KT Submarine Acquisition Completed

70 Billion KRW Invested in Submarine Cable Business Since 2008

Expectations for US Offshore Wind Power Plans

Technology and Price Competitiveness Are Key

LS Cable & System is making a series of bold moves, including acquiring KT Submarine from KT, to secure a leading position in the submarine cable market. The company aims to expand its market share by growing to a size comparable to traditional powerhouses such as France's Nexans, Italy's Prysmian, and Germany's NKT. Now, the market's attention is focused on the United States, which has announced large-scale offshore wind power plans. Although a surge in demand for submarine cables is expected, the U.S. faces difficulties in domestic production. The company that partners with the U.S. is anticipated to lead the submarine cable ecosystem, raising expectations for LS Cable & System's strategy to compete with the global top three.

LS Cable & System loading submarine cables at Donghae Port, Donghae-si, Gangwon-do.

LS Cable & System loading submarine cables at Donghae Port, Donghae-si, Gangwon-do. [Photo by LS Cable & System]

On the 17th, LS Cable & System purchased a 24.3% stake (6,290,558 shares) in KT Submarine from KT for 44.9 billion KRW, securing a total of 45.69% and becoming the largest shareholder. This completed all acquisition procedures about four months after temporarily securing management control shares through a call option contract in April. KT Submarine held a shareholders' meeting on the same day and confirmed the name change to LS Marine Solutions. With this, LS Cable & System has vertically integrated from submarine cable manufacturing (LS Cable & System) to construction (KT Submarine), enhancing its competitiveness in securing orders.

Since building Korea's first submarine cable factory in the East Sea in 2008, LS Cable & System has invested approximately 700 billion KRW in the submarine cable business. In May, it also completed the only HVDC (High Voltage Direct Current) submarine cable dedicated factory in Korea, which is the largest in Asia. Recently, LS Cable & System has expanded its business achievements by winning orders for HVDC cables worth over 2 trillion KRW connecting offshore wind farms in the North Sea, Europe. The scale of large submarine projects ordered by the company since last year, including those in Europe, amounts to around 3 trillion KRW.

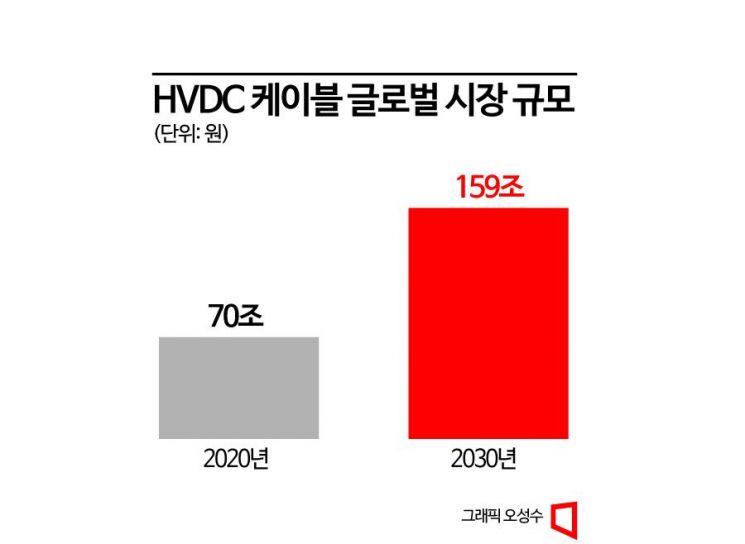

This aggressive investment by LS Cable & System is partly due to the growth trend in the submarine cable industry. As the world intensifies efforts to produce energy using offshore wind power, the future of the submarine cable industry, which connects this energy to the land, looks bright. Ultra-high voltage submarine cables are essential to transfer electricity generated at offshore wind farms to the land. The industry estimates that the global market size for HVDC cables will expand from 70 trillion KRW in 2020 to 159 trillion KRW by 2030.

In particular, the U.S. market is expected to serve as a stepping stone accelerating the growth of the global submarine cable business. Earlier, the Biden administration announced plans to install 30 GW of offshore wind power plants capable of supplying electricity to 10 million households by 2030. The U.S. Bureau of Ocean Energy Management (BOEM) expects that more than 27 GW will be installed by 2025 once the planned projects are completed.

Above all, the industry notes that although the Inflation Reduction Act (IRA), which aims to expand the supply of renewable energy such as offshore wind power, has been implemented, it applies relatively relaxed regulations to the offshore wind industry. While other renewable energy industries require a 40% share of U.S.-made components, offshore wind only needs to exceed 20%. Unlike Europe, where major cable manufacturers are regionally concentrated, the U.S. has no domestic submarine cable production companies, which is a positive signal for major submarine cable companies.

The challenge lies in the fact that producing ultra-high voltage submarine cables requires advanced technology and specialized facilities, creating high entry barriers. For this reason, the HVDC market is dominated by a few companies, including LS Cable & System, Nexans, Prysmian, NKT, and Sumitomo. Nexans is the only company with a submarine cable production plant in the U.S., while Prysmian is building a new factory there.

LS Cable & System must secure technological and price competitiveness comparable to traditional leaders in the cable industry despite geographical disadvantages. As the fourth-largest submarine cable company, LS Cable & System's determination to enter the U.S. market is expected to be stronger than anyone else's. However, LS Cable & System remains cautious. A company representative stated, "There are no concrete plans regarding U.S. entry at this time."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.