Analysis of Interest Coverage Ratio of Domestic Listed Companies in Q1 This Year

High Interest Rates and Economic Slowdown Increase at-Risk Companies... Concerns Over Domestic Economy 'Time Bomb'

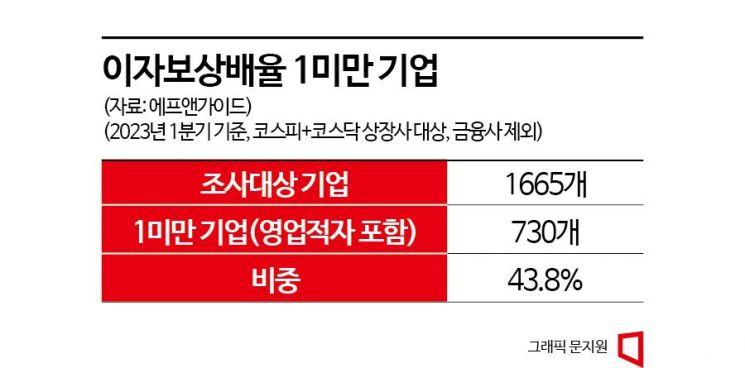

43.8%. This is the proportion of domestic listed companies in the first quarter of this year whose interest coverage ratio (the ratio of operating profit to interest expenses) falls below 1. This means that nearly half of the listed companies were unable to cover even their interest expenses despite making profits. Given the ongoing high-interest-rate environment, it is likely that the number of such distressed companies remained significant in the second quarter as well. Amid persistent concerns about an economic recession, there is growing worry that the increase in 'zombie companies' (marginal companies) could become a ticking time bomb for the domestic economy.

The interest coverage ratio is an indicator that shows how much a company's earnings (operating profit) exceed the interest expenses it must pay in a given year. It is calculated by dividing operating profit by interest expenses and reflects a company's ability to service its debt. An interest coverage ratio below 1 means the company cannot even cover its interest expenses with its earnings for the year. Typically, a ratio of 1.5 or higher indicates sufficient ability to repay debt, while a ratio below 1 classifies the company as potentially distressed. Companies with an interest coverage ratio below 1 for three consecutive years are considered marginal companies (those with an interest coverage ratio under 100% for three consecutive years or those recording negative cash flow from operating activities).

Ratio of Distressed Companies Rises from 33.7% in Q1 Last Year to 43.8% in Q1 This Year

According to financial information provider FnGuide on the 9th, an analysis of the interest coverage ratios of 1,665 domestic listed companies (KOSPI and KOSDAQ) for the first quarter of this year showed that 730 companies (including 603 operating loss-makers) had an interest coverage ratio below 1, accounting for 43.8% of the total. According to FnGuide's survey, the proportion of companies with an interest coverage ratio below 1 was 33.7% last year (726 companies including 583 operating loss-makers). This means that one in three listed companies could not cover their interest expenses. The increase in the ratio of distressed companies is attributed to the high interest rates.

The problem is that even relatively large companies are struggling with the interest burden from high-interest loans. Companies such as Lotte Shopping, Hyosung, Hanjin KAL, Hyosung Heavy Industries, Samsung Heavy Industries, E-Mart, and Pulmuone were recorded with interest coverage ratios below 1.

Many companies have recorded operating losses for three consecutive years, including 2021, 2022, and this year (as of Q1). These include Korea Electric Power Corporation, HD Hyundai Heavy Industries, Hanwha Ocean, HD Korea Shipbuilding & Offshore Engineering, Hyundai Mipo Dockyard, Alteogen, Lunit, Oscotec, Shinpung Pharmaceutical, Voronoi, HLB Life Science, LegoChem Biosciences, Eoflow, Lotte Tour Development, ST Cube, Hydro Lithium, JLK, NK Max, GemVax, WIZWID Studio, Saltlux, Nepes, ENPlus, Naturecell, KMW, Open Edge Technology, SillaJen, and Vuno.

There are also companies with an interest coverage ratio below 1 for three consecutive years. Hanjin KAL and Lotte Shopping are representative examples. This is interpreted as a failure to escape the impact of COVID-19. Hanjin KAL recorded an operating loss in 2021 due to a sharp decline in traveler demand, and its interest coverage ratio was only 0.19 last year. It remained low at 0.59 in the first quarter of this year. Lotte Shopping also had ratios of 0.43 in 2021, and 0.77 and 0.78 in 2022 and Q1 this year, respectively. A representative from the Korea Capital Market Institute expressed concern, saying, "With market interest rates rising sharply, companies' debt servicing ability this year is expected to deteriorate further compared to last year."

