In the Second Half, a Period to Confirm AI and Semiconductor Performance Figures

High Demand for Investment-Related Semiconductors like High-Bandwidth Memory

Unfavorable Outlook for Consumer-Related Semiconductors such as Home Appliances and Handsets

NVIDIA Volta

NVIDIA Volta

U.S. computer graphics processing semiconductor (GPU) design company NVIDIA announced 'surprise earnings' that far exceeded expectations, prompting cheers in the market. This served as a catalyst reinforcing the existing forecast that the semiconductor industry, which had experienced a historic slump in the first half of the year, would improve starting in the second half.

On the 24th, when NVIDIA's earnings report was released, semiconductor and artificial intelligence (AI) related stocks in the domestic stock market all surged. Major semiconductor companies such as SK Hynix (4.22%), DB Hitek (2.13%), and Samsung Electronics (1.64%) closed with simultaneous gains. Polaris Office, which is about to launch a generative AI office platform, soared to the price limit (30%), and AI-related stocks such as BridgeTec (9.82%), Saltlux (9.12%), and Maum AI (8.45%) also showed strong performance. Additionally, various industry stocks incorporating AI technology also closed sharply higher, including Curexo (18.73%), a medical robot developer using AI; Syntekabio (15.56%), an AI new drug development company; and Moa Data (14.44%), a developer of AI-based anomaly detection and prediction solutions.

Riding the wave of optimism from NVIDIA, the KOSPI also closed at 2,537.68, up 1.28% from the previous trading day. This was the largest gain in about three weeks since the 1.31% rise on the 1st. Choi Yoo-jun, a researcher at Shinhan Investment Corp., said, "The AI momentum has proven stronger than expected, leading the semiconductor sector to drive the overall index rebound," adding, "The industrial paradigm shift led by AI is perceived to be relatively less affected by macroeconomic factors such as interest rate hikes, which will further solidify the semiconductor sector's position as a leading stock."

The securities industry is also optimistic about NVIDIA's strong performance. Following the recent Nasdaq listing application by the UK semiconductor design company ARM, NVIDIA's rapid growth is interpreted as a signal of a global semiconductor industry rebound. Han Dong-hee, a researcher at SK Securities, said, "The direction of improvement in the semiconductor industry has become clear," and forecasted, "With the start of inventory decline reducing valuation losses and strong AI demand, the DRAM industry will sequentially begin to turn around from the third quarter depending on the intensity of benefits." Kim Soo-yeon, a researcher at Hanwha Investment & Securities, also said, "If stock prices rose in the first half due to expectations for AI, the second half will be a time to confirm this with numbers," adding, "In Korea, hardware stocks related to AI mainly rose, but now the focus should expand to software that can utilize AI."

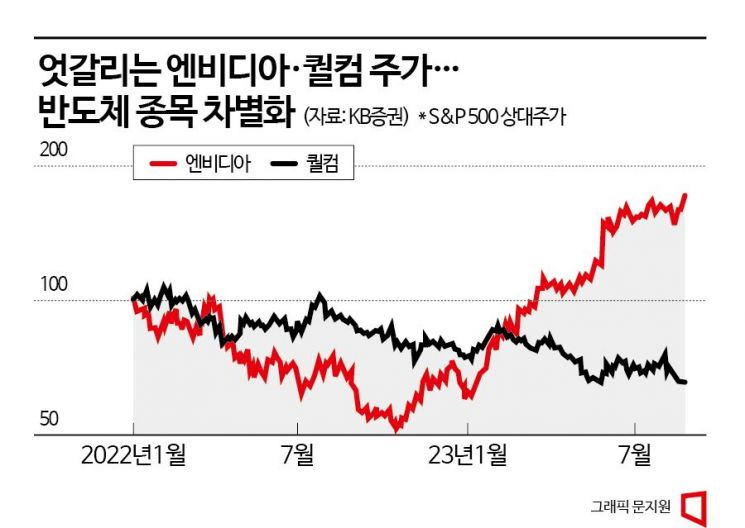

However, since 'IT consumption' remains sluggish, there is analysis that the strength of improvement may vary by stock. A representative example is Qualcomm. Unlike NVIDIA's sharp stock price rise, Qualcomm's stock price has not escaped the slump for over a year and a half, showing a contrasting picture. This is because Qualcomm's semiconductor business is overwhelmingly focused on smartphones, making it highly sensitive to consumer indicators. In this context, among domestic semiconductor companies, there is expected to be a divergence between those focused on existing IT product semiconductors and those aiming to capture the high-bandwidth memory (HBM) market for high-performance AI semiconductors.

Lee Eun-taek, a researcher at KB Securities, analyzed, "NVIDIA, which benefits from investment momentum, is doing well, while Qualcomm, which benefits from consumption momentum, is doing poorly," adding, "Both are cyclical stocks, so their revenue growth patterns are similar, but the difference lies in whether the trend is structural or not." He continued, "The same applies to memory semiconductors; areas related to investment such as HBM have strong demand, while consumer-related areas like home appliances and handsets have weak demand," but added, "Although Korean semiconductors face the unfortunate reality of weak consumer demand, a moderate outperformance is possible in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.