The so-called 'dual pricing' phenomenon, where prices vary significantly even within the same apartment complex in Seoul's jeonse market, is subsiding. This is analyzed to be due to the decline in new jeonse contract deposits influenced by the weakening jeonse prices and reverse jeonse effects.

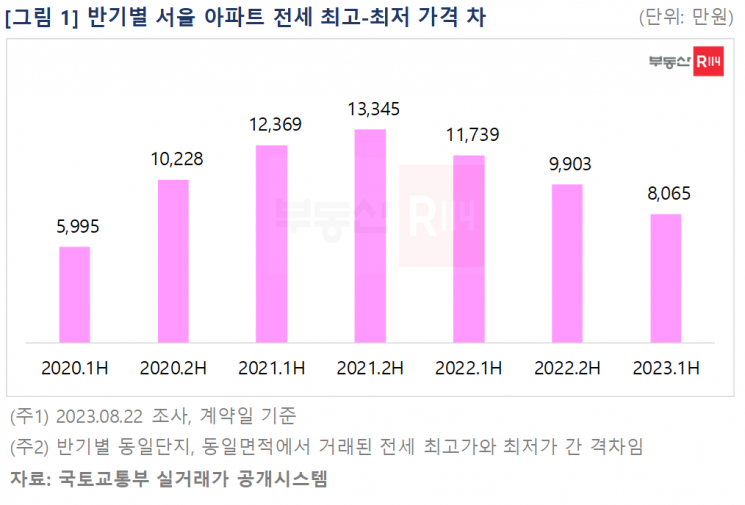

On the 29th, Real Estate R114 compared jeonse prices semiannually since 2020 using actual transaction data from the Ministry of Land, Infrastructure and Transport. The gap between the highest and lowest deposits began to widen from the second half of 2020, after the implementation of the Lease Protection Act, peaking at 133.45 million KRW in the second half of 2021. Since then, it has gradually narrowed to 80.65 million KRW in the first half of this year.

The reason for the easing of the dual pricing phenomenon is that the prolonged weakening of Seoul apartment jeonse prices has led to a downward leveling of new deposits to renewal levels. Looking at cases where more than one jeonse contract occurred within the same complex and area in Seoul, the new contract deposit decreased by about 130 million KRW from 661.59 million KRW in the second half of 2021 to 524.53 million KRW in the first half of this year. Meanwhile, deposits for jeonse contracts other than new contracts maintained an average in the mid-500 million KRW range.

A representative from Real Estate R114 said, “Although new apartment contract deposits in Seoul showed a declining trend until the first half of this year, jeonse prices reversed to an upward trend since last month, and with steady inflow of new jeonse demand into apartments, the levels will gradually recover to previous standards. As jeonse prices shift to an upward trend, the dual pricing issue may resurface.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)