Terraform Labs lawsuit related "Worth examining coin securities characteristics" judgment

Industry: "Not the final decision on virtual asset securities status... Impact unlikely to be significant"

In the United States, differing views on whether virtual assets constitute securities have drawn market attention. This follows an assessment that the virtual asset issuer Ripple effectively won its lawsuit against the U.S. Securities and Exchange Commission (SEC), while a ruling potentially favorable to the SEC has also emerged.

According to industry sources, on the 31st of last month, U.S. District Judge Jed Rakoff of the Manhattan Federal Court rejected a request to dismiss the lawsuit filed by the SEC against Terraform Labs and its founder Do Kwon. Earlier in February, the SEC sued Terraform Labs and Do Kwon on charges including unregistered securities offering and sales fraud. Terraform Labs denied the allegations, arguing that the virtual assets they issued, such as the stablecoin TerraUSD, do not qualify as securities. However, with this decision, the trial on fraud and other charges will proceed.

Ultimately, Judge Rakoff dismissed Terraform Labs' request, not ruling that virtual assets are securities but lending support to the SEC's claims. He judged that the lawsuit has merit to proceed as argued by the SEC. Judge Rakoff stated, "I refuse to distinguish securities status based on the method of sale." This contradicts the Ripple ruling. On the 13th of last month, U.S. District Judge Analisa Torres of the New York District Court issued a summary judgment stating, "Ripple itself is not a security." She further ruled, "Ripple Labs' sales of Ripple to general investors on virtual asset exchanges did not violate federal securities laws," adding that "sales to general investors on exchanges did not allow investors to reasonably expect profits from Ripple." She also noted, "Investors likely did not know whether the money they paid went to Ripple Labs or other sellers."

However, regarding sales of Ripple to institutional investors such as hedge funds, the court recognized the security nature of Ripple. Judge Torres stated, "Sales of Ripple to institutional investors constitute investment contracts because investors expected Ripple's price to rise," and "therefore, federal securities laws must be complied with in these cases."

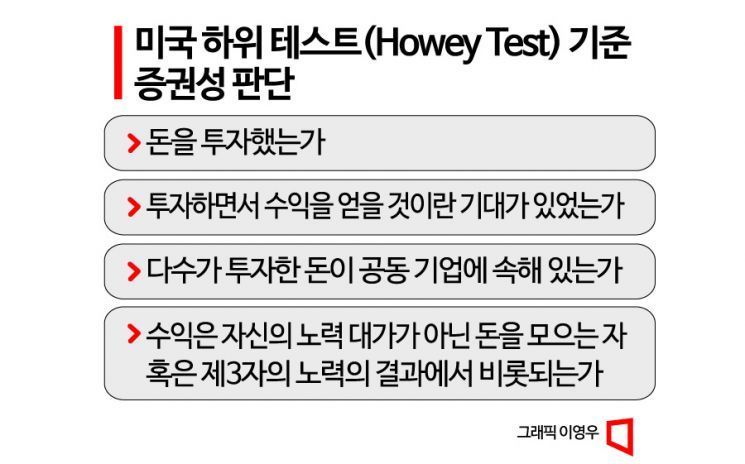

In the U.S., the Howey Test is used to determine securities status. The Howey Test considers whether: ▲money was invested ▲there was an expectation of profits from the investment ▲the invested money is part of a common enterprise ▲profits derive from the efforts of others rather than the investor's own efforts. If all these conditions are met, the asset is deemed a security. The Howey Test is also applied to virtual assets.

Judge Torres viewed Ripple sales to institutions as sales of investment contract securities. Specifically, under the fourth condition of the Howey Test, institutions that purchased directly from Ripple Labs could expect value appreciation due to Ripple Labs' efforts. However, trades by general investors through exchanges, where buyers and sellers do not know each other and funds may flow to sellers other than Ripple Labs, were judged not to allow the same expectation of value increase due to Ripple Labs' efforts. This ruling does not definitively deny Ripple's security status but differs from the SEC's claim that Ripple is a security, leading to an assessment that Ripple Labs effectively won this lawsuit.

In contrast, Judge Rakoff stated that under the Howey Test, securities status should not be determined based on who the purchaser is. He countered Judge Torres by saying, "I reject the approach recently adopted by another judge in this district in a similar case."

Industry experts do not expect Judge Rakoff's decision to have a major impact on the market. This is because it does not represent a final ruling that "virtual assets are securities," but merely that the lawsuit between Terraform Labs and the SEC has merit to proceed. Furthermore, even if the SEC wins this case and securities status is recognized, it would only apply to virtual assets related to Terraform Labs, and securities status would need to be reassessed for other coins.

Professor Hong Ki-hoon of Hongik University's Business Administration Department explained, "The core of the Ripple lawsuit is that the court did not fully accept the SEC's claims, and that Ripple is not always a security. Interpreting Ripple as not a security is excessive," adding, "Similarly, there is no need to overinterpret the Terraform Labs case."

Senior Research Fellow Kim Gap-rae of the Korea Capital Market Institute said, "The lawsuit between Terraform Labs and the SEC is ongoing, no conclusion has been reached, and evidence collection is not yet complete," adding, "The significance of this decision lies in the statement that the Ripple case will not be directly applied. While there may be vague concerns that another judge in the appellate court might share Judge Rakoff's view and overturn the Ripple ruling, it is nothing more or less than that."

Given that the securities status of virtual assets is a critical issue in the coin market, domestic financial authorities and exchanges are also taking action. In February, the Financial Supervisory Service (FSS) formed a task force (TF) to support the determination of securities status for virtual assets circulating domestically. Currently, exchanges review the securities status of virtual assets before listing them if no issues are found. The FSS TF operates by supporting exchanges when securities status determination is difficult. Determining securities status involves examining not only whitepapers but also marketing materials, social media promotions, and statements. Domestically, the Capital Markets Act clearly defines securities and lists their classifications, and securities status is generally interpreted more narrowly than in the U.S.

An FSS official explained, "Because these are unprecedented transactions, we are in the process of developing new methods to determine the securities status of virtual assets," adding, "When new virtual asset-related products emerge, exchanges must make determinations, so we focus more on supporting capacity building." The official also said, "Unlike traditional securities, virtual assets vary in business content and require extensive review, so progress on creating a checklist for securities status assessment has been slow," adding, "Due to the many considerations, it inevitably takes time, but we are working closely with exchanges."

The Digital Asset Exchange Joint Council (DAXA), composed of the five major Korean won market exchanges?Gopax, Bithumb, Upbit, Korbit, and Coinone?has also set securities status determination as a key item in its virtual asset listing guidelines. A DAXA representative said, "We are reviewing and discussing various cases related to virtual asset securities status determination."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.