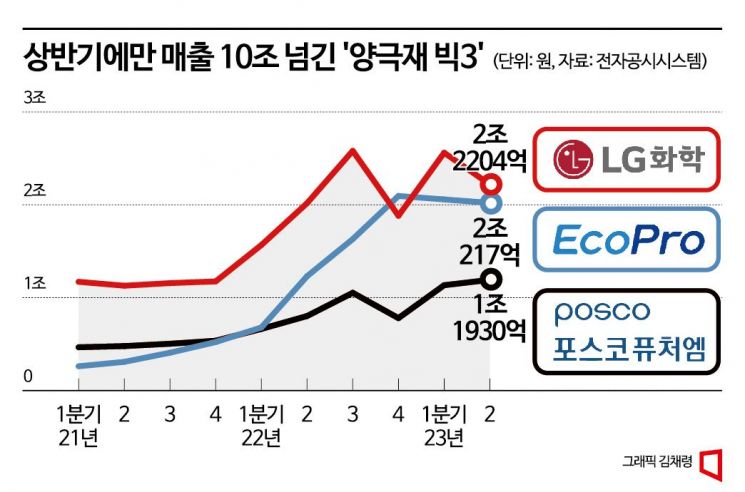

LG Chem (Advanced Materials Division)·Ecopro·POSCO Future M

Combined Sales of 11.19 Trillion KRW in H1

Operating Profit of 809.6 Billion KRW... Remaining Task is 'Maximizing Profit'

Choi Wook, Head of the Cathode Material Production Department at POSCO Future M, is introducing single-particle cathode materials. Photo by POSCO Future M

Choi Wook, Head of the Cathode Material Production Department at POSCO Future M, is introducing single-particle cathode materials. Photo by POSCO Future M

The combined sales of the 'Big 3' domestic battery cathode material companies surpassed 10 trillion KRW for the first time in history in the first half of the year. The remaining challenge for cathode material companies, which are significantly expanding their production scale of cathode materials, a core battery material, is maximizing profits.

The combined sales of the Big 3 cathode material companies?LG Chem (Advanced Materials Division), EcoPro, and POSCO Future M?reached 11.1906 trillion KRW in the first half of this year alone. Just two years ago, in the first half of 2021, their combined sales were 3.8211 trillion KRW. Sales increased by 192.8% over two years, nearly tripling. The combined operating profit in Q2 this year was 809.6 billion KRW, with an operating profit margin of 7.23%.

By company, LG Chem and EcoPro appear to have stably settled into quarterly sales in the 2 trillion KRW range. LG Chem's Advanced Materials Division recorded Q2 sales of 2.2204 trillion KRW and operating profit of 184.6 billion KRW. Although sales slightly decreased compared to Q1 (2.5615 trillion KRW), solid performance continued. The first half sales were 4.7818 trillion KRW with an operating profit of 387.3 billion KRW. EcoPro achieved Q2 sales of 2.0172 trillion KRW and operating profit of 170.3 billion KRW. Sales slightly declined from the previous quarter but remained above 2 trillion KRW. EcoPro's cumulative first half sales were 4.0816 trillion KRW, with operating profit of 352.7 billion KRW, representing increases of 113.4% and 57.6% respectively compared to the same period last year. POSCO Future M posted Q2 sales of 1.193 trillion KRW and operating profit of 52.1 billion KRW. For the first half, total sales were 2.3282 trillion KRW with operating profit of 72.4 billion KRW.

The operating profit growth of the three cathode material companies appears to have slowed in the first half of this year. This is the result of raw material prices such as lithium dropping and being reflected in product prices. Lithium prices (based on lithium carbonate) hovered around 100 million KRW per ton last year but fell to 27 million KRW in April this year. Currently, prices have risen again to about 46.46 million KRW. Companies are forced to sell cathode materials made with lithium purchased at high prices at lower prices, causing some decrease in profits. After announcing Q2 results, LG Chem stated, "Profitability declined due to the slowdown in the European electric vehicle market growth and the drop in metal prices," and added, "In Q3, as the metal prices that sharply fell in Q2 are fully reflected in product prices, sales and profitability of the battery materials business are expected to decrease further."

POSCO Future M recorded an operating profit margin of 3.1% in the first half of this year. This is somewhat lower than competitors LG Chem (about 8.09%) and EcoPro (about 8.57%). POSCO Future M explained, "Operating profit margin declined somewhat due to initial operating costs of the Gwangyang cathode material plant, our main production base completed last year," and added, "We expect performance to improve in the second half as shipments of the premium product 'N86 (nickel content 86%) cathode material' increase." Cathode material plants, like battery plants, are known to require time to improve yield (good product rate).

Although profit growth has slowed, there is no disagreement about the growth of the Big 3 cathode material companies. This is because they are significantly expanding production capacity. In particular, they are actively securing the cathode material value chain by expanding precursor (intermediate raw material for cathode materials) production, which had been dependent on China. LG Chem plans to expand cathode material and precursor production capacity from 90,000 tons last year to 260,000 tons in 2026 and 470,000 tons in 2028 by expanding factories mainly in Korea, the US, and Europe. Through this, they aim to increase battery materials division sales from 4.7 trillion KRW in 2022 to 30 trillion KRW in 2028. The Gumi cathode material plant, completed and started production this year, is expected to have a production capacity of 60,000 tons next year.

The EcoPro Group is also expanding cathode material and precursor production capacity. EcoPro BM and EcoPro EM (a joint venture with Samsung SDI) plan to increase cathode material production from 180,000 tons this year to 270,000 tons next year. POSCO Future M will expand high-nickel NCA cathode material production capacity to 82,500 tons by 2025. Adding the confirmed NCM and NCMA production capacity of 240,000 tons by 2025, POSCO Future M's total cathode material production capacity will increase to 320,000 tons.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)