Lotte Hotel Holdings USA, Lotte Europe Holdings, and Lotte Construction Provide Support

Hotel Lotte's Debt and Contingent Liability Burden Also Increases

Hotel Lotte continues to bear the burden of financial support for its overseas subsidiaries and construction companies. With borrowings exceeding 9 trillion won, contingent liabilities remain high as it provides guarantees and other credit facilities for funding overseas hotels and construction companies.

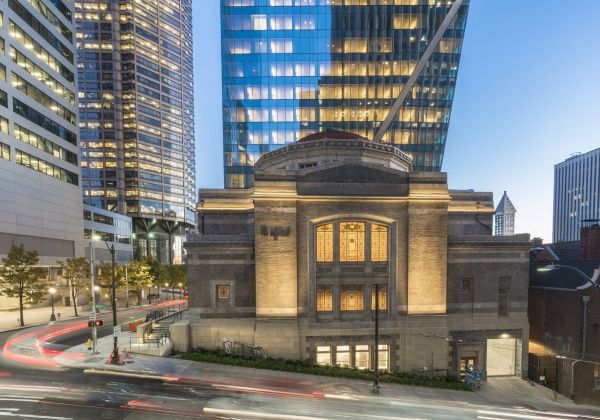

According to the investment banking (IB) industry, Lotte Hotel New York Palace, LLC recently selected KB Investment & Securities as the lead manager and borrowed $150 million (approximately 190 billion won) from domestic investors. The raised funds are reportedly intended for repaying existing loans and operating expenses.

Hotel Lotte provided a capital replenishment agreement during the borrowing process of New York Palace Hotel. The capital replenishment agreement is a credit facility contract in which Hotel Lotte agrees to support any shortfall if New York Palace Hotel faces difficulties repaying the loan on its own.

Hotel Lotte continues to support overseas hotels through such methods. In addition to Lotte Hotel New York Palace, it has consecutively provided guarantees or capital replenishment agreements as credit facilities for borrowings of Lotte Hotel Holdings USA, Lotte Europe Holdings, and Hotel Lotte Arai.

Lotte Europe Holdings is a holding company established in the Netherlands to comprehensively manage Russian businesses such as hotels, department stores, and confectionery shops. Hotel Lotte Arai is a subsidiary of Hotel Lotte operating a luxury resort located in Mokyo City, Niigata Prefecture, Japan.

Since the end of last year, the burden of supporting Lotte Construction has also increased. In November last year, it invested 86.1 billion won in a paid-in capital increase of Lotte Construction, and in December, it provided indirect support by offering a total return swap (TRS) for the issuance of 200 billion won convertible bonds (CB) by Lotte Construction. In January this year, it supported 150 billion won in subordinated loans to Lotte Construction and also provided capital replenishment agreements for senior borrowings.

The contingent liability burden related to Lotte Group’s Shenyang project in China also continues. Borrowings related to Shenyang Limited Company, established for the Shenyang project, exceed 700 billion won. Although sales have been pursued since last year, there has been no news of a successful sale yet.

An IB industry official said, "Although cash flows of overseas hotels have improved with the end of COVID-19, Hotel Lotte’s borrowing and contingent liability burdens have not decreased due to rising interest rates and the burden of supporting affiliates," adding, "Financial burdens on affiliates will continue until overseas businesses normalize."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)