Ratio of Marginal Companies Doubles Over Six Years

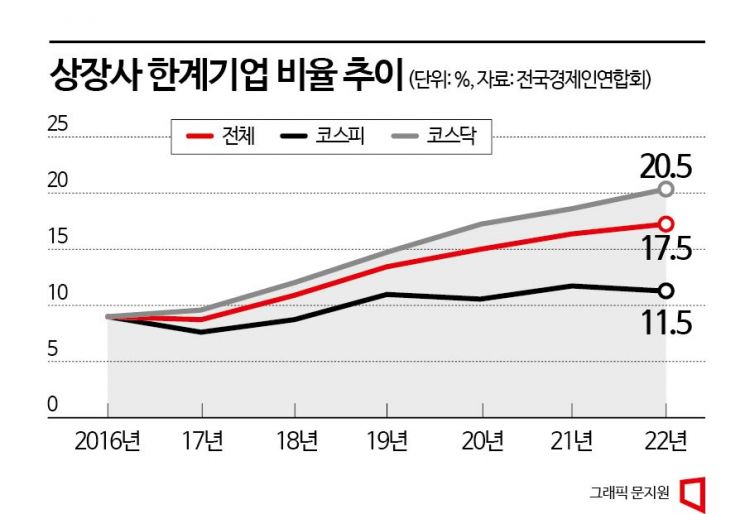

Consequently, warnings about corporate distress are growing louder. The likelihood of an increase in marginal companies compared to last year is high. According to an analysis by the Federation of Korean Industries of the proportion of marginal companies among KOSPI and KOSDAQ listed companies, 17.5% of listed companies were marginal companies as of the end of last year. Notably, the proportion of marginal companies among listed companies has been steadily increasing. It rose from 9.3% in 2016 to 9.2% in 2017, 11.2% in 2018, 13.7% in 2019, 15.2% in 2020, 16.5% in 2021, and 17.5% in 2022, nearly doubling over six years.

A survey by the Korea Economic Research Institute of 23,273 companies subject to external audits with publicly available financial indicators also shows an increasing trend in marginal companies. The number rose by 241 companies (8.7%) to 3,017 last year. The institute noted that the speed at which companies fall into marginal status has also accelerated. Among all externally audited companies, the proportion of 'zombie companies' was 12.9%, increasing at an average annual rate of 10.1% from 2017 to 2022. The Korea Economic Research Institute analyzed that the number of listed companies in marginal status last year reached a record high of 411, far exceeding the numbers during the Asian Financial Crisis (255 companies) and the 2008 Financial Crisis (322 companies). Two out of every ten listed companies are classified as marginal companies.

Choo Kwang-ho, head of the Economic and Industrial Headquarters at the Federation of Korean Industries, said, "The spread of COVID-19 since 2020, rapid interest rate hikes, and recent economic downturns are analyzed as factors contributing to the increase in marginal companies," emphasizing, "It is necessary to maintain a stable financial policy stance and implement tailored policies considering industry-specific characteristics." Hana Financial Management Research Institute pointed out, "Corporate profitability is deteriorating due to declining performance amid global economic slowdown and increased production costs caused by high interest rates and inflation," adding, "Cash flow is gradually worsening as cash assets of listed companies have decreased since Q2 last year, raising concerns about corporate distress."

Moreover, economic conditions this year are worse than last year. According to the Bank of Korea's real GDP statistics for Q2 this year, exports decreased by 1.8% compared to the same period last year. According to the Ministry of Trade, Industry and Energy's export-import trends, the export decline that had been gradually easing since April worsened again last month. The increase in private debt is also a concern. Despite sharp interest rate hikes, 'debt investment' (borrowing to invest) has not slowed, and private debt rose to 4,833 trillion won last year.

Another worrisome point is that once a company becomes marginal, it tends to remain chronic as the frequency of recurrence is high. Researchers Park Chan-kyun and Jung Hwa-young from the Korea Capital Market Institute said, "The probability that a marginal company remains marginal the following year increased from 68% in 2002 to 75% in 2017," adding, "The average time for a company entering marginal status to exit it is 3.8 years, and many remain marginal for over 10 years."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)