"The South Korean economy, which experienced severe stagnation in the first half of the year, continues to show sluggish recovery due to weak domestic demand and delayed effects of China's reopening." - Korea Economic Research Institute (KERI)

"Recently, our economy has seen a mitigation of the downturn centered on manufacturing, and the economy is expected to recover moderately in the second half of the year." - Korea Development Institute (KDI)

The economic forecasts from national and private economic research institutes, which serve as the foundation for companies to decide future investment directions and establish management strategies, have diverged, making confusion among companies inevitable.

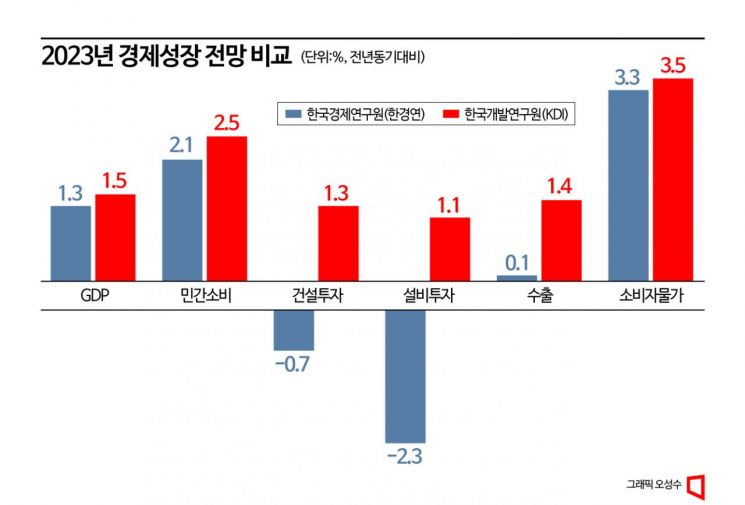

On the 11th, the Korea Economic Research Institute (KERI), a private economic research institute under the Federation of Korean Industries (FKI), projected in its ‘KERI Economic Trends and Outlook: Q3 2023 Report’ that South Korea’s economic growth rate this year will be as low as 1.3%, the lowest ever. It assessed that it would be difficult for the severely sluggish economy to reverse its trend within the year. Both domestic demand and exports are expected to remain weak. The 1.3% growth rate is the lowest figure excluding economic crisis periods such as the financial crisis (2009?2011) and COVID-19 (2020?2021).

The analysis pointed out that the prolonged gradual deterioration of economic conditions, weakening growth momentum, and delayed recovery in major countries including China have made an economic rebound by the end of the year virtually impossible. KERI diagnosed that if economic growth uncertainties expand due to ▲absence of China’s reopening effect, ▲continued interest rate hikes by the U.S. Federal Reserve, ▲real economy contraction due to the real estate slump, and ▲rising risk of financial crisis from a sharp increase in debt delinquency rates, an additional decline of 0.1 to 0.2 percentage points in the growth rate cannot be ruled out.

On the other hand, the government-affiliated Korea Development Institute (KDI) took a more optimistic view. In its newly revised economic outlook released this month, KDI maintained the growth rate forecast at 1.5%, the same as presented in May. KDI recognized the current economic situation by stating, "Recently, the economic downturn has eased, centered on manufacturing." It also optimistically predicted, "After forming a bottom in the first half of the year, the economy will recover moderately in the second half." Despite contraction in the government sector, the expansion of growth in the private sector led to signs of economic recovery, such as a 0.6% increase in GDP in the second quarter compared to the first quarter (annualized rate: 2.4%).

This easing of the economic downturn was attributed to the reduced decline in exports centered on automobiles and semiconductors, which expanded manufacturing growth. Accordingly, corporate facility investment is expected to show a trend similar to the previous forecast (1.1%). It also predicted that merchandise exports in the second half of the year will show a similar increase to the previous forecast, supported by the continued solid growth of the U.S. economy.

This view also contrasts with that of KERI. KERI focused on the fact that, rather than an expansion of manufacturing growth, domestic demand stagnation and global economic contraction caused all investments except semiconductors to plunge, leading corporate facility investment to contract by 2.3%. Exports are also expected to grow only 0.1%, as the anticipated effect of China’s reopening remains minimal. Due to these factors, corporate earnings continue to decline, nominal wage growth stagnates, and real purchasing power weakens due to high inflation, severely shrinking consumption conditions and increasing downward pressure on domestic demand. Essentially, KERI diagnosed a 'triple weakness' where the 'three horses' driving the domestic economy?consumption, investment, and exports?all weaken.

However, both national and private research institutes identified the absence of China’s reopening effect and China’s economic downturn as risk factors threatening the South Korean economy. Although South Korea is trying to reduce dependence on China through supply chain diversification, the current high dependence means that China’s economic slowdown directly impacts South Korea’s economy. Lee Seung-seok, a senior researcher at KERI, said, "If the failure of China’s economic rebound spreads to major trading partners such as the U.S., the growth rate could be even lower."

Additionally, prolonged Russia-Ukraine war-driven global inflation and continued interest rate hikes by major countries, along with ongoing recession and high interest rates, could increase delinquency rates and financial institution insolvency, raising the risk of a financial crisis, which is also identified as a risk factor limiting South Korea’s economic growth.

The Korea Development Institute, established by the government in 1971, is the country’s first social science think tank. The Korea Economic Research Institute, founded in 1981 by the Federation of Korean Industries, is the largest private economic research institute in South Korea. These two institutions, representing the government and private sectors respectively, have repeated cooperation and competition for over 40 years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.