Over 60% Attendance of Shareholders, Approval from 25% of Total Issued Shares Required

Major Shareholders Likely to Pose No Resistance... Variables Are Foreign and Minority Shareholders

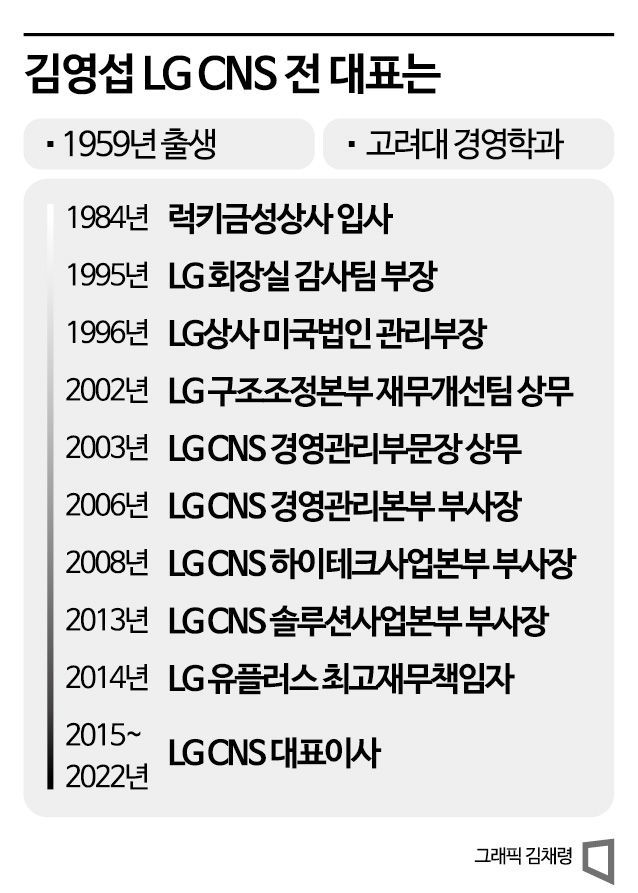

With the final candidate for KT's CEO position decided, the path to management normalization has passed the critical point. Only the shareholders' meeting remains before Kim Young-seop officially takes the helm of KT. While insiders and outsiders of KT expect Kim's smooth approval, recent increases in the requirements for CEO appointment and the unpredictable voting intentions of foreign and minority shareholders suggest it is still too early to be complacent.

As of the 10th, KT's shareholding structure shows the National Pension Service as the largest shareholder with an 8.27% stake, followed by Hyundai Motor Group (7.79%) and Shinhan Bank (5.57%) as the second and third largest shareholders, respectively. Foreign shareholders hold about 40%, and minority shareholders account for around 35%.

To be appointed as KT's CEO, a candidate must secure support from more than 60% of the voting rights of shareholders attending the general meeting and at least 25% of the total issued shares. Previously, the requirement was over 50% of voting rights of attending shareholders and 25% of total issued shares, so the hurdle has been raised. This means Kim must now focus on winning over shareholders after his fierce competition with other candidates.

Industry insiders believe Kim will likely secure the support of the major shareholders without much difficulty. This is because KT formed the board of directors by selecting outside director candidates recommended by the largest shareholders, including the National Pension Service, and actively incorporated their opinions in choosing the CEO candidate.

Moreover, unless institutional and corporate shareholders intend to engage actively in management, they often prefer "stable leadership" that can deliver investment returns. Given Kim's long tenure in large corporations and proven leadership, there is little reason to veto him.

Above all, there is a consensus among shareholders that the management vacuum lasting over half a year must end. KT has experienced a management gap of more than five months since former CEO Koo Hyun-mo declined to seek reappointment in February and former President Yoon Kyung-rim was dismissed. During this period, key management decisions such as executive appointments and organizational restructuring were not properly made. Currently, there are about 40 executives at the senior manager level awaiting promotion.

An industry insider said, "If there are no major procedural issues, the prevailing opinion is to trust and entrust the company to Kim. If Kim fails at the shareholders' meeting, the company could fall into another prolonged management vacuum. Shareholders are surely aware of this risk."

A similar sentiment is present within KT. The KT labor union previously expressed support, stating, "We believe and support Kim as the right person to lead KT's continuous growth as a national enterprise by presenting an innovative vision for future growth."

The union also urged, "Kim must stabilize the organization immediately upon appointment and swiftly resolve management issues. He should not undermine management stability by pursuing reckless restructuring focused on short-term results or by operating the organization through indiscriminate recruitment of external personnel as in the past."

The variables to watch are foreign investors and minority shareholders. Among them, foreign shareholders are likely to decide their votes based on evaluations of Kim by global proxy advisory firms such as ISS and Glass Lewis. These advisory firms have influenced investor voting by providing their analyses and opinions on major issues of domestic listed companies. Since foreign investors are not deeply familiar with local circumstances, they tend to rely on these advisory reports. However, the recommendations of these firms do not always lead to the expected outcomes. For example, both firms had recommended approval of former President Yoon's appointment, but Yoon voluntarily withdrew, resulting in an outcome contrary to their advice.

Minority shareholders are expected to vote based on Kim's announced management policies and future strategies. Currently, minority shareholders are gathering opinions regarding support or opposition to Kim. On the Naver cafe "KT Minority Shareholders' Group," there is a plan to send an open letter to Kim addressing topics such as ▲strengthening KT's core competencies and new business strategies ▲enhancing minority shareholder representation ▲measures to prevent poor management. This group represents about 4.22 million shares, approximately 1.61% of KT's total issued shares of around 261.11 million.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)