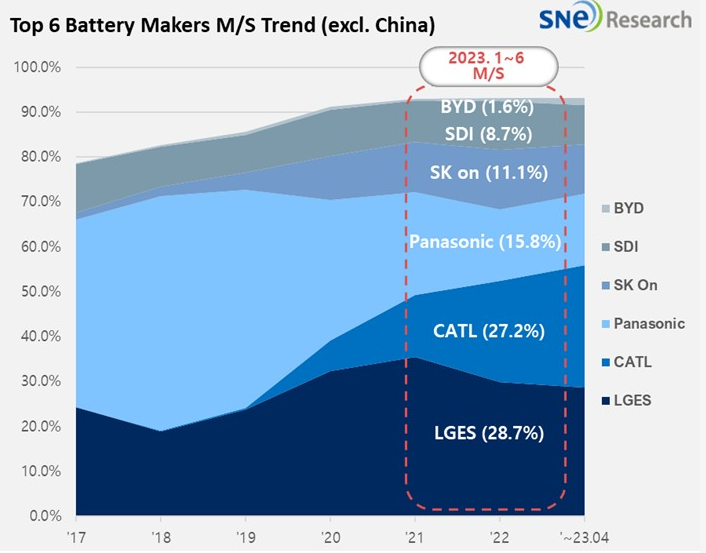

Market share rankings by company for electric vehicle batteries sold from January to June this year. Data provided by SNE Research

Market share rankings by company for electric vehicle batteries sold from January to June this year. Data provided by SNE Research

From January to June this year, the three domestic companies recorded a 48.5% market share in the electric vehicle battery market excluding China.

Energy-focused market research firm SNE Research announced on the 7th that the cumulative usage of electric vehicle batteries from January to June this year reached approximately 143.1 GWh, marking a 56.0% growth compared to the same period last year.

All three domestic companies ranked within the top five. LG Energy Solution maintained its leading position with a 55.1% (41.1 GWh) growth compared to the same period last year. SK On and Samsung SDI recorded growth rates of 15.7% (15.8 GWh) and 28.8% (12.5 GWh), respectively, ranking 4th and 5th. China's CATL is closely pursuing LG Energy Solution with a triple-digit growth rate of 107.1% (38.9 GWh).

Although the market share of the three domestic companies fell by 5.9 percentage points to 48.5% compared to the same period last year, their battery usage showed a growth trend. The growth of the three domestic companies is mainly due to strong sales of models equipped with their batteries. LG Energy Solution continued its growth driven by increased sales of Tesla Model 3 and Y, Volkswagen ID.3 and ID.4, and Ford Mustang Mach-E. SK On showed growth following the global popularity of Hyundai Ioniq 5 and 6, and Kia EV6. Samsung SDI demonstrated growth through sales of Rivian R1T, BMW i4 and X, and Fiat 500 Electric.

Japan's Panasonic recorded a battery usage of 22.7 GWh this year, growing 40.1% compared to the same period last year. Panasonic is one of Tesla's major battery suppliers, with most of its battery usage coming from Tesla vehicles in the North American market. In particular, the Tesla Model Y, which saw a sharp increase in sales compared to the previous year, drove Panasonic's growth.

Several Chinese companies, including CATL, showed explosive triple-digit growth rates in non-Chinese markets. They are gradually expanding their market share in the global market excluding China. CATL ranked second in non-Chinese markets due to strong sales of Tesla Model 3 and Y (Chinese-made units exported to Europe, North America, and Asia), Mercedes EQS, Volvo XC40 Recharge, and MG-4. It is also expected that CATL's batteries will be installed in Hyundai's new Kona electric vehicle model, further expanding its market share in non-Chinese markets. Among the top 10 battery companies, BYD showed the highest growth rate, gaining high popularity in the Chinese domestic market through price competitiveness achieved by vertically integrated SCM (supply chain management) including battery supply and vehicle manufacturing. BYD's price competitiveness targeting the Chinese domestic market and its well-established quality are rapidly increasing its market share in Europe and Asia.

Driven by Chinese companies' determination to expand overseas, continuous high growth is being seen in non-Chinese markets. In particular, CATL's market share is rising sharply, threatening LG Energy Solution's top position. Recently, global automakers such as Tesla and Volkswagen announced the adoption of LFP batteries, shifting the market toward price-competitive LFP batteries. Attention is focused on changes in market share of Chinese companies and LFP (Lithium Iron Phosphate) battery usage, especially in Europe where LFP battery usage is low.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.