The International Monetary Fund (IMF) has slightly revised upward the global economic growth rate for this year to 3.0%. This adjustment is based on the observation that the global economy is showing more resilience than initially expected, and the financial sector turmoil that occurred earlier this year has stabilized. However, ongoing interest rate hikes by central banks worldwide to curb inflation continue to pose a burden on the overall economy. Signs that global economic activity is losing momentum have also been increasingly confirmed.

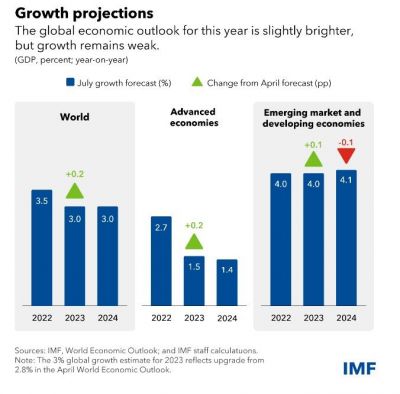

In the World Economic Outlook (WEO) update report released on the 25th (local time), the IMF projected that the global economic growth rate will be 3.0% for both this year and next year. Compared to the April WEO forecast, this year's growth rate was revised up by 0.2 percentage points, while next year's growth rate remained unchanged. Pierre-Olivier Gourinchas, the IMF’s Chief Economist, stated, "The global economy is gradually recovering from the pandemic and Russia's invasion of Ukraine," adding, "Global economic activity in the first quarter showed resilience, leading to a slight upward revision of the 2023 growth rate, but historically, it remains at a weak level."

The slight upward revision of this year's economic outlook is attributed by the IMF to the resolution of the US debt ceiling negotiations and the calming of financial sector turmoil in the US and Swiss banks earlier this year due to strong regulatory measures. With the official end of the COVID-19 pandemic, supply chains are recovering to previous levels. Economic activity in the first quarter showed resilience based on a strong labor market, and global inflationary pressures eased more than expected.

By region, the IMF raised the growth forecast for advanced economies this year to 1.5%, up 0.2 percentage points from the previous forecast. Emerging and developing economies were adjusted up by 0.1 percentage points to 4.0%. The forecast for next year is 1.4% for advanced economies and 4.1% for emerging and developing economies. Chief Economist Gourinchas noted, "The slowdown in growth is concentrated in advanced economies, shrinking from 2.7% last year to 1.5% this year and 1.4% next year."

By country, the US growth rate is expected to be 1.8% this year and 1.0% next year. Compared to the April forecast, this represents a 0.2 percentage point upward revision for this year and a 0.1 percentage point downward revision for next year. China is forecasted to grow 5.2% this year and 4.5% next year, unchanged from the previous outlook. The Eurozone's growth forecast was raised by 0.1 percentage points to 0.9% this year and 1.5% next year. Germany (-0.3%) is the only major European country with a downward revision this year, attributed to weakness in manufacturing in the first quarter. France and Italy are expected to grow by 0.8% and 1.1% respectively this year. Russia, under sanctions following the invasion of Ukraine, had its growth forecast raised by 0.8 percentage points to 1.5% this year. South Korea’s growth forecast was revised down again from 1.5% to 1.4% this year, while the forecast for next year remains unchanged at 2.4%.

The IMF reiterated that although some risks have eased, the balance of global economic growth remains tilted downward. Chief Economist Gourinchas said, "We cannot deny short-term signs of improvement," but added, "There are still many challenges ahead. It is too early to celebrate."

He diagnosed that signs of global economic activity losing momentum are growing. As policy interest rates enter restrictive territory, pressure is being exerted on overall economic activity, and excess savings in the US are nearly depleted. China is also facing concerns in the real estate sector, and the reopening effects have fallen short of expectations. These factors inevitably impact the global economy.

Inflation remains a significant concern. The IMF projects global inflation to rise by 6.8% this year and 5.2% next year. The forecast for this year was revised down by 0.2 percentage points from April, but next year's forecast was raised by 0.3 percentage points, indicating the ongoing difficulty in the fight against inflation. Core inflation, excluding energy and food, far exceeds central banks' price stability targets.

The IMF noted, "In more than half of the countries, core inflation is expected to remain unchanged this year," and "In 96% of countries with inflation targets, inflation is expected to exceed the target this year." Chief Economist Gourinchas also explained, "The fight against inflation is not yet won. The key to persistent inflation will be the labor market and wages." Furthermore, if the Ukraine war intensifies or extreme climate issues and related shocks occur, upward pressure on inflation will be inevitable. This increases the need for further tightening, which could weigh heavily on the overall economy.

Additionally, the IMF cited risks such as China's sluggish recovery due to a real estate market downturn, debt issues among emerging and developing countries, and the adverse effects of geopolitical fragmentation on trade. It recommended that policymakers continue to send tightening signals to reduce inflation while monitoring associated risks and strengthening efforts to maintain financial market stability. It also urged countries to build fiscal buffers through strengthened fiscal policies and to enhance global cooperation on climate policy, international trade, and debt restructuring to address global challenges.

Chief Economist Gourinchas said, "As inflation begins to slow, we are entering the final phase of the inflation cycle that started in 2021," but emphasized, "It is important not to prematurely ease interest rates until inflation shows clear and definitive signs of cooling." The US Federal Reserve (Fed) is expected to raise the benchmark interest rate by 0.25 percentage points at the Federal Open Market Committee (FOMC) meeting scheduled for July 25-26. This week, monetary policy meetings of the European Central Bank (ECB) and the Bank of Japan (BOJ) are also scheduled.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)