Over 90% of New June Mortgage Loans Have Interest Rates in the 4% Range

Credit Loans Mostly in the 4-5% Range

Similar Levels to May

Last Week's US Rate Hike Has Minimal Impact on Commercial Bank Rates

In June, mortgage loan interest rates issued by commercial banks concentrated in the 4% range. Over 90% of all newly issued mortgage loans had interest rates in the 4% range. Internet banks, which have a high demand for refinancing existing mortgage loans, still accounted for a significant portion of loans with interest rates in the 3% range.

The Trend of Mortgage Loan Interest Rates Remained at 4% in June Following May

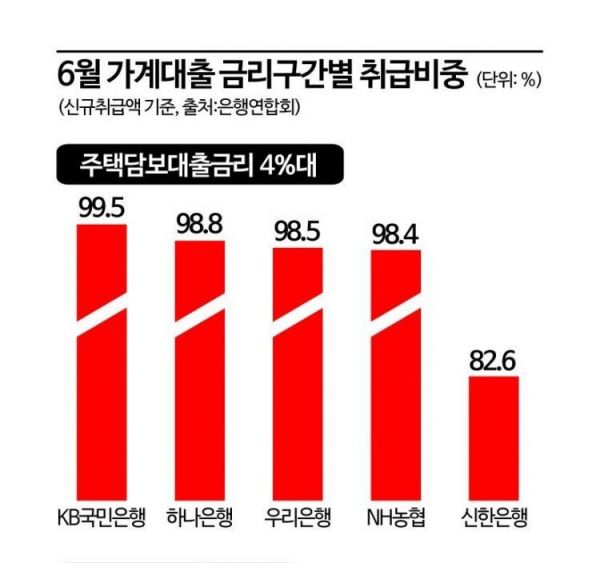

According to the 'June Household Loan Interest Rate Distribution (Amortized Repayment Method)' posted on the website of the Korea Federation of Banks on the 31st, the proportion of mortgage loans with interest rates in the 4% range was similar among KB Kookmin Bank (99.5%), Hana Bank (98.8%), Woori Bank (98.5%), and NH Nonghyup Bank (98.4%). Only Shinhan Bank (82.6%) had a lower proportion, with a somewhat higher share of loans in the 5% range (16.9%) compared to other banks. In May, all five major banks had over 90% of mortgage loans in the 4% range, and this trend continued through June.

At KakaoBank and K Bank, mortgage loans with interest rates in the 3% range were still noticeable. They accounted for 45.2% and 30.5% of newly issued loans, respectively. Compared to May, when both banks had about 70% of loans in the 3% range, this is a significant decrease, but they still maintained lower rates than commercial banks.

Minimal Impact from the U.S... Banks Rather Lower Interest Rates

Loan interest rates appear to be taking a breather. Although the U.S. raised its benchmark interest rate last week, the movement of bank loan interest rates has been far from an upward trend. A representative from a commercial bank said, "NH Nonghyup Bank lowered mortgage and jeonse deposit loan interest rates by 0.3 percentage points starting from the 28th, and K Bank also reduced apartment mortgage loan rates by 0.38 percentage points last week," adding, "Although rates briefly rose earlier this month due to the Saemaeul Geumgo incident, they soon stabilized, and despite the U.S. raising its benchmark rate, it has had little effect on commercial bank interest rates."

This can also be seen by looking at the variable interest rates on mortgage loans from the five major banks. Comparing June 27 and 31, right after the U.S. Federal Reserve (Fed) raised the benchmark rate by 0.25 percentage points, rates remained unchanged at 4.33?6.06%. While there were slight differences among banks, some even lowered rates slightly. The representative explained, "This U.S. rate hike was expected, and the market views the probability of further hikes as low."

The bank bond interest rates, which serve as the benchmark for commercial bank rates, also declined over the past month. Compared to July 3, the 6-month bank bond rate dropped slightly from 3.834% to 3.773% on July 28, and the 1-year rate fell from 3.890% to 3.823%.

Meanwhile, as of June, credit loan interest rates at commercial banks clustered in the 4% and 5% ranges. Based on newly issued amounts, the proportions were Woori Bank (86.4%), Hana Bank (80.9%), NH Nonghyup Bank (70.0%), Shinhan Bank (67.3%), and KB Kookmin Bank (59.0%). In May, a similar level of concentration in the 4?5% range was observed for commercial bank credit loans. As of the 31st, the 6-month credit loan interest rates at the five major banks ranged from 4.36% to 6.36%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)