Economic Contraction Spurs Cutthroat Competition Among Companies

Biguiyuan Faces Default Crisis Next Month

Bond Trading Suspended Starting Today

Concerns Over Domino Effect of China's Real Estate Collapse

#Nanchengxiang, a fast-food chain with 160 stores in Beijing, China, offers a breakfast buffet every morning consisting of three menu items: porridge, a sour and spicy soup, and milk, all for just 3 yuan per person (approximately 550 KRW). Gao Yi, 71, who visited Nanchengxiang for breakfast with his grandson, said, "During the COVID-19 pandemic, many affordable and good options appeared."

This is the evaluation of Chinese people regarding the 550-won breakfast recently introduced in Beijing, the capital of China. This breakfast is a product of a price war aimed at opening the wallets of consumers who have tightened spending due to the economic downturn, leading to analyses that the fear of 'deflation' has spread to the very roots of the Chinese economy.

As the Chinese economy gradually sinks into a recession, the default status of Country Garden, one of China's top three private real estate developers, will be decided early next month. Since Evergrande Group's default declaration in 2021, the economy has been in a prolonged slump, and the emergence of new variables has raised concerns that the Chinese economy could sink even deeper into crisis.

China Enters Deflation

According to major foreign media on the 14th, price-cutting competition among Chinese food service companies has been intensifying recently. The Chinese sandwich franchise Xixiaoye recently launched a sandwich menu priced at 10 yuan (about 1,800 KRW), lower than before. Yum China, the operator of the American fast-food chain KFC in China, has reduced the price of some hamburger set menus to 19.9 yuan (about 3,600 KRW).

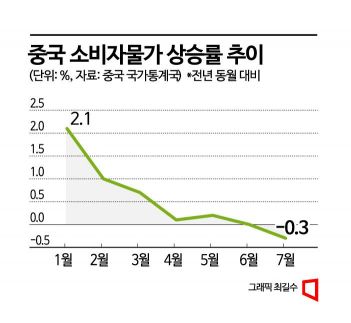

These are the results of a price war emerging as the Chinese economy contracts. Retail sales in June, which reflect Chinese consumer trends, increased by only 3.1% year-on-year, falling to single digits for the first time in four months. Last month, China's Consumer Price Index (CPI) also fell by 0.3% year-on-year. This is the first monthly CPI decline in 2 years and 5 months. The slump in the real estate market, contraction of domestic demand, decline in exports, and the impact of US-China tensions have combined to pull prices down.

Concerns Over Domino Effect of Defaults Among Chinese Real Estate Firms

Amid the price war and assessments that the Chinese economy has already entered a deflationary phase, the recent default crisis of Country Garden has heightened concerns about the Chinese economy. The domino effect of defaults among real estate companies is acting as a source of fear that could deliver a major shock to the Chinese economy.

According to foreign media such as Bloomberg, the Shanghai and Shenzhen stock exchanges in China suspended trading of approximately 5.6 billion yuan (1 trillion KRW) worth of Country Garden bonds (11 issues) starting on the 14th. This measure aims to calm the panic in the bond market after Country Garden failed to pay $22.5 million (about 30 billion KRW) in interest on bonds with a face value of $1 billion (1.33 trillion KRW) on the 7th. If the company fails to repay the interest within 30 days, a default will be officially declared. Currently, Country Garden's bonds have fallen from $5-6 at the beginning of the year to 7-8 cents, effectively regarded as defaulted bonds in the market. Bloomberg reports that Country Garden's outstanding bonds amount to 71.756 billion yuan (13 trillion KRW), with total debt reaching 1.4 trillion yuan (256 trillion KRW) as of the end of last year.

The market fears that the Country Garden default crisis will accelerate the collapse of the already sluggish Chinese real estate market. Starting with Evergrande Group's default in 2021 and followed by Wanda Group's default declaration last month, additional economic shocks are feared. Since real estate accounts for 25% of China's GDP, the shock originating from Country Garden is expected to cause significant damage. Brock Silver, Chief Investment Officer (CIO) of Kaiyuan Capital, a Hong Kong private equity firm, expressed concern, saying, "The market is now practically uninvestable," and "systemic risks are much greater than previously anticipated."

There are also voices expressing concern about a prolonged Japanese-style recession. One foreign media outlet reported, "Contrary to economists' predictions, there was no immediate increase in consumer spending after the lifting of lockdowns in China. Employment market uncertainty remains high, spending desires are limited, and the economy is barely growing," adding, "If deflation prolongs like in Japan in the 1990s, China's economic growth could be pressured."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)