AlbaCheonguk Survey of 1,319 People in Their 20s

Receiving an Average Monthly Support of 502,000 Won

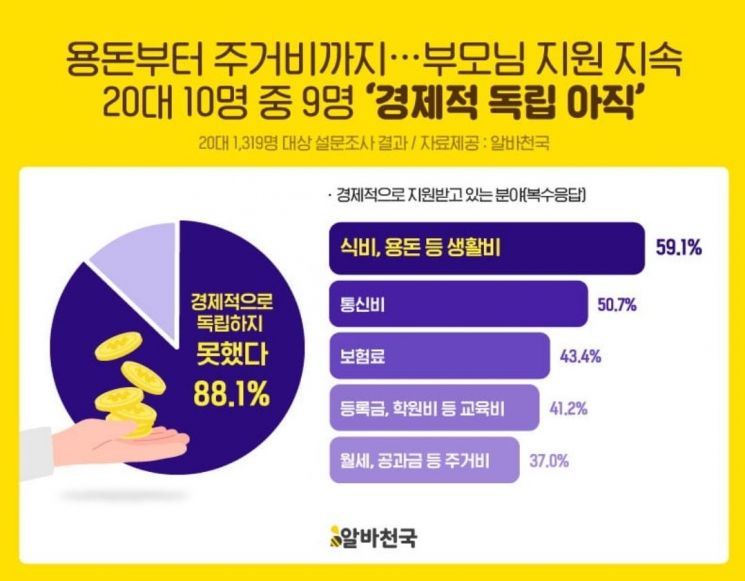

A survey revealed that most people in their 20s have not yet achieved financial independence, with many still receiving monetary support from their parents.

On the 24th, AlbaCheonguk, a job and part-time job portal, conducted a survey of 1,319 people in their 20s. The results showed that the majority of respondents (88.1%) reported receiving financial support from their parents. Among them, nearly all university students (97%) were financially dependent on their parents, while 83% of job seekers preparing for employment received financial assistance. Even among employed workers, more than half (59.9%) were receiving financial support.

Looking specifically at the areas in which they receive support from their parents, 'living expenses such as food and allowance' was the most common at 59.1% (multiple responses allowed), followed by ▲communication fees (50.7%) ▲insurance premiums (43.4%) ▲education expenses such as tuition and academy fees (41.2%) ▲housing costs such as monthly rent, deposit, and utilities (37.0%) ▲medical expenses (33.1%). The average monthly amount of support received by people in their 20s was 502,000 KRW, with university students receiving an average of 540,000 KRW, which is 38,000 KRW more than the overall average.

Among them, 9 out of 10 (92.5%) expressed their intention to become completely financially independent in the future. The expected age for full financial independence was on average 27.6 years old across all respondents, but the average age among employed respondents was 30.1 years, 2.5 years older.

The vast majority (94.1%) said they are currently making efforts to achieve financial independence. The most common method they are practicing was 'part-time jobs' (45.2%), followed by ▲focusing on current studies and work for a better future (22.1%) ▲steady savings (14.4%) ▲preparing for employment and job changes to earn higher wages (8.6%) ▲expanding assets through financial technology and investments (3.3%).

When asked why they do not plan to become financially independent in the future, 7.5% of respondents cited 'absolute lack of income' (47.1%, multiple responses allowed) as the most common reason. Other reasons included ▲not confident in coping with soaring prices (35.6%) ▲lack of capacity to engage in economic activities due to studies or other reasons (28.7%) ▲able to live a more affluent life due to parents' financial support (24.1%) ▲simply not wanting to engage in economic activities (18.4%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.