SK Hynix Deficit, Battery Investment Pushes Group Debt Close to 105 Trillion Won

Minimizing Short-Term Operating Fund Burden... Utilizing Financing Methods Without Additional Borrowing

SK Group's affiliates in the refining business sector alleviated the burden of large-scale cash outflows by securitizing promissory notes worth 680 billion KRW. It is interpreted that they conducted promissory note securitization transactions to reduce short-term operating fund burdens without increasing additional borrowings. SK Group, whose borrowings have exceeded 100 trillion KRW due to SK Hynix's large-scale deficits and investments in the secondary battery business, is recently focusing on debt and liquidity management.

Large-scale Promissory Note Securitization... First Case in Korea

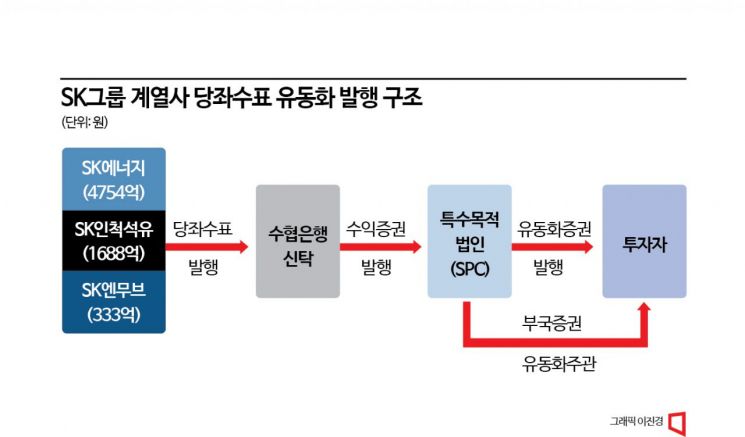

According to the investment banking (IB) industry on the 1st, SK Energy, SK Incheon Petrochem, and SK Enmove issued promissory notes worth a total of 680 billion KRW to Suhyup Bank. The amount of notes issued by each company is 475.4 billion KRW for SK Energy, 168.8 billion KRW for SK Incheon Petrochem, and 33.3 billion KRW for SK Enmove. All three companies are subsidiaries of SK Innovation, the intermediate holding company of SK Group, and are affiliates related to the refining business.

A promissory note refers to a check issued by a company that has opened a checking account at a bank within a pre-agreed limit with the bank. It is mainly used as a payment method between companies. SK Group affiliates entrusted Suhyup Bank with payment fund agency services and then issued large-scale promissory notes to Suhyup Bank Trust.

Suhyup Bank acquired the promissory notes and then sold trust beneficiary certificates (rights to convert promissory notes into cash) to a special purpose company (SPC). Using the proceeds from the sale of the beneficiary certificates, payment funds were executed on behalf of SK Group affiliates.

The SPC that purchased the promissory note trust beneficiary certificates issued securitized securities using the beneficiary certificates as underlying assets (a kind of collateral). Investors in the securitized securities effectively invested in the promissory notes issued by SK Group. Bukook Securities was in charge of the securitization process, including SPC establishment and investor recruitment.

An IB industry official explained, "It is the first time ever that a large corporation has issued large-scale promissory notes as securitized securities," adding, "From SK Group's perspective, it reduces the immediate burden of large cash outflows, so it can be seen as short-term operating fund procurement."

Group Borrowings Near 105 Trillion KRW... Minimizing Debt and Managing Liquidity

SK Group affiliates' securitization of promissory notes is interpreted as a financial strategy to reduce temporary large-scale cash outflows. SK Group set the condition in the securitization process that promissory note payments will be made in monthly installments from September this year to February next year. Normally, when the holder of a promissory note requests cash payment, it must be settled immediately within the checking limit, but the payment maturity has been spread out.

There is also an underlying purpose to minimize the group's borrowing burden. According to the IB industry, promissory note securitization is settled within the checking limit and thus is not recorded as debt. SK Incheon Petrochem also securitized accounts receivable worth 500 billion KRW to secure short-term funds without increasing borrowings.

According to NICE Credit Rating, as of the end of last year on a consolidated basis, SK Group's total borrowings approached 105 trillion KRW. While SK Hynix continues to incur large deficits, borrowings surged due to annual investments exceeding 20 trillion KRW in semiconductors and secondary batteries. As a result, borrowings increased about 2.5 times compared to 2018 when investments began in earnest.

It is analyzed that the borrowing burden has increased further this year. Since 2018, SK Group has spent 20 to 24 trillion KRW annually on large-scale investments, and last year the amount increased to 32 trillion KRW. This year, SK Group issued corporate bonds worth 8.4 trillion KRW by the end of July, the largest scale ever. In particular, SK Innovation affiliates, including SK Energy and SK On, are expected to spend 6 to 7 trillion KRW annually on battery sector investments. Additionally, a large equity investment burden arose from the joint venture with Ford in the United States.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.