CJ Group Acquired Microbiome Development Company 2 Years Ago

New Drug Development Requires Massive Funds and Time... Operating Losses Continue in Q1

CJ Bioscience, which received over 70 billion KRW in funding from CJ CheilJedang two years ago, has launched a capital increase through a rights offering to raise funds. This move comes as clinical costs have increased, leading to larger losses. The largest shareholder, CJ CheilJedang, plans to subscribe to all newly allocated shares. The funds raised from shareholders will be used for clinical costs to develop microbiome therapeutics.

According to the Financial Supervisory Service on the 2nd, CJ Bioscience is pursuing a paid-in capital increase through a rights offering of 0.55 new shares per existing share, followed by a general public offering of forfeited shares. The initially calculated issue price per share is 15,350 KRW, which is about 23.6% lower than the planned issue price of 20,100 KRW decided at the board meeting on May 22. The fundraising scale has also shrunk from 65 billion KRW to 49.6 billion KRW. Before the capital increase resolution, the stock price was above 25,000 KRW, but it started to decline immediately after the news of the rights offering. After about two months, the stock price has fallen below 20,000 KRW.

CJ Bioscience is a company developing microbiome therapeutics. Microbiome is a portmanteau of Microbiota and Genome. It refers to the entire collection of microbial communities and related genetic information existing in environments such as humans, animals and plants, soil, sea, and atmosphere. The company is developing a new drug candidate, discovered and isolated from fermented foods, as a treatment for lung cancer.

In July 2021, CJ Group acquired the microbiome development company Cheonlab and renamed it CJ Bioscience. Through acquiring existing shares and new shares, CJ Group secured a 44% stake. CJ CheilJedang invested 73.2 billion KRW solely to acquire existing shares, with an issue price of 37,465 KRW per share. At the time of acquisition, CJ Group presented a blueprint focusing on developing next-generation new drug technologies by combining CJ CheilJedang’s top-level microbial strain fermentation technology with Cheonlab’s precise microbiome analysis technology. The stock price was highly anticipated, surpassing 70,000 KRW at that time.

The microbiome new drug development business is considered a core business in the 'Wellness' sector, one of CJ Group’s four major growth engines. The plan is to nurture it as a future growth engine by maximizing CJ Bioscience’s unique capabilities and synergy effects among CJ affiliates.

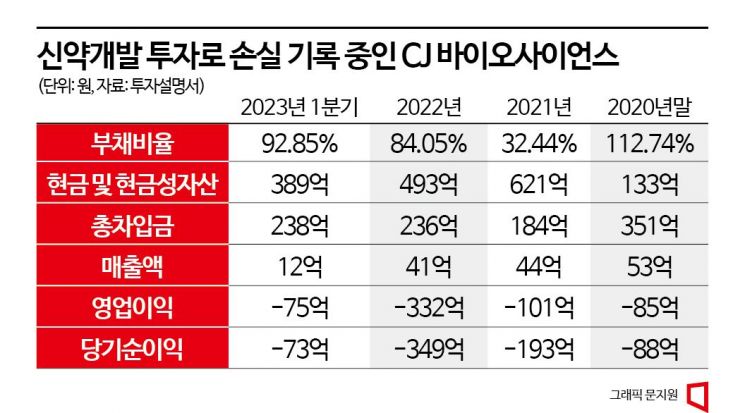

Despite high expectations, no visible results have emerged from investments over the past two years. Although CJ Group’s acquisition increased financial capacity, the time required to develop new drugs could not be shortened. CJ Bioscience recorded net losses of 19.3 billion KRW and 34.9 billion KRW in 2021 and 2022, respectively. Sales remained around 4 billion KRW. Losses increased due to rising clinical costs.

The debt ratio improved from 112.7% at the end of 2020 to 32.4% at the end of 2021, reflecting the effect of CJ Group’s capital injection. However, the debt ratio rose again to 84.1% at the end of 2022. In the first quarter of this year, a net loss of 7.3 billion KRW was recorded, and the debt ratio at the end of the first quarter was 92.9%.

As of the end of the first quarter this year, cash and cash equivalents stood at 38.9 billion KRW. Considering that clinical trials for the main pipeline have not yet fully started and the scale of last year’s net loss, the need to secure operating funds has increased.

The company decided to raise funds for clinical trials through the capital increase. It is developing CJRB-101, a microbiome new drug candidate strain for treating lung cancer patients who do not respond to immune checkpoint inhibitors. CJRB-101 enhances the efficacy of human immune cells and has a mechanism that increases anticancer effects when used together with immune checkpoint inhibitors. Its efficacy was confirmed through animal models implanted with cancer tissues from lung cancer patients. In January this year, the U.S. Food and Drug Administration (FDA) approved the Investigational New Drug (IND) application for phase 1/2 clinical trials. In June, clinical approval was obtained from the Korea Ministry of Food and Drug Safety. Approximately 13.1 billion KRW will be invested from the third quarter of this year to the fourth quarter of next year.

85 billion KRW will be used for clinical costs related to the microbiome new drug candidate strain (CLP-105) for treating inflammatory bowel disease (IBD) and strains introduced from UK-based 4D Pharma.

An industry insider said, "Developing new drugs requires enormous costs and time. Increases in R&D costs, delays in sales approval, and clinical trial failures cannot be ruled out."

CJ CheilJedang is considering 100% or 120% subscription participation for existing shareholders’ allocation. Even after completing the capital increase process, the largest shareholder’s stake is not expected to decrease.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.