Global Alcohol Market Expected to Exceed 200 Trillion Won This Year

Domestic Market Also Driven by Young Generation's Premium Alcohol Consumption

Mixology as a New Growth Engine in the Alcohol Market

The global alcoholic beverage market, which had slowed during the COVID-19 pandemic, is accelerating its recovery and is expected to grow to over 2,000 trillion won this year. Globally, 'Mixology,' the trend of mixing various alcoholic beverages and drinks according to personal taste, is emerging as a new driving force for market growth. Similarly, in the domestic market, the younger generation is emerging as new consumers of mixology products as well as premium liquors such as whiskey and wine, leading market growth.

Global Alcoholic Beverage Market Expected to Exceed 2,500 Trillion Won by 2027

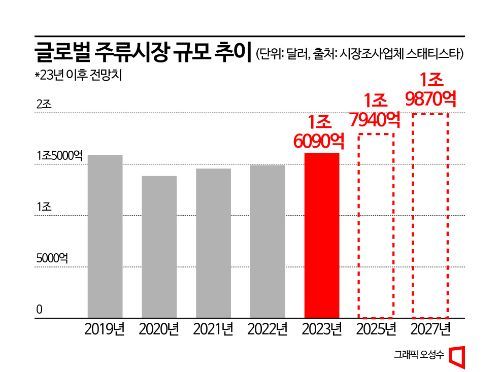

According to market research firm Statista on the 26th, the global alcoholic beverage market size last year was $1.489 trillion (approximately 1,900 trillion won), marking a 2.3% increase compared to the previous year. The global market, which was $1.591 trillion in 2019, shrank by 12.9% to $1.385 trillion the following year due to the impact of COVID-19 but has since shown signs of recovery with an average annual growth rate of 3.7%.

The global alcoholic beverage market is expected to continue its growth trend. This year alone, it is projected to reach $1.609 trillion (approximately 2,062 trillion won), an 8.1% increase from last year, and is expected to grow at an average annual rate of 4.3%, reaching $1.987 trillion (approximately 2,546 trillion won) by 2027. By region, the Asia-Pacific region is forecasted to reach $827.8 billion by 2027, followed by Europe at $461 billion, North America at $412.3 billion, and Latin America at $143.4 billion, with growth expected across all continents.

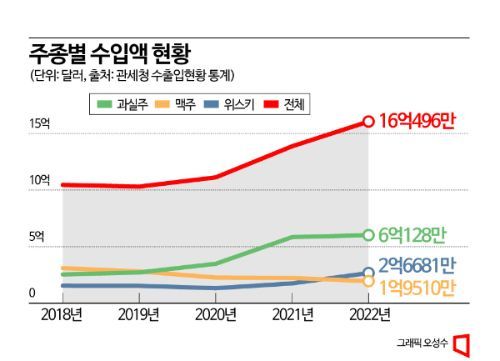

The domestic alcoholic beverage market is also growing, centered on imported liquors such as whiskey and wine, as consumption culture changes. According to the National Tax Service, consumption of soju and beer, which accounted for more than 80% of total shipments, has slowed, decreasing from 9.2437 trillion won in 2017 to 8.8345 trillion won in 2021, showing an average annual decline of 1.1%. In contrast, imports of fruit wines, including wine, increased by more than 120% over three years, from $27.193 million in 2019 to $601.28 million last year, and whiskey imports also rose by over 70%, from $153.93 million to $266.81 million during the same period.

With ongoing high inflation and rising alcohol prices, the home drinking trend continues to gain momentum as people prefer to enjoy alcohol at home. This has expanded consumption from the traditional soju and beer to a variety of alcoholic beverages. According to the Korea Agro-Fisheries & Food Trade Corporation (aT) alcohol market trend report, 84% of respondents said they mainly enjoy drinking at home after COVID-19, more than double the pre-pandemic rate of 40%. The rate of drinking alone also increased from 36% to 44% during the same period.

The home and solo drinking trends centered on premium liquors are led by young consumers in their 20s and 30s. Particularly, the MZ generation (Millennials + Generation Z), who are curious about alcohol and actively expanding their drinking experiences, show a clear preference for high-priced liquors such as whiskey and wine. They are creating a new alcohol consumption culture, such as lining up early to purchase famous whiskey brands.

In fact, 71% of whiskey buyers are consumers in their 20s and 30s, and these age groups also account for 64% of wine shop customers. When drinking at home, 57% and 60% of people in their 20s and 30s, respectively, expressed a desire to drink premium alcohol, which is relatively higher compared to 47% of people in their 40s and 39% in their 50s. The willingness to try various types of alcohol also showed a significant difference, with 59% of people in their 20s compared to 42% of those in their 50s.

Mixology Rising as a Trend... Mixing Drinks According to Taste

Another trend driving growth in both the domestic and global alcoholic beverage markets recently is mixology, which involves mixing various liquors and drinks. In Korea, the sales channels for premium liquors have expanded to convenience stores and supermarkets, and small-sized premium liquors have been launched, increasing consumer accessibility and rapidly spreading mixology culture. Additionally, the sharing of various recipes through social networking services (SNS) has helped mixology become a mainstream trend.

As mixed drinks gain popularity, demand for RTD (Ready to Drink) alcoholic beverages, which can be enjoyed lightly, is also growing. Among the MZ generation, the culture of drinking to lightly taste and enjoy rather than just to get drunk is expanding, making RTD beverages that can be consumed immediately after purchase a rising trend.

Domestic companies are actively responding to market growth by launching various products or sharing recipes that allow their products to be used in mixology. Lotte Chilsung Beverage has released fruit carbonated waters such as 'Soonhari Lemon Gin' and 'Cloud Hard Seltzer,' while Diageo Korea is introducing mixology recipes like 'Johnny Watermelon Highball' and 'Johnny Berry Highball' through the official SNS of 'Johnnie Walker.'

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)