Strong Performance in Q2, the Off-Season for Major Airlines

Improved Results Expected in Q3 with Peak Season Entry

Peak-Out Concerns and Uncertainty Over Korean Air-Asiana Merger Remain Variables

On the 28th, marking the official start of the summer vacation season, international travelers at Incheon International Airport Terminal 1 are completing their check-in procedures. Photo by Jinhyung Kang aymsdream@

On the 28th, marking the official start of the summer vacation season, international travelers at Incheon International Airport Terminal 1 are completing their check-in procedures. Photo by Jinhyung Kang aymsdream@

Airlines recorded strong performance in the off-season second quarter. With the recovery of international passenger traffic and the arrival of the summer peak season, strong results are also expected in the third quarter, raising hopes for a stock price rebound.

According to the Korea Exchange, on the 8th, Korean Air's stock price closed at 24,550 KRW, down 0.20% compared to the end of last month. During the same period, Asiana Airlines recorded 1.52%, Jeju Air 1.15%, Air Busan 0.33%, and T'way Air -1.15%. These returns were better than the KOSPI index (-2.23%).

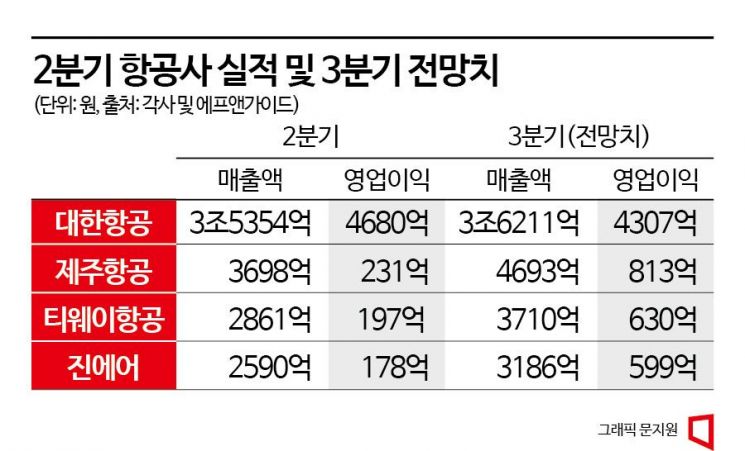

Airlines posted strong results in the second quarter. Korean Air's standalone revenue for the second quarter increased by 6% year-on-year to 3.5354 trillion KRW, while operating profit decreased by 36% to 468 billion KRW. Revenue increased due to the recovery in passenger demand, but operating profit declined due to rising costs. However, the results met market expectations.

Low-cost carriers (LCCs) fell short of market expectations but achieved record-breaking results. Jeju Air and Air Busan posted their highest quarterly results ever in the second quarter of this year. Jeju Air's standalone revenue increased by 195.6% year-on-year to 369.8 billion KRW, and operating profit turned positive at 23.1 billion KRW. Air Busan also recorded revenue of 198.295 billion KRW and operating profit of 33.888 billion KRW. T'way Air achieved revenue of 286.1 billion KRW and operating profit of 19.6 billion KRW.

The improvement in their performance is attributed to the rapid increase in overseas travelers following the COVID-19 endemic. According to Incheon International Airport Corporation, 24,401,190 passengers used Incheon International Airport in the first half of this year. This is 69.2% of the 35,258,765 passengers during the same period in 2019 before COVID-19. However, it represents a 519.7% increase compared to 3,937,404 passengers in the first half of last year.

Especially since the third quarter is the peak season, the positive performance trend is expected to continue. Passenger traffic at Incheon Airport last month was 5.23 million, which is 84% of July 2019 levels. Compared to the same month last year, it increased by 201%, showing a rapid rise in overseas travelers. Park Seong-bong, a researcher at Hana Securities, said, "With the seasonal peak in the third quarter, both long- and short-haul routes recorded significant increases compared to the previous month," adding, "Due to the summer vacation in August and the Chuseok holiday in September, international passenger demand recovery is expected to be prominent throughout the third quarter."

According to FnGuide, securities firms forecast Korean Air's third-quarter revenue and operating profit at 3.6211 trillion KRW and 430.7 billion KRW, respectively. Revenue is expected to increase by 2.42% from the previous quarter, while operating profit is expected to decrease by 7.97%. Jeju Air is expected to see revenue of 469.3 billion KRW and operating profit of 81.3 billion KRW, increasing by 26.9% and 251.94%, respectively. T'way Air is also expected to achieve revenue of 371 billion KRW and operating profit of 63 billion KRW, up 29.67% and 221.43% from the previous quarter, respectively.

However, concerns remain over the 'peak-out' of passenger and cargo demand and uncertainties surrounding the Korean Air-Asiana Airlines merger. Jeong Yeon-seung, a researcher at NH Investment & Securities, said, "For domestic airlines, long-haul route fares are expected to remain strong for a prolonged period, and cargo fare levels are rising, which should lead to upward revisions in profit forecasts." However, he added, "Concerns about peak-out in short-haul and domestic demand in the second half, especially among U.S. airlines, are increasing downward valuation pressure across the airline industry," and pointed out, "Moreover, delays in approval of Korean Air's acquisition of Asiana Airlines mean that uncertainties in industry restructuring remain."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)