Regulatory Easing Leads to Credit Card Launch for Minors

Postpaid Payments Possible Using Parents' Credit

Concerns Over Reckless Overspending

"Safe Due to Industry and Amount Restrictions"

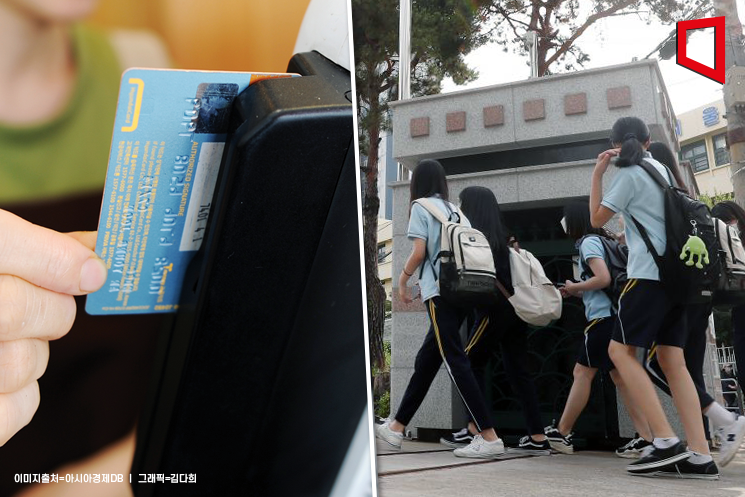

Card products targeting teenagers are emerging one after another. As financial authorities temporarily eased regulations to allow minors aged 12 and over to obtain credit cards, card companies are moving to capture this new market. While there are concerns that this could encourage reckless overspending, there are also voices saying that young people can learn the concept of financial transactions and develop spending habits from an early age.

According to the industry on the 11th, Lotte Card recently launched the 'Tiny Card,' a prepaid card that minors can use freely within the allowance range set by their parents. It is linked to the parent's credit card.

However, unlike existing youth cards that require pre-charging allowances or debit cards that can only be used if there is cash in the account, this card allows parents to set a monthly limit according to the child's allowance, and the child pays only for the amount used. The monthly allowance can be set up to a maximum of 500,000 KRW, and additional allowances can be provided. The amount used by the child is also included in the connected parent's credit card usage record. Except for the relatively small payment limit and the inability to use installment payments, it is not much different from adult credit cards.

The reason card companies are focusing on teenage customers is not only to expand short-term profits but also to secure future customers. In particular, with the Financial Services Commission allowing limited issuance of credit cards (family cards) for minors through the designation of innovative financial services, competition is expected to become more intense.

Previously, those under 19 years old could not be issued credit cards, but now teenagers aged 12 and over can obtain credit cards in their own names. The family credit card is issued based on the parent's credit, not the minor's own credit. It is no longer a 'mom's card'; even without money in the account, credit card payments are possible with their own card. Shinhan Card and Samsung Card, which were designated as innovative financial services in 2021, have already launched card products called 'My Teens' and 'ID Pocket,' respectively. Hyundai Card and Woori Card, designated in June, plan to release similar products in the first half of next year.

With the emergence of credit cards for teenagers, concerns have also been raised. There are criticisms that teenagers, who may have less self-control than university students during the past 'card crisis,' could engage in reckless card spending. According to a survey conducted by Korea's largest credit card platform, Card Gorilla, on about 700 people in early last month, 58.7% responded that they were worried about side effects such as misuse and abuse of cards by minors.

However, unlike in the past, there are many safety measures in place, so there is also a considerable positive perspective. Since the card can only be issued by applying together with parents, and the types of businesses where the card can be used are limited to youth-related sectors such as education, transportation, hospitals, and convenience stores, parents can set per-transaction and monthly usage limits for each card company. It is argued that allowances, which were previously received in cash or through accounts, can be used more conveniently, and that young people can build sound financial transaction experiences and form spending habits. An industry insider said, "Since various safety measures are included, it may be easier for parents to manage than giving allowances in cash," adding, "However, since it is a credit card, education about finance should also precede."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.