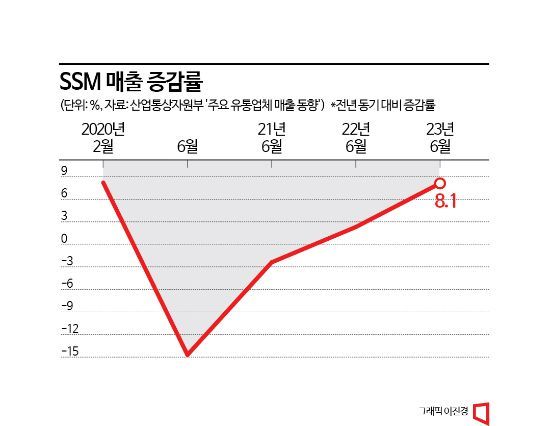

June Sales Growth Rate 8.1%... Highest in 3 Years and 4 Months

Quarterly Sales Growth Rate Also Highest Since 2016

Analysis Suggests 'Fresh Food Strengthening Strategy' Effective

Corporate Supermarkets (SSMs), which had struggled to shed the label of 'operating at a loss' due to competition from convenience stores and e-commerce, recorded the highest sales growth rate compared to the same period last year in 3 years and 4 months. Industry analysts suggest that SSMs’ strategy of strengthening fresh food offerings as a decisive move to enhance competitiveness is beginning to show results.

According to the '2023 First Half Major Retailers Sales Trends' announced by the Ministry of Trade, Industry and Energy on the 1st, SSM sales growth rate last month was 8.1% compared to the same period last year, marking the highest level in 3 years and 4 months since February 2020 (8.2%). Among all offline retail formats, this was the second highest figure following convenience stores (10.3%). In contrast, department stores (0.3%) and large discount stores (0.3%) saw slight declines compared to the previous month, continuing their sluggish performance.

The quarterly sales growth rate also reached the highest level since the survey began in 2016. In the second quarter of this year, SSM sales growth rate rose to 5.6% year-on-year, recovering from a contraction in the first quarter (-1.1%) and returning to a growth trend. SSM sales had recorded negative growth for eight consecutive quarters from the fourth quarter of 2020 through the third quarter of 2022. Although there was a brief growth spurt in the fourth quarter of 2022 (4.6%), it immediately reverted to negative in the first quarter of this year. Sales per store and the number of stores increased by 5.5% and 2.5%, respectively.

Industry experts analyze that SSM’s strategy of choosing fresh food as a key card to overcome the crisis is starting to take effect. Since 2020, SSMs have launched fresh food specialty brands and undertaken customized store renovations to differentiate themselves. Additionally, to survive the intensified delivery competition in the retail sector, they have actively strengthened a local delivery network capable of delivering within 24 hours. Their goal has been to offer “a place closer than large discount stores and fresher food than convenience stores.” These efforts are also reflected in tangible indicators. Examining sales growth rates by product category, daily necessities declined by 3.7% year-on-year, showing weakness, but fresh and prepared foods increased by 9.4%, and processed foods by 9.1%, significantly boosting overall sales.

Experts predict that SSM’s focus on strengthening fresh food will continue to be effective in securing competitiveness in the industry. Professor Eunhee Lee of Inha University’s Department of Consumer Studies said, “Although online purchases have increased significantly, there are still many consumers who prefer to buy fresh food offline. SSMs are sufficiently competitive as locations that are closer than large discount stores but offer a wider variety of fresh foods than convenience stores. The strategy of strengthening fresh food offerings by SSMs is increasingly proving effective.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.