Record High Number of Investments This Year... Investment Amount Recovers to 700 Billion KRW

Fashion and Electric Vehicle Charging Solution Startups Attract Large Funds

Musinsa Raises 240 Billion KRW, Largest Scale Last Month

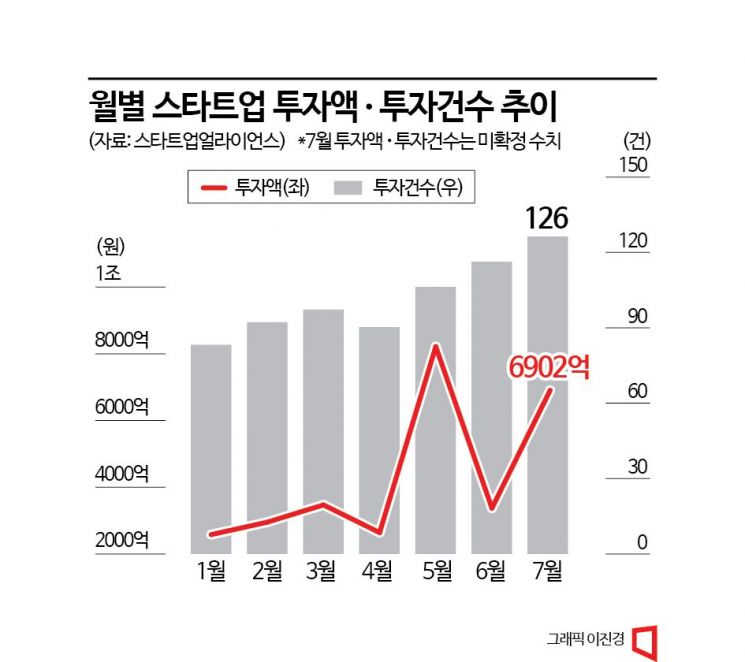

Startup investment in July recovered to about 700 billion KRW, more than double the amount from the previous month. Industry attention is growing on whether the frozen investment market will revive due to the government's measures to revitalize the venture and startup investment market and the upcoming implementation of the multiple voting rights system scheduled for November.

According to statistics from Startup Alliance on the 3rd, startup investment last month recorded 690.2 billion KRW as of the morning tally. This is more than double the 337.2 billion KRW invested in June. It is the second highest amount this year after May (821.5 billion KRW). The number of investment deals was 126, the highest so far this year. However, this statistic only aggregates data disclosed externally by companies or investors, so there may be differences from figures announced later by the government.

In last month's investments, startups related to fashion and electric vehicle charging attracted high interest. The largest investment was Series C funding of 240 billion KRW raised by Korea's online fashion platform Musinsa. Global private equity firm Kohlberg Kravis Roberts (KKR) participated as the lead investor. This is KKR's first investment in Korea under its Asia Next Generation Technology (NGT) strategy. Since 2016, KKR has been investing in innovative companies in fields such as software, consumer technology, and fintech through its NGT Growth Fund. Musinsa was valued in the mid-3 trillion KRW range during this investment round. It has grown further since becoming a "unicorn" (a private startup valued at over 1 trillion KRW) with a valuation in the 2 trillion KRW range during its first funding round in 2019.

Another fashion company, Rapolabs, raised 34 billion KRW in Series B2 funding. Altos Ventures led the investment, with existing investors Kakao Ventures and Atinum Investment also participating. Rapolabs operates the fashion platform "Queenit," targeting women in their 40s and 50s. It has secured over 1,300 brands including Nice Claup, Minimum, Metrocity, Valencia, and She’s Miss. Since March, its monthly revenue has turned profitable.

Electric vehicle charging platform company Everon also succeeded in raising 50 billion KRW, marking one of the "big deals." Major domestic investors such as KDB Industrial Bank, DSC Investment, and IBK Industrial Bank participated, exceeding the initial target of 30 billion KRW by a wide margin. Everon, which has over 100,000 members, operates infrastructure with about 30,000 chargers nationwide. Recently, it revamped its service to allow charging start and stop via a mobile application without card contact or QR authentication procedures.

Electric vehicle charging solution provider Eva also succeeded in raising 22 billion KRW last month. Participants included Japan's ORIX, KDB Industrial Bank, Samsung Securities, and SBI Investment. This is the first time a domestic charger manufacturer has attracted overseas investment. Eva is the 35th company from Samsung Electronics' in-house venture program C-Lab. It became an independent corporation in 2018. To date, it has supplied about 20,000 slow chargers nationwide.

The domestic startup investment market has entered a harsh winter since the second half of last year, heavily influenced by US interest rate hikes, economic uncertainty, and exchange rates. However, since the multiple voting rights system, a long-standing wish of the venture industry, passed the National Assembly in April, and recent announcements of venture investment revitalization measures and tax incentives for private venture funds, expectations are gradually rising. The multiple voting rights system allows venture company founders to exercise voting rights exceeding their shareholding. A venture capital (VC) industry official said, "Once the multiple voting rights system is implemented, companies that were reluctant to raise funds fearing loss of management rights will actively seek funding," adding, "There is a possibility that capital more interested in profits than company management will flow in massively." A representative from the Korea Venture Business Association expressed hope, saying, "The tax benefits at the stages of contribution, operation, and recovery of private venture funds, as recently announced by the government in the tax law revision, will inject vitality into the contracted venture investment market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.