Correction: Partial Lock-up on CB Confirmed

Company States "Correction Disclosure Issued to Reduce Overhang Issue"

The Korea Exchange held a listing ceremony for Phil Energy on the KOSDAQ market at its Seoul office on the 14th. From the left: Namgi Chae, Chairman of the Korea IR Council; Soonwook Hong, Head of the KOSDAQ Market Division at the Korea Exchange; Kwangil Kim, CEO of Phil Energy; Seongbeom Kang, Vice President of Mirae Asset Securities; Wangrak Kang, Vice Chairman of the KOSDAQ Association. Photo by Korea Exchange

The Korea Exchange held a listing ceremony for Phil Energy on the KOSDAQ market at its Seoul office on the 14th. From the left: Namgi Chae, Chairman of the Korea IR Council; Soonwook Hong, Head of the KOSDAQ Market Division at the Korea Exchange; Kwangil Kim, CEO of Phil Energy; Seongbeom Kang