Resumption of Stock Trading After 17 Months

Recorded $4.5 Billion Net Loss in First Half

Restructuring Critical with Bankruptcy Protection Filing in US

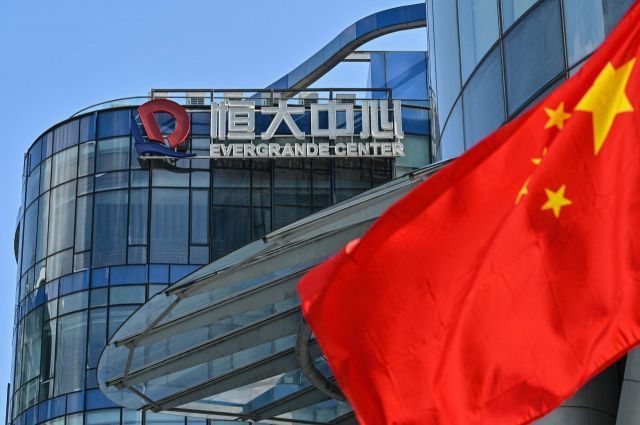

Evergrande, a real estate developer that declared default and brought a crisis to the Chinese real estate industry, recorded a loss of about $4.5 billion (6 trillion KRW) in the first half of this year. Despite this loss, Evergrande resumed trading on the Hong Kong stock market after 17 months.

According to Evergrande's annual report submitted to the Hong Kong Stock Exchange on the 25th, the company's consolidated net loss from January to June was 39.3 billion yuan (approximately 7.15 trillion KRW). Since declaring default in 2021, Evergrande has accumulated a net loss of 851.3 billion yuan, equivalent to about 154 trillion KRW, over two and a half years. Its debt reached 1.78 trillion yuan, a significant increase from 1.72 billion yuan last year. Evergrande's total assets stand at 1.74 trillion yuan.

Amid the substantial increase in losses and deficits, Evergrande is desperately seeking a turnaround. According to foreign media, Evergrande's stock trading resumed at 10:30 a.m. on the same day after a 17-month suspension. On the Hong Kong Stock Exchange, Evergrande started trading at 0.22 Hong Kong dollars (37.07 KRW), down 86.67% compared to March 18 of last year, just before the trading suspension.

On the 25th, Evergrande submitted documents to the Hong Kong Stock Exchange stating that it had fulfilled all conditions to lift the suspension order on its stock trading. Since delisting is decided if trading is suspended for more than 18 months, the company has put all its efforts into meeting the exchange’s conditions and restructuring. Evergrande stated, "We prioritize stabilizing company operations and resolving management difficulties, and we are doing our best to ensure stable housing supply."

On the 17th, Evergrande also filed for bankruptcy protection under Chapter 15 of the U.S. Bankruptcy Code in the Southern District of New York. Chapter 15 is a measure that prevents creditors in the U.S. from seizing assets while restructuring is underway in another country. Evergrande requested the court to recognize ongoing restructuring negotiations in Hong Kong, the Cayman Islands, and the British Virgin Islands. This month, Evergrande plans to gather creditors to vote on whether to approve the restructuring negotiations. Earlier, in April, Evergrande announced a restructuring plan to resolve $19.5 billion in offshore debt. At that time, 77% of investors holding Class A bonds supported the restructuring plan, but only 30% of Class C bond investors voted in favor. Approval of the debt restructuring requires the consent of 75% of creditors.

Evergrande is known as the epicenter of the Chinese real estate crisis, and the market is closely watching whether the company will succeed in its recovery. Evergrande fell into default in December 2021 after the Chinese government tightened real estate regulations and restricted its funding, causing it to fail to repay dollar-denominated bonds. Following Evergrande, the crisis spread across the market, and Country Garden, a leading company in the industry, recently faced default after failing to pay $22.5 million in dollar bond interest.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.