Samsung Electronics, SK Hynix, Micron

Investment and Operating Profit Summary 2012-2022

Similar Operating Profit Ratio to Capital Expenditure

Samsung Dominates R&D... Memory Sector Disappoints

Over the past decade, Samsung Electronics has invested approximately 267 trillion KRW in semiconductor facility investments and more than 196 trillion KRW in research and development (R&D) costs. In terms of R&D scale, it overwhelmingly surpasses its competitors. However, the evaluation is that the results have not been satisfactory relative to the scale of investment.

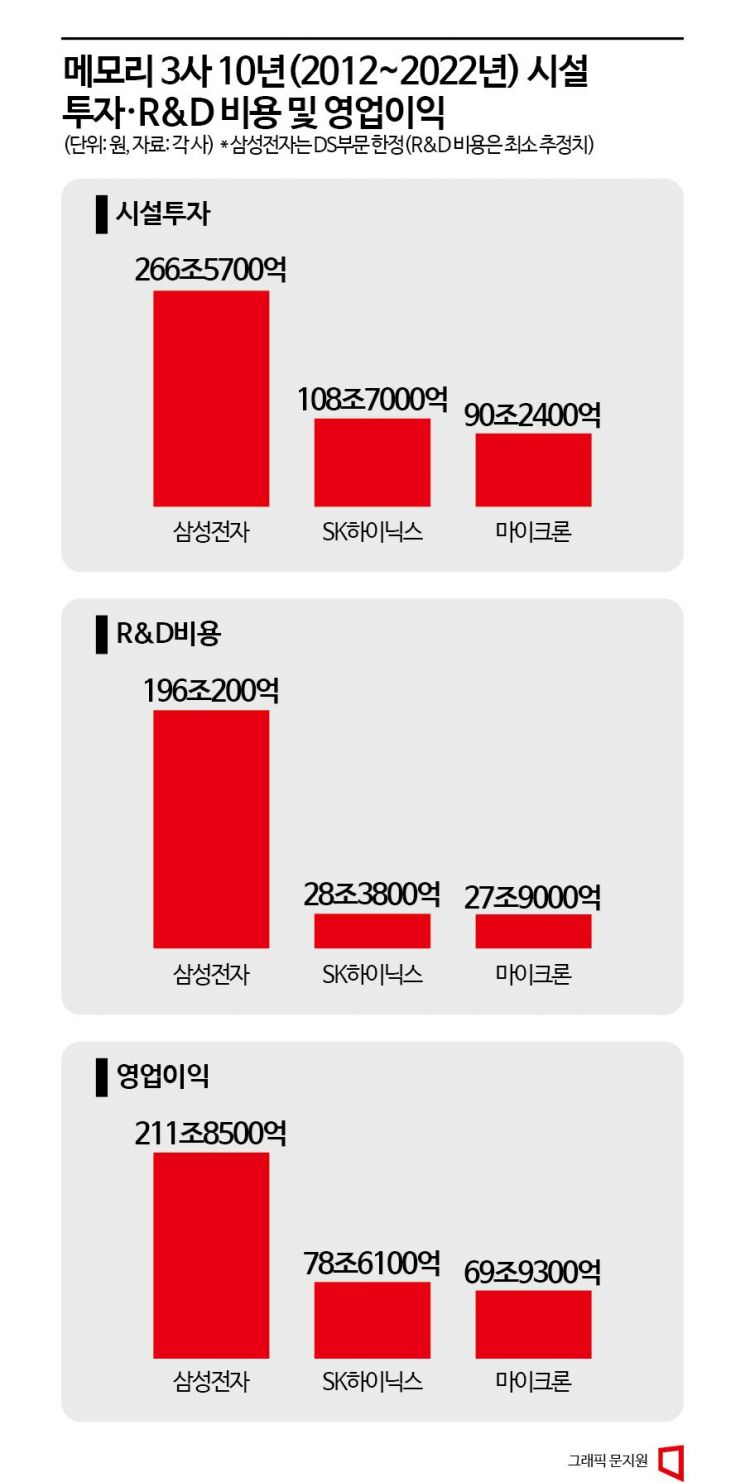

On the 9th, a survey of the facility investment scale and operating profits over 10 years (2012?2022) of the top three memory semiconductor companies?Samsung Electronics, SK Hynix, and US-based Micron?showed that the ratio of operating profit to facility investment did not differ significantly. During this period, Samsung Electronics (including memory and system semiconductors under the DS division) recorded operating profits of 212 trillion KRW, SK Hynix 79 trillion KRW, and Micron 70 trillion KRW. The scale of facility investment during this period was 267 trillion KRW for Samsung Electronics, 109 trillion KRW for SK Hynix, and 90 trillion KRW for Micron. Expressed as a percentage of operating profit relative to facility investment, Samsung Electronics was 79%, Micron 77%, and SK Hynix 72%. Although the differences are not large, it can be interpreted that Samsung Electronics is investing in facilities more efficiently than other companies.

