Interest Income Rises Due to Rate Hikes and Increased Household and Corporate Loans

Mixed Outcomes in Non-Bank Sectors Like Insurance

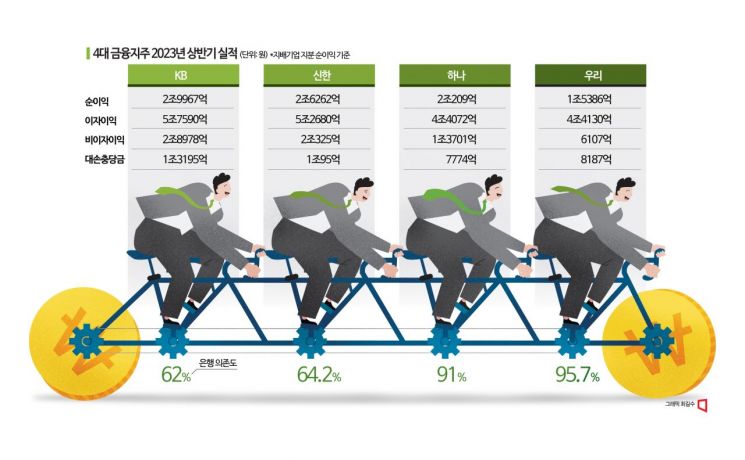

The four major financial holding companies surpassed 9 trillion won in net profit in the first half of this year, achieving the highest half-year performance ever. This was due to increased interest income from rising household and corporate loans, as well as efforts to boost non-interest income. However, reliance on banks has increased further, leaving portfolio improvement as an ongoing challenge.

According to the financial sector on the 28th, the net profit of the four major financial holding companies?KB, Shinhan, Hana, and Woori?was recorded at 9.1824 trillion won in the first half of this year. This is the highest ever for a half-year period, up 3.6% from 8.8473 trillion won in the first half of last year.

KB Financial Group, which maintained its position as the 'leading bank,' posted a net profit of 2.9967 trillion won in the first half. Shinhan Financial came in second with 2.6262 trillion won, followed by Hana Financial with 2.0209 trillion won, and Woori Financial with 1.5386 trillion won. KB Financial and Shinhan Financial are expected to achieve annual net profits of 5 trillion won this year, surpassing last year's levels in the 4 trillion won range (KB Financial 4.4133 trillion won, Shinhan Financial 4.6423 trillion won).

Both interest income and non-interest income showed balanced growth. The interest income of the four major financial holding companies reached 19.8472 trillion won in the first half of this year. This includes KB Financial with 5.759 trillion won, Shinhan Financial with 5.268 trillion won, Hana Financial with 4.4072 trillion won, and Woori Financial with 4.413 trillion won. Non-interest income was 2.8978 trillion won, 2.0325 trillion won, 1.3701 trillion won, and 610.7 billion won, respectively.

The record-breaking performance of the four major financial holding companies was driven by interest income. Last year’s interest rate hikes increased margins on existing loans, and this year, with interest rates stabilizing, both household and corporate loans increased simultaneously. A financial sector official explained, “Due to the combined effect of overall interest rate increases and bond market instability, many large corporations have preferred bank loans over issuing corporate bonds.” The core banking subsidiaries of the four major financial holding companies posted a net profit of 6.8566 trillion won in the first half of this year. This includes KB Kookmin Bank with 1.8585 trillion won, Shinhan Bank with 1.6871 trillion won, Hana Bank with 1.839 trillion won, and Woori Bank with 1.472 trillion won. Hana Bank led the holding company’s highest performance with a 33.9% (465.4 billion won) increase compared to the same period last year.

The difference in performance among the companies was influenced by non-bank sectors such as insurance. KB Financial’s results increased significantly compared to other holding companies due to its ownership of a strong non-life insurance company and a surge in profits and losses following the adoption of IFRS17. A financial sector official explained, “KB Non-Life Insurance saw an increase in profits and losses of 80 to 90 billion won due to the IFRS17 adoption effect.”

It is particularly meaningful that net profit increased despite doubling the provision for loan losses last year. The four major financial holding companies have been under pressure from financial authorities to strengthen risk management by increasing provisions. KB Financial set aside 1.3195 trillion won, Shinhan Financial 1.0095 trillion won, Hana Financial 777.4 billion won, and Woori Financial 818.7 billion won. Considering that higher provisions reduce net profit, this indicates that earnings have increased even more. This demonstrates that strengthening loss absorption capacity and increasing profits can coexist.

On the other hand, reliance on banks increased compared to last year, leaving portfolio diversification as a challenge. In the first half of this year, the bank dependence ratios of the four major financial holding companies were 62% for KB Financial, 64.2% for Shinhan Financial, 91% for Hana Financial, and 95.7% for Woori Financial. Except for KB, these figures increased by about 2 to 11 percentage points compared to the first half of last year. KB’s ratio decreased by 0.6 percentage points from the same period last year. Higher bank dependence tended to correlate with lower holding company net profits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.