Pension Funds and Mutual Aid Associations Flood Capital Formation... VC Exit Market Functions

KDB Industrial Bank Supports with Policy Backing like the Korea Fund of Funds

Need to Improve Perception of 'Distressed Asset Exit'

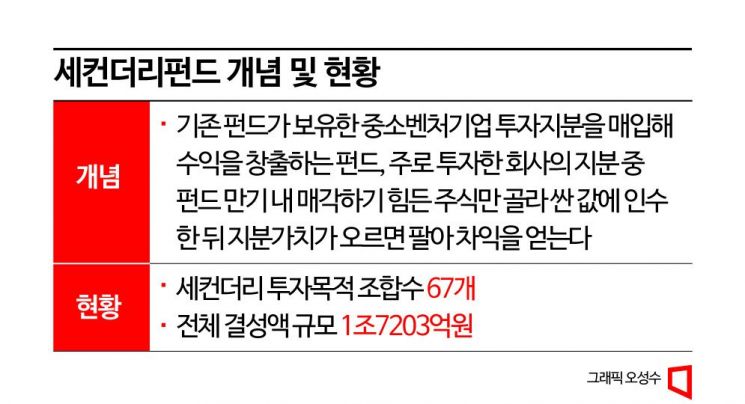

Secondary funds have risen to the top of the shopping lists of major institutional investors such as pension funds and mutual aid associations. Secondary investment refers to transactions where private equity funds, venture capital (VC), and others sell their stakes in venture companies to other private equity funds to liquidate their holdings. Existing investors who need liquidity sell their shares to secondary funds to recover their investments, while new investors can purchase stakes in verified companies at discounted prices.

The Hot Topic in Alternative Investments is 'Secondary Funds'... The Background is Institutions' Capital Recovery and Liquidity

According to the investment banking (IB) industry on the 27th, the majority of institutional investors consider this year as the 'Year of Secondary Funds.' The Chief Investment Officer of Pension Fund A said, "This year, institutional interest in alternative investments is focused on secondary funds." Interest in secondary fund investments can also be seen as a self-help measure by market participants to recover existing investments and find new investment opportunities despite the capital market contraction. As the interests of existing investors needing liquidity and new investors seeking verified investment destinations align, secondary fund investments are expected to increase further. In particular, from an investor's perspective, it is an opportunity to purchase shares of startups whose corporate value has significantly declined at a low price. For example, if an existing fund invested 10 billion KRW to acquire shares in a venture company and the share value rose to about 13 to 14 billion KRW, it would sell these shares to a secondary fund at about a 10% discount.

Overseas, the secondary fund market has been established and activated earlier than in Korea. Fund price lists are even set and circulated in the market. Although the assets in these funds are illiquid, information exchange among investors leads to industry-generated price lists. An IB industry official explained, "Large funds continuously receive funding from pension funds and must avoid any accidents to continue their business, so the assets they transfer are relatively safe." He added, "Discovering new investment companies requires effort and carries high risk, but buying companies already selected by reliable VCs is convenient and relatively less risky."

Recently, the Government Employees Pension Service selected three overseas managers?Ardian, HarbourVest Partners, and Lexington Partners?as secondary fund managers and invested a total of 120 billion KRW, 40 billion KRW each. The performance of previously invested secondary funds was excellent, with an internal rate of return (IRR) of 30-40%, prompting additional investments. Hamilton Lane is also raising funds targeting domestic pension funds and mutual aid associations.

The Secondary Fund Market is Also Active Domestically... Strengthened Policy Support from Institutions like the Korea Development Bank

The domestic secondary fund market is still in its early stages but is rapidly growing with policy support. According to the electronic disclosure of Small and Medium Business Venture Investment Companies, there are a total of 67 partnerships for secondary investment purposes in Korea, with a total raised amount of 1.7203 trillion KRW. After the COVID-19 pandemic caused a sharp contraction in investments, venture companies faced difficulties attracting mid-to-late-stage investments, and existing investors experienced longer-than-expected holding periods, prompting the government and affiliated institutions to intervene for proper capital circulation.

Previously, the Ministry of SMEs and Startups revised the regulations governing the Korea Fund of Funds (FoF) to allow it to invest in general private equity funds. Since secondary funds are mainly general private equity funds, this expanded the FoF's investment targets to revitalize the investment market. Currently, the FoF is preparing to raise a 500 billion KRW secondary fund. This year, through its investment projects, the FoF plans to raise 340 billion KRW for LP share liquidity funds and general secondary funds, and 150 billion KRW for venture secondary private equity funds.

Additionally, the Korea Development Bank recently announced a policy support fund investment project, planning to select three managers (one large, two medium-sized) in the secondary fund sector. It intends to invest 120 billion KRW in the secondary sector (60 billion KRW for large funds, 60 billion KRW for medium-sized funds). The Korea Venture Capital Association is also leading the formation of secondary funds. DSC Investment, led by its chairman Yoon Geon-su, is raising the largest-ever fund of 200 billion KRW called the 'DSC Secondary Package Acquisition Fund No.1.' This fund acquires entire venture funds nearing maturity rather than investing in shares of specific startups.

There have been critical views regarding the injection of policy funds into secondary funds. The purpose of policy funds in the VC market is to activate venture capital to nurture venture companies, but since secondary funds invest more in existing shares than new shares, some argue that this is distant from policy goals.

However, recently, there is growing recognition that policy measures to minimize shocks caused by the deteriorating exit market are inevitable. This also reflects the difficulties in the venture market. Nonetheless, for secondary investments to firmly establish themselves in the domestic market, it is pointed out that the negative perception of 'secondary funds as funds that dispose of distressed assets' must be resolved by incorporating high-quality assets with diverse investment purposes.

The Chief Investment Officer of Pension Fund B said, "There seem to be more attempts to launch secondary funds in the domestic venture investment industry than before," adding, "However, since the perception of 'secondary' is not yet mature in the domestic market, it will take some time to settle." He explained, "Overseas, LPs sell assets they already hold to secondary funds for various purposes such as liquidity of illiquid alternative assets, early exit (capital recovery), and adjusting the proportion of alternative asset classes. But domestically, the motivation to dispose of assets that are difficult to hold or somewhat problematic still seems to be greater than acquiring high-quality assets." He concluded, "To gain investors' trust, attractive assets must be included in the fund, and managers must carefully select and include them."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)