BYD Japan Surpasses Hyundai in Japan Market 6 Months After Entry

Secures Subsidies for Cost-Effective Chinese EVs, Targets Japanese Market

BYD's Overseas Expansion Weighs Entry into Korea

Korean EV Market Entry Challenging Due to Cost-Effectiveness Strategy Difficulties

The onslaught of Chinese electric vehicles (EVs) in the global market is becoming significant. Following last year, BYD once again surpassed Tesla in the first half of this year to become the world's top-selling electric vehicle manufacturer. At the same time, BYD entered Japan's electric vehicle market, a powerhouse in the automotive industry, and easily overtook Hyundai Motor within six months. BYD is now considering expanding beyond Germany, Japan, and Southeast Asia to enter the Korean market.

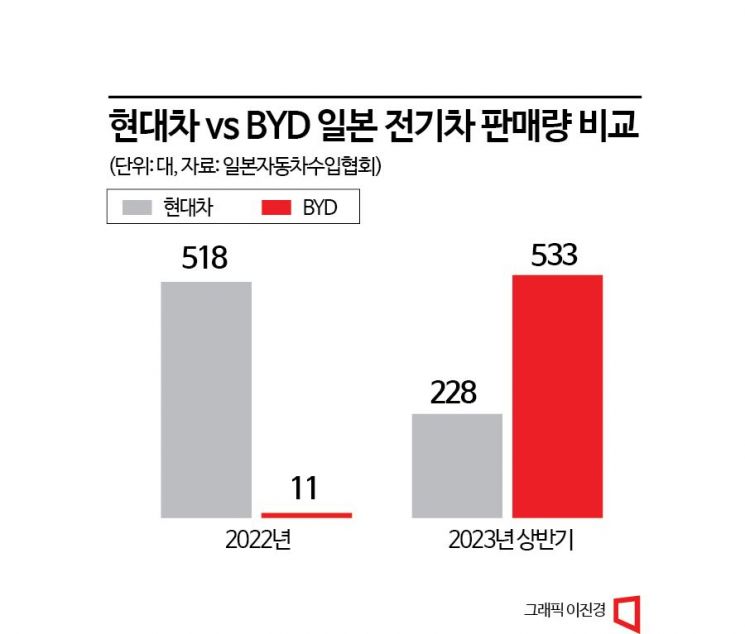

According to data from the Japan Automobile Importers Association (JAIA) on the 3rd, BYD sold 533 units of the compact electric SUV Atto 3 in Japan during the first half of this year. In the same period, Hyundai Motor's Japan subsidiary (Hyundai Mobility Japan) sold 228 units of the similarly classed electric SUV Ioniq 5. This figure is less than half of BYD Japan's sales volume.

Hyundai Motor on Alert Amid Chinese Onslaught in Global Market

This achievement by BYD is a milestone that Hyundai Motor has not reached even a year after re-entering the Japanese market. BYD Japan surpassed Hyundai Mobility Japan's total annual sales of 518 units from last year within just six months of entering Japan. Hyundai Motor is now pushing forward with its Japan entry, with President Jang Jae-hoon personally driving the effort. This result is a painful report card for Hyundai and simultaneously a warning that Chinese electric vehicles, emphasizing cost-effectiveness, must be closely monitored in the global EV market.

BYD is selling the compact electric SUV Atto 3 in Japan for 4.4 million yen (approximately 39.5 million KRW). Hyundai Mobility Japan is selling the comparable Ioniq 5 model for 4.79 million yen (approximately 43 million KRW). There is a price difference of more than 390,000 yen (3.5 million KRW) at the launch price. When combined with subsidies from the Japanese government and local authorities, the price gap between the two models exceeds 1 million yen (9 million KRW). This is because BYD quickly adapted to the revised Japanese government subsidy criteria starting this year. Among imported car brands, BYD is the first to obtain the 'type designation certification' that allows receiving 100% of the Japanese government subsidy.

BYD, which entered the Japanese market earlier this year, plans to establish 100 sales dealerships by 2025. The strategy is to allow Japanese consumers, who remain skeptical about Chinese cars, to experience the vehicles firsthand before making a decision. In the second half of this year, BYD will introduce two additional models: the small electric hatchback Dolphin and the electric sedan Seal. Hyundai Motor also plans to sequentially launch the second-generation Kona electric vehicle this fall and the high-performance electric Ioniq 5 N next year.

Slow EV Transition in Japan... Why Is BYD Targeting Korea?

BYD's entry into Japan was a predictable step. With the slow transition to electric vehicles among domestic brands, Japan's EV market is expected to have a gap in the coming years. BYD has devised a strategy to penetrate this gap with cost-effective electric vehicles. If Chinese EVs gain recognition for their product quality in Japan, a traditional automotive powerhouse, it will be easier to implement marketing strategies in Southeast Asian markets, which are dominated by Japanese car brands.

However, the Korean market is different. This is because global top-tier EV manufacturers Hyundai Motor and Kia are well established there. In the imported car industry, the Korean market is known as a place where premium brands can do well regardless, but mass-market brands struggle. Hyundai Motor and Kia have a full lineup of electric vehicles ranging from premium to mass-market models. It seems difficult for Chinese EVs, emphasizing cost-effectiveness, to penetrate the Korean market.

For this reason, it is known that BYD Korea is facing difficulties in coordinating the scale and timing of its entry into the passenger electric vehicle market. Externally, there are issues with certification and subsidy receipt, while internally, deciding on launch pricing and securing dealerships are challenging, causing delays in the Korean market entry schedule. A BYD Korea official said, "BYD headquarters has never specifically mentioned the timing of entry into Korea from the past until now," adding, "However, it is true that the entry itself is under consideration."

Industry insiders believe that BYD is unlikely to make large-scale investments in Korea as it did in Japan. Instead, they analyze that the entry itself holds significance from the perspective of Korea as a strong electric vehicle manufacturing country in terms of batteries and complete vehicles. There is also speculation that BYD will lower its self-certified driving range to secure price competitiveness domestically.

The lithium iron phosphate (LFP) batteries equipped in BYD vehicles have a characteristic of reduced performance in low temperatures. Reflecting this, the Korean government provides subsidies only for electric vehicles that maintain at least 70% of their normal temperature single-charge driving range even in low temperatures. The driving range of electric vehicles can be reported directly by manufacturers to the Ministry of Trade, Industry and Energy. Therefore, it is expected that BYD will lower its basic normal temperature driving range to meet the subsidy eligibility criteria.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)