Moreover, Samsung Electronics’ semiconductor facility investment costs include system semiconductor business expenses, unlike other companies that only operate in the memory business. Samsung Electronics is the unrivaled leader in memory semiconductors but is a latecomer trailing Taiwan’s TSMC in the system semiconductor business. Naturally, the profit relative to investment is lower than in memory. Nevertheless, Samsung Electronics’ overall semiconductor facility investment profit margin is higher than that of other companies. In other words, the profit margin relative to facility investment in Samsung Electronics’ memory business is greater than the figures shown.

However, when looking at R&D costs, Samsung Electronics’ operating profit ratio relative to investment was lower than that of other companies. Samsung Electronics disclosed a total company-wide R&D cost of 196 trillion KRW over 10 years. Samsung Electronics stated, “It is estimated that more than 60% of the total cost was invested in the semiconductor business.” This means that at least about 118 trillion KRW was poured into the semiconductor business. The operating profit ratio relative to this cost is 180%. If the R&D cost spent on the semiconductor business was higher, the operating profit ratio would likely be lower. In contrast, SK Hynix invested 28 trillion KRW in R&D over 10 years, achieving an operating profit ratio of 277%. Micron also invested 28 trillion KRW over 10 years, with an operating profit ratio of 251%, higher than Samsung Electronics. Simply put, SK Hynix and Micron can be seen as having invested more efficiently in R&D than Samsung Electronics. Of course, Samsung Electronics must be considered to have poured a significant amount of money into R&D not only for memory semiconductors but also for the foundry (semiconductor contract manufacturing) business. Therefore, the actual operating profit ratio relative to memory business R&D is evaluated to be higher than 180%.

When combining R&D and facility investments as total costs, Samsung Electronics had the lowest operating profit ratio at 55%. SK Hynix was 57%, and Micron 59%. Although the difference is not large, Samsung Electronics recorded the lowest operating profit ratio among the three companies because it spends more on R&D. Since Samsung Electronics operates both memory and system semiconductor businesses, it may have spent more on R&D to enhance technological capabilities compared to other companies. In particular, the company is competing with Taiwan’s TSMC, the number one player in the foundry market, in the sub-5-nanometer (nm; one billionth of a meter) fine process technology. In the memory sector, evolving computing systems and other factors are changing technology demands, so Samsung is focusing on securing next-generation technologies from a mid- to long-term perspective. Samsung Electronics is concentrating R&D investments to secure a major position in both system and memory businesses. This is the background behind Samsung Electronics emphasizing that it is increasing R&D investment even amid the recent downturn in the semiconductor market.

Still, there is an assessment that the recent results are disappointing compared to the considerable R&D investments Samsung Electronics has made so far. A major basis for this is SK Hynix’s prominent performance in high-value new markets such as Double Data Rate (DDR) 5 DRAM and High Bandwidth Memory (HBM). Researchers Lee Seung-woo and Lim So-jeong of Eugene Investment & Securities recently stated in a report, “Samsung’s overwhelming competitiveness and characteristic strengths in new technology and growth areas have weakened compared to the past,” and “Market doubts are growing about whether Samsung Semiconductor remains the world’s strongest both qualitatively and quantitatively.”

In particular, in the HBM field, Samsung Electronics increased its market share by launching second- and third-generation products such as HBM2 and HBM2E, but it is trailing SK Hynix in the latest fourth-generation product, HBM3. SK Hynix is the only company mass-producing HBM3 and supplying products to GPU manufacturer Nvidia. TrendForce expects SK Hynix’s market share in the HBM market this year to rise to 53%, up from 50% last year. Samsung Electronics is forecasted to hold 38%, and Micron 9% market share.

In response, Samsung Electronics plans to rapidly expand its business by mass-producing HBM3 within this year and launching the fifth-generation product, HBM3P. Kim Jae-jun, Vice President of Samsung Electronics’ Memory Business Division, said, “Through expansion investments next year, we plan to secure at least twice the HBM capacity compared to this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)