53.49%) and holds three non-executive directors on the board.

Taekwang Industrial’s stance changed abruptly at the end of last month. It suddenly filed an injunction to suspend the board’s effectiveness, opposing Lotte Homeshopping’s purchase of the headquarters. Upon reconsideration, it views the acquisition as an act to provide cash support to affiliates and the holding company. Both Lotte Corporation and Lotte Wellfood have weakened cash-generating capabilities; Lotte Corporation’s free cash flow is expected to turn negative this year from 148 billion KRW last year, while Lotte Wellfood is projected to slightly improve from -33.3 billion KRW last year to 8 billion KRW this year.

Taekwang Industrial also criticizes the opaque process of determining the purchase price to support affiliates. It claims that Lotte Homeshopping inflated the appraisal price by 30 billion KRW by not applying the cost approach stipulated in real estate construction laws but instead using a weighted average of the cost approach, comparable transaction method, and income capitalization method at a ratio of 20:40:40. However, according to appraisal industry experts, it is common to use comparable transaction and income capitalization methods alongside the cost approach when appraising corporate buildings rather than apartments or general houses, so not using only the cost approach does not necessarily constitute illegal conduct.

The court ruled against Taekwang Industrial’s injunction request on the 31st, siding with Lotte Homeshopping. Nevertheless, Taekwang Industrial is determined to continue the fight, stating it will proceed with legal reviews including breach of trust. On the 29th of last month, it also filed a complaint with the Fair Trade Commission against Kim Jae-gyeom, CEO of Lotte Homeshopping; Lee Chang-yeop, CEO of Lotte Wellfood; and Lee Dong-woo, CEO of Lotte Corporation, alleging unfair support practices. Under the Fair Trade Act, unfair support refers to a business operator providing excessive economic benefits to affiliates through funds or assets under substantially favorable conditions. A Taekwang Industrial official said, “It is not yet known whether the Fair Trade Commission will initiate an investigation, but independently of that, we are reviewing all possible legal measures.”

In response, Lotte Homeshopping and Lotte Corporation have dismissed the claims as “irrational” and have not taken official countermeasures. Regarding Taekwang Industrial’s core allegations, they emphasized, “The purchase price determination process underwent full legal review, so there is no possibility of unfair support.” They also stated that if Taekwang Industrial takes legal action, they will respond legally in kind.

Industry insiders say the likelihood of Taekwang Industrial winning a court battle is low. The matter was decided through proper procedures at the board meeting, and the building was not purchased at a price higher than the market value. It is also said that the uncomfortable relationship that has persisted since the acquisition of Lotte Homeshopping is influencing the current situation. When Lotte Shopping acquired Woori Homeshopping shares from Kyungbang in 2006, Taekwang Industrial was a competing company. After failing to acquire additional shares and with its plan to enter live homeshopping canceled, Taekwang Industrial remained the second-largest shareholder and has continued to exert influence over Lotte Homeshopping’s management. The uncomfortable relationship is evident even in the corporate name; changing the corporate name to Lotte Homeshopping requires amending the articles of incorporation, which cannot be done without Taekwang’s consent at the board meeting.

There is also analysis that Taekwang Industrial is escalating the situation to assert its presence. Last October, Taekwang Industrial showed significant displeasure over reports that Lotte Homeshopping was considering providing 500 billion KRW in financial support when Lotte Construction’s liquidity was depleted. The actual support to Lotte Construction was reduced to 100 billion KRW. An industry insider said, “Taekwang Industrial probably does not see this as a winnable fight but appears to be preparing for a legal battle as a means to check Lotte Homeshopping.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.