Samsung Electronics and LG Electronics captured nearly 50% of the global TV market share in the first half of this year by emphasizing a premium strategy, despite sluggish market conditions. However, concerns are rising that their market share could be taken away due to the rapid pursuit by Chinese brands such as TCL and Hisense, which have strong price competitiveness.

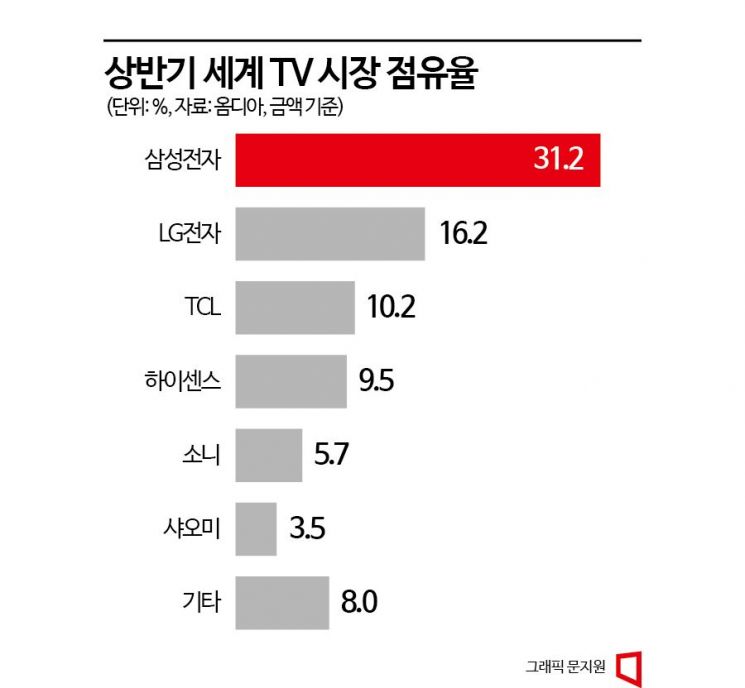

Market research firm Omdia announced on the 21st that Samsung Electronics ranked first in the global TV market share by value in the first half of this year, recording 31.2%. In terms of shipment volume, it was 17,927,700 units. Samsung Electronics has maintained the number one position in the global TV market for 18 consecutive years despite the market difficulties. LG Electronics shipped a total of 10,482,400 TVs, capturing a 16.2% share by value. This means that about half of the global TV sales value in the first half of the year came from Samsung Electronics and LG Electronics.

Samsung and LG Emphasize Premium Strategy

The reason Korean brands were able to record nearly a majority share by value is due to the trend of "the bigger the TV, the better" (Geogeuikseon, 巨巨益善) and their strategy of prominently promoting premium products with higher price points.

Samsung Electronics stood out in the premium TV market priced above $2,500. Leading with Neo QLED, it recorded an overwhelming 61.7% market share. In the ultra-large TV market of 80 inches and above, Samsung achieved a 41.6% share this year with newly released 98-inch models. This figure surpasses the combined shares of the second to fourth ranked companies, demonstrating Samsung Electronics' influence in the ultra-large TV market.

LG Electronics dominated the global OLED (Organic Light Emitting Diode) TV market. LG's OLED TV market share in the first half of the year was 55.7%. Marking the 10th anniversary of OLED TV launches this year, LG solidified its leadership position in the next-generation premium TV market with a majority share. The proportion of OLED TVs, LG's top-tier lineup, accounted for up to 30% of LG's TV sales in the first half.

LG Electronics plans to continue targeting demand for ultra-large and premium TVs in the second half of the year with the 'LG Signature OLED M,' which features the world's first 4K·120Hz wireless solution, showcased in the largest existing 97-inch OLED TV launched last month. Samsung Electronics, a latecomer to OLED TVs, sold 352,000 OLED TVs in the first half, capturing an 18.3% share and ranking second.

On the 19th, the 'LG SIGNATURE OLED M' was exhibited at the '2023 World IT Show' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

On the 19th, the 'LG SIGNATURE OLED M' was exhibited at the '2023 World IT Show' held at COEX in Gangnam-gu, Seoul. Photo by Jinhyung Kang aymsdream@

In an environment where global TV shipments in the first half totaled 92,706,600 units, showing no growth and remaining similar to the previous year, Korean brands capturing about half of the global market share by value is a clear achievement. However, as Chinese brands rapidly penetrate the global TV market with price competitiveness, the gap in market share between Korea and China is expected to narrow further.

Chinese Brands' Fierce Pursuit

Chinese brands TCL and Hisense, ranked third and fourth in the global market share by value, recorded shares of 10.2% and 9.5% respectively in the first half of this year. This is an increase of 1.5 percentage points and 1.3 percentage points from 8.7% and 8.2% recorded in the first half of last year. In contrast, Samsung Electronics and LG Electronics saw their market shares by value decline by 0.3 percentage points and 1.2 percentage points respectively over the year. Japanese company Sony's share also dropped 1.7 percentage points from 7.4% to 5.7%.

Despite the sluggish TV consumption environment, the market share increase of Chinese brands was driven by relatively affordable prices that appealed to consumers. In fact, TCL and Hisense had shipment volume shares of 12.4% and 11.7% respectively, higher than LG Electronics' 11.3%, but their market shares by value were lower, revealing a sales trend focused on low-priced products.

Accordingly, whether the United States imposes additional tariffs on Chinese-made TV imports has become important for Korean companies as well. KB Securities researcher Kim Dong-won stated in a report, "If the U.S. raises tariffs on TVs manufactured in China imported into North America from the current 11.5% to 25%, or imposes an additional 15% tariff on TVs equipped with Chinese panels, Chinese TV companies will lose price competitiveness, benefiting Samsung Electronics, LG Electronics, and others."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)