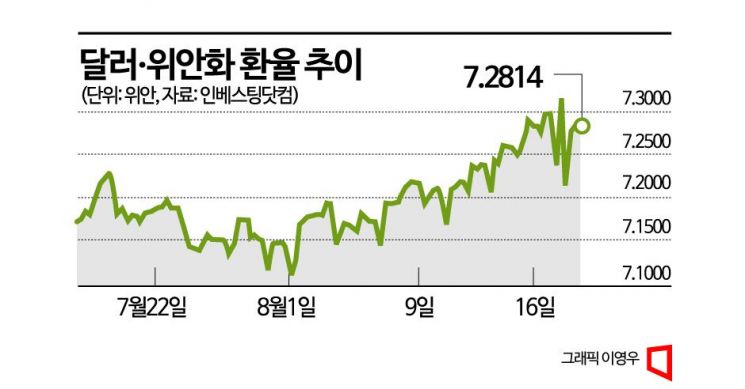

As the value of the yuan plummeted due to the strong dollar and concerns over the Chinese economic crisis, the monetary authorities intervened through state-owned banks.

On the 17th (local time), Bloomberg News, citing sources, reported that Chinese monetary authorities instructed state-owned banks to strengthen market intervention to defend against increased volatility in the yuan exchange rate. The directive came when the yuan's value against the dollar briefly fell to 7.35 yuan, sources said. The authorities also requested some investment institutions to refrain from net selling of stocks, and state-owned banks have recently been selling dollars and buying yuan in both onshore and offshore spot foreign exchange markets.

The yuan's weakness is interpreted as reflecting not only the impact of the strong dollar amid concerns over further U.S. tightening but also worries about the overall Chinese economy, including funding crises among Chinese real estate developers and trust companies. In July, key real economy indicators such as retail sales, industrial production, exports, prices, and unemployment were sluggish, and recently, concerns over domino defaults among real estate companies have spread a sense of crisis in the financial markets.

Earlier, the People's Bank of China stated in its monetary policy report that "China will firmly prevent excessive adjustment of the yuan." Mahaveer Jaman, a strategist at ANZ Bank, explained, "The People's Bank of China has allowed the yuan to weaken so far, signaling a priority to support growth even at the expense of the currency." He added, "They likely do not want the risk of a sharp drop in the yuan's value that could potentially cause financial stability issues," and forecasted, "The yuan's value decline will be defended in the short term around the 7.4 yuan (per dollar) level."

The People's Bank of China demonstrated its determination to defend the yuan by announcing the official exchange rate at 7.2076 yuan, lower than the market forecast of 7.2994 yuan compiled by Bloomberg, the previous morning. The gap between the official rate and market expectations was the largest since October last year.

The monetary authorities' market intervention has already begun. Previously, the People's Bank of China injected 297 billion yuan (approximately 51 trillion won) into the market through a 7-day reverse repurchase agreement (reverse repo) contract. After lowering the 7-day reverse repo rate by 0.1 percentage points from 1.9% to 1.8%, it supplied the largest amount of short-term funds since February.

On the 15th, the People's Bank of China also cut the policy rate for the 1-year Medium-term Lending Facility (MLF) loans by 0.15 percentage points from 2.65% to 2.50%. This was the first rate cut in two months since June. According to convention, the Loan Prime Rate (LPR), which will be announced on the 21st, is also expected to be lowered. In China, the LPR effectively serves as the benchmark interest rate. Additionally, further rate cuts and reserve requirement ratio reductions are anticipated in the second half of this year. These rate cuts are further strengthening the yuan's weakness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.