Korea Exchange Conducts Preliminary Review for Ecopro Materials' KOSPI Listing

Management Transparency and Investor Protection Measures More Crucial Than Major Shareholder Eligibility

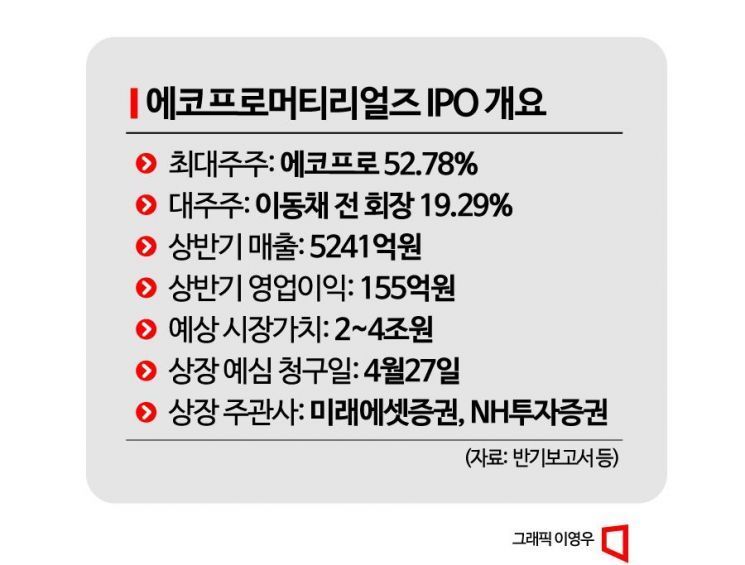

The Supreme Court confirmed a prison sentence for Lee Dong-chae, former chairman of EcoPro Group, who was indicted for obtaining unfair profits exceeding 1 billion KRW using undisclosed information, drawing attention to whether EcoPro Materials' initial public offering (IPO) will succeed. This is because the eligibility of the major shareholder could become a controversial issue. However, during the preliminary listing review process, how to establish investor protection measures is expected to be more important.

A Korea Exchange (KRX) official said on the 21st, "The approval is not automatically denied just because the major shareholder of a company preparing for listing has been convicted," adding, "We need to check whether there are any investor protection issues related to the largest shareholder." This means that if sufficient investor protection measures are prepared, listing is possible.

Qualitative Review is Important... Must Ensure Management Transparency, Internal Control, and Investor Protection

The Korea Exchange is currently conducting a preliminary listing review for EcoPro Materials, which applied for listing on the KOSPI market in April. In June, it additionally requested materials to prove management transparency. This was influenced by the fact that former chairman Lee was convicted and legally detained in the appellate court for obtaining unfair profits using undisclosed information.

The Korea Exchange is known to focus on management transparency and internal control systems regarding EcoPro Materials. This is because former chairman Lee's prison sentence was confirmed for violating the Capital Markets Act. Generally, the preliminary listing review period is 45 days. If significant issues that could affect the listing arise, the review period is extended. In the case of LG Energy Solution, the preliminary listing review took seven months due to a battery fire incident.

A Korea Exchange official explained, "Companies applying for listing review meet formal requirements such as sales and operating profit, so qualitative review is key," adding, "Sustainability of the industry and transparency of governance must be maintained even after listing."

The delay in EcoPro Materials' preliminary listing review is also influenced by doubts about the group's internal control system. After former chairman Lee's detention, executives of EcoPro and EcoPro BM sold their own shares, sparking controversy over responsible management in the market.

Four executives of EcoPro sold 5,790 shares (about 2.6 billion KRW) on the market in July. In June, Choi Moon-ho, president of EcoPro BM, and other executives sold 2,800 shares (about 783.8 million KRW) on the market.

"Notify in Advance of Executive Share Sales"... Is a Tailored Measure Being Proposed to Authorities?

The Korea Exchange considers this an important review criterion because financial authorities announced the 'Insider Trading Pre-Disclosure System Introduction Plan' in September last year and are preparing amendments to the Capital Markets Act. The amendment includes a requirement that major shareholders and executives of listed companies must disclose their trading plans if they sell 1% or more of the total issued shares or if the transaction amount exceeds 5 billion KRW.

When major shareholders or executives who know the company's situation well sell their own shares, it is perceived as a peak in stock price or judged as bad news, causing the stock price to fall. Even if it is a simple sale, individual investors must fully bear the stock price fluctuations. Recently, as the government strengthens 'investor protection' in the capital market, it is paying attention to improving systems such as post-disclosure frameworks.

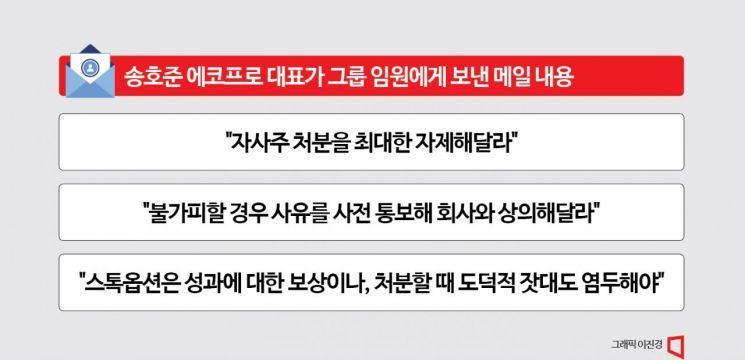

On the 17th, Song Ho-jun, CEO of EcoPro, urged executives to notify in advance when selling their own shares, which is interpreted as considering the preliminary listing review. Recently, Song sent an email to executives of listed companies including EcoPro, EcoPro BM, and EcoPro HN, stating, "During sensitive market periods, please refrain from disposing of your own shares as much as possible to avoid misunderstandings, and if unavoidable, notify the reasons in advance and consult with the company."

An EcoPro Group official explained, "Although stock options granted as corporate performance rewards are personal property rights and cannot be forced, we recommended refraining from selling own shares and notifying in advance as a responsible attitude to communicate with the market," adding, "Since financial authorities are improving regulations related to major shareholders' share sales, it was decided to communicate with the market and immediately disclose when executives sell shares."

In the preliminary listing review, qualitative requirements mainly include △corporate continuity △management stability △management transparency △investor protection. Corporate continuity means the growth potential of the industry and sustainability of sales. Together with management stability, which examines whether stable shareholding can be secured after listing, it is evaluated as having no problems at all.

The key to listing ultimately lies in management transparency and investor protection measures. When judging a company's management transparency, the Korea Exchange focuses on whether an effective internal control system has been established and whether transactions with stakeholders were appropriate. Since former chairman Lee was sentenced to prison for obtaining unfair profits using insider information, it is interpreted that EcoPro Group manages executives' stock transactions at the company level.

A financial investment industry official said, "EcoPro Group is a company that has grown into a large corporation in a short period through the battery industry," adding, "Although it is pursuing membership in the Federation of Korean Industries and the KOSPI listing of affiliates, there are doubts about whether it can communicate with market investors with a responsible management attitude in terms of management transparency, internal control, and governance, so the Korea Exchange has no choice but to be cautious."

Although the major shareholder caused problems due to unfair trading practices, from the market's perspective, since it is a company capable of sustainable growth, it is interpreted that listing is fully possible if management transparency and investor protection measures are prepared at a high level.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.