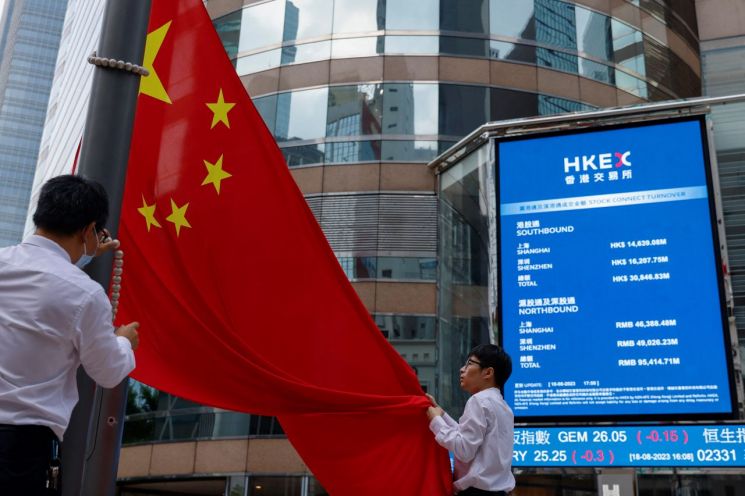

The Chinese stock market, which had been sluggish amid a real estate-driven economic crisis, made a surprising rebound on the 28th. The Chinese government's decision to cut the stock transaction stamp duty for the first time in 15 years to revitalize the stock market appears to have boosted investor sentiment.

On that day, the CSI300 index, which focuses on large-cap stocks, closed at 3752.62, up 1.17% from the previous session. The index surged as much as 5.5% shortly after the market opened but gave up most of the gains as profit-taking sales emerged. The Hang Seng Index also closed at 18,157.62, up 1.12% from the previous session. Since the beginning of the year, the CSI300 index has fallen 4.2% (based on the previous trading day's close), while the Hang Seng Index has plunged 9.2%.

The stock market stimulus measures announced by the Chinese government the day before acted as a driving force for the stock price increase. The Ministry of Finance of China announced that from that day, the stock transaction stamp duty would be lowered from the current 0.1% to 0.05%, half the previous rate. This is the first reduction in 15 years since the stamp duty was lowered to 0.1% during the 2008 global financial crisis when the stock market plummeted.

However, the effect of the stock market stimulus did not last until the market close. Bloomberg News evaluated that "the Chinese government's stock market stimulus measures fell short of investors' expectations."

Market participants agreed that stronger support measures are needed. Lewis Tse, director at Hong Kong investment firm Welsh Securities, said, "These measures may trigger an immediate rally in the Chinese stock market, but it is unclear how long the rally will last," and pointed out, "More fundamental and sustainable measures are necessary."

Separately, the China Securities Regulatory Commission also announced measures on the same day to slow down the pace of initial public offerings (IPOs), further regulate the reduction of major shareholders' stakes, and lower margin requirements. Earlier, on the 18th, the commission had announced stock market support measures that included reducing stock trading costs, supporting share buybacks, and introducing long-term investment incentives.

Earlier this year, China abandoned its zero-COVID policy and began reopening its economy, but economic recovery has been slow, and the stock market has continued to show weakness. Meanwhile, the real estate-driven crisis has spread to the financial sector, intensifying fears of a prolonged downturn.

Meanwhile, Evergrande, whose stock trading resumed that day, closed down over 81% on the Hong Kong stock market. Evergrande, which defaulted, had its trading suspended on March 21 last year and resumed trading on this day after 17 months.

The resumption of stock trading came just one day after Evergrande announced on the 27th that its losses in the first half of this year had significantly narrowed thanks to recent sales growth. Evergrande reported a net loss of 33 billion yuan in the first half of this year, about half of the 66.4 billion yuan loss in the same period last year. Revenue also increased by 44% to 128.2 billion yuan (approximately 23.3 trillion won). Debt slightly decreased from 2.44 trillion yuan at the end of last year to 2.39 trillion yuan (about 434 trillion won).

Earlier this month, Evergrande filed for bankruptcy protection under Chapter 15 of the U.S. Bankruptcy Code in Manhattan Bankruptcy Court, New York. Since the end of 2021, Evergrande has been at the center of the Chinese real estate sector crisis due to defaults, halted housing construction, and unpaid subcontractor fees.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)