Impact of China's Economic Slowdown on Surge in Mining Investments

Shortages of Lithium and Cobalt Expected to Ease

Battery Companies Likely to See Reduced Cost Burden

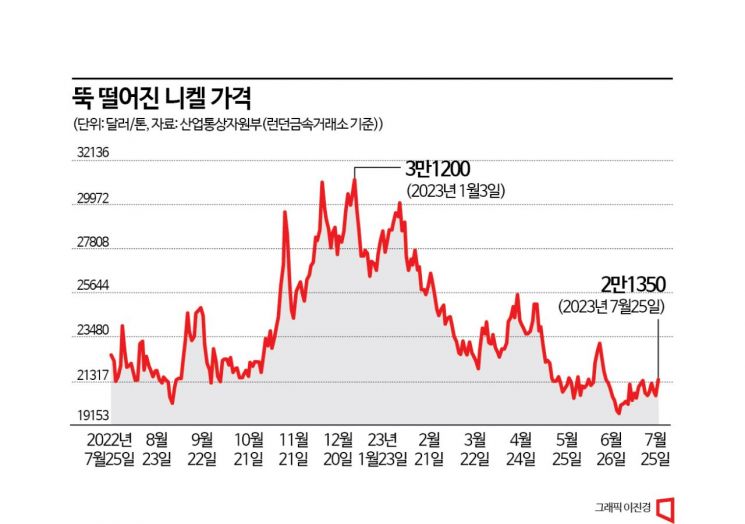

Nickel prices, which surged sharply last year due to supply shortage concerns, have been falling significantly this year. Experts predict that nickel prices will maintain a downward stabilization trend in the second half of the year. The sharp drop in nickel prices, a key raw material for battery cathodes, is expected to reduce the cost burden of electric vehicles. Prices of other essential raw materials such as lithium and cobalt have also fallen significantly compared to last year. There is even analysis suggesting that concerns over supply shortages of key electric vehicle materials have eased considerably.

On the London Metal Exchange (LME), the spot price of nickel was traded at $21,350 per ton as of the 25th. This is about 31.5% lower compared to January 3. It has closely approached the 52-week low of $19,745 set in June last year. The general outlook is that nickel prices will find it difficult to rebound in the second half of the year.

Market research firm S&P Global forecasted, "In the second half of this year, nickel prices will show a downward trend due to expanded supply and structural changes in demand." ING also predicted in an early-month report, "Nickel prices fell by 37% in the first half of this year alone," and "will continue to decline in the second half."

◆Rapid Increase from 15 to 62 Nickel Mines in Indonesia

Nickel prices soared significantly due to supply-demand instability following the Russia-Ukraine war and expectations for the electric vehicle market. In March last year, nickel futures prices surged 250% in a single day, reaching as high as $100,000.

The situation has changed this year. One of the main reasons nickel prices have been struggling recently is the slow recovery of the Chinese economy. Although nickel has recently gained attention as a material for battery cathodes, its largest use is in stainless steel production, accounting for 70% of nickel consumption. As the growth rate of China’s economy, the largest steel consumer, fell short of expectations, stainless steel prices dropped, and nickel prices followed suit. China's manufacturing Purchasing Managers' Index (PMI) recorded 49 in June, indicating a contraction phase for three consecutive months.

On the other hand, nickel supply has increased significantly. This is the result of global battery and electric vehicle companies rushing into mining amid nickel supply concerns. According to the International Nickel Study Group (INSG), Indonesia's nickel mining volume increased by 48% annually last year. Additionally, it rose by 41% in the first quarter of this year alone. Indonesia is the world's largest nickel producer.

Since Indonesia banned nickel exports in 2020 to foster its domestic industry, investments from various countries' companies have followed. In June, a consortium including Swiss commodity company Glencore, Belgian battery material company Umicore, Indonesian state-owned mining company Aneka Tambang, and Chinese energy company Envision Group agreed to invest $9 billion in nickel mining.

Domestically, POSCO Holdings announced plans to invest $441 million to build a nickel refining plant in Indonesia. The Indonesian Nickel Mining Association reported that the number of nickel mines surged from 15 in 2018 to 62 as of April this year. This number is expected to continue increasing.

◆Lithium and Cobalt Prices Also Plummet

Lithium prices, a key cathode material that rebounded in the second quarter, have also seen their upward momentum stall. According to the Korea Mineral Information Service (KOMIS), the price of lithium carbonate was 280.5 yuan per kilogram as of July 25.

This price is about 43% higher than the April low point (157.5 yuan/kg) but 51% lower than the peak in November last year (581.5 yuan/kg).

Another essential battery raw material, cobalt, was traded at $32,975 per ton on the LME on the 25th. This is a 60% drop compared to the peak of $82,250 per ton in March last year.

This trend is analyzed to be influenced by increased investment and mining of major minerals. According to a report released by the International Energy Agency (IEA) on the 11th, global investment in critical minerals increased by 30% last year following a 20% rise in 2021. Particularly, investment in lithium surged by 50% last year alone.

◆Cost Burden Has Decreased, But...

Accordingly, concerns that shortages of key minerals will disrupt electric vehicle production are expected to subside. Bloomberg News analyzed, "Shortages of major critical minerals, including battery materials, do not seem likely to hinder the transition to a low-carbon economy."

This is positive in terms of cost burden for domestic battery material and battery cell companies. However, it is unlikely to have a significant impact on profitability.

An LG Energy Solution official said, "Since contracts are made to adjust battery cell prices linked to raw material prices with automakers, it does not have a major impact on profitability." POSCO Future M also stated, "While the cost burden has decreased, profitability is influenced by various factors beyond raw material prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.