Creating an Ecosystem for Recycling, Reuse, and Repair

"Need for Government Standards Establishment and Institutional Support"

Electric vehicle (EV) batteries are difficult to partially repair, leading to situations where the entire battery must be replaced even for minor damage. This has raised concerns that the expansion of EV demand is slowing down and environmental pollution is worsening. Furthermore, there are criticisms that this could lead to increased loss ratios for insurance companies and higher insurance premiums for consumers in the long term. This is the background behind calls for government-level policy support to revitalize the EV battery repair and recycling market.

Less than 5% of repair shops capable of repairs... Entire battery replaced even for minor damage

On the 13th, the Korea Insurance Research Institute released a report titled "Current Status and Challenges of EV Battery Repair." According to the report, since EV adoption is still in its early stages, there are few cases of battery damage and specialized electrical repair skills have not become widespread. In South Korea, less than 5% of repair shops are capable of repairing EVs. Only 17% of private inspection centers have introduced safety inspection equipment for EV batteries, such as the Electronic Device Diagnostic System (KADIS). As a result, partial repairs are practically difficult, and due to concerns about secondary damage such as fires after repair, the entire battery is often replaced even for minor damage.

Ultimately, rising EV maintenance costs slow the pace of EV demand growth, and the increase in discarded batteries raises environmental pollution issues. The report states that the production of lithium-ion batteries for EVs emits nine times more greenhouse gases (CO2 eq) compared to lead-acid batteries, and also results in 5 to 10 times higher levels of photochemical smog, ozone depletion, acid rain, and eutrophication nutrients.

From the consumer perspective, this is also a loss. While insurance riders that cover battery replacement help alleviate the financial burden, as the number of replacements increases, insurance companies’ loss ratios rise, which could lead to higher insurance premiums for consumers in the long term.

Currently, all insurance companies have introduced special riders that fully cover battery replacement costs in the event of own-damage accidents. When subscribing to these riders, consumers do not bear any separate deductible costs for battery damage. Last year, the battery replacement rate among own-damage claims for passenger cars was about 0.2%, a negligible level.

However, the number of registered EVs is growing at a high annual rate of around 60%, so the number of battery replacements is expected to increase in the future. Already, 83% of battery replacement accidents last year were single-vehicle accidents caused by undercarriage impacts. Compared to the accumulated data on internal combustion engine vehicle accidents, it is difficult to predict the rate of battery damage. Unexpected repair costs (around 20 million KRW for battery replacement) are expected to pose obstacles to appropriate insurance premium calculations.

Establishing national standards... Support for early repair shops

The report emphasized the need for the government to strengthen the value chain for battery recycling. First, it calls for the establishment of unified national standards for battery repair diagnostics and support to increase the number of EV repair-capable businesses.

EV batteries vary in specifications depending on the vehicle model. Infrastructure for handling high-voltage batteries is also insufficient. Since the technology is not yet widespread, repair shops for internal combustion engine vehicles require high-cost equipment investments and acquisition of electrical-related skills that differ from their usual expertise.

Researcher Cheon Ji-yeon of the Korea Insurance Research Institute explained, "While establishing unified national standards for battery diagnosis and evaluation to estimate residual battery value, it is necessary to diversify evaluation criteria variables related to safety to strengthen safety issues associated with battery reuse. For this, it seems necessary for automobile and battery manufacturers to provide battery diagnostic data."

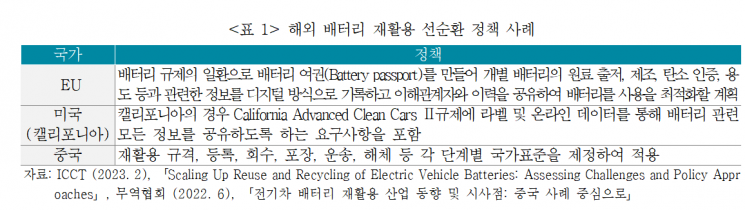

To revitalize the battery recycling market, the government should take the lead in expanding policies to create a virtuous cycle structure for battery recycling, including damage diagnosis, residual value measurement, and battery 'reuse.' Researcher Cheon emphasized, "As seen in the cases of the European Union (EU), the United States, and China, institutional support is needed to grow the used battery recycling and reuse market by establishing performance-based pricing standards for used batteries and preparing guidelines for each stage of battery recycling."

Repair diagnostic standards needed... Manufacturers must also collaborate

From the insurance companies’ perspective, a nationally credible EV repair diagnostic standard is necessary to gain consumer trust. Additionally, it is essential to evaluate the remaining battery value and accurately predict various insurance processing costs. Although battery production costs may decrease and the battery recycling market may expand in the long term, reducing battery replacement costs, these costs could be burdensome in the short term.

Currently, since batteries differ by manufacturer, unified diagnostics are difficult. Analysts suggest that the roles of EV and battery manufacturers are important to create a "battery circulation structure." Some automakers have implemented battery return policies upon replacement, and in some cases, total replacement costs are lower than when no return policy exists, indicating the need for appropriate collaboration.

However, if the battery recycling market becomes concentrated among a few manufacturers, monopoly issues may arise. Researcher Cheon said, "The price of used batteries varies widely from $59 to $1,183 per kilowatt-hour (kWh) depending on battery type, buyer, and market activation, so the cost of handling damaged batteries will differ depending on the sales channel. As the recycling market grows, insurance companies need to secure diverse and stable sales channels to reduce accident handling costs, improve prediction accuracy, and calculate appropriate insurance premiums."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)