Decline in Tether (USDT) Trading Volume as Bitcoin Stalls Around $29,000

Market Shows Signs of Pause

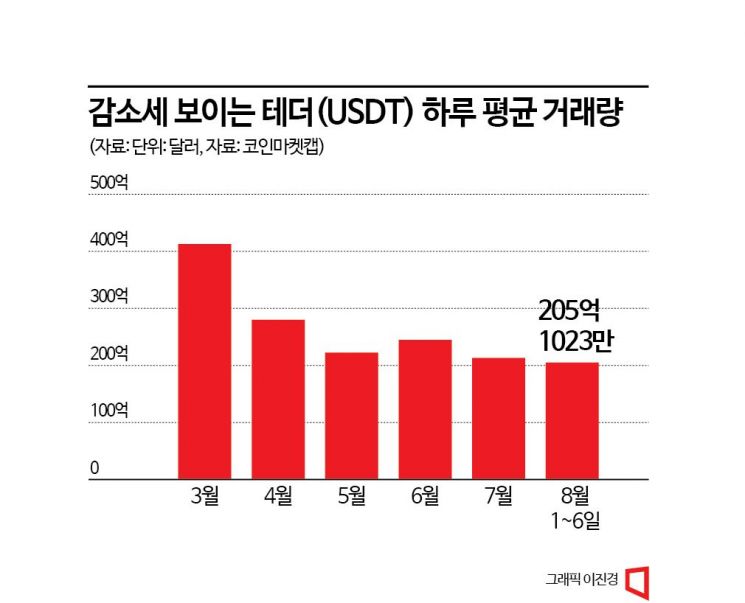

As the virtual asset market fails to gain momentum, the trading volume of stablecoins used as a means of exchange is also gradually showing a declining trend.

Analyzing data from CoinMarketCap, a global virtual asset market tracking site, the average daily trading volume of the stablecoin Tether (USDT) from the 1st to the 6th of this month was recorded at $20.51023 billion (approximately 26.7289 trillion KRW). Compared to last month's average daily trading volume ($21.29948 billion), this represents a decrease of $789.25 million (approximately 1.0293 trillion KRW).

Until March, the average daily trading volume of USDT was about twice as high as this month, at $41.26309 billion. However, it has since shown a downward trend and has decreased compared to the previous month except for June. USDT is designed to be pegged (fixed) to fiat currency, the US dollar. It was developed to ensure stability as coin prices continue to fluctuate. In the market, USDT is mainly used as a means of transaction by leveraging its price stability. It is considered a representative stablecoin. Among all virtual assets, USDT's market capitalization is the third largest after Bitcoin and Ethereum. Additionally, its trading volume is the highest among all virtual assets, and as of 3:15 PM on the 7th, it was about 1.93 times that of Bitcoin.

The continuous decline in USDT's trading volume is due to unfavorable market conditions, such as the lack of upward momentum in coin prices. Bitcoin, for example, has remained in the $29,000 range since the 24th of last month. On the 7th, it briefly dropped to the $28,900 range before recovering to the $29,000 level. When New York District Court Judge Analisa Torres ruled in a summary judgment that the virtual asset Ripple is "not a security in itself," siding with Ripple against the US Securities and Exchange Commission (SEC), which had claimed it was a security, Bitcoin's price rose to the $31,000 range. This was due to expectations that the US Commodity Futures Trading Commission (CFTC), which has relatively lighter regulations than the SEC, would oversee the virtual asset market. However, concerns over continued tightening by the Federal Reserve (Fed) later caused the price to fall back to previous levels.

With coin prices stagnating and USDT trading volume declining, investor sentiment toward the virtual asset market is gradually worsening. According to Alternative, a virtual asset data provider, the Fear & Greed Index, which represents investor sentiment as an index, was 49 points (neutral) as of the previous day. This is a 1-point decrease compared to 50 points (neutral) a week ago. Until a month ago, investor sentiment maintained a greed level, but the index has fallen as the coin market failed to revive. Alternative's Fear & Greed Index ranges from 0 points, indicating extreme fear and pessimism about investment, to 100 points, indicating optimism.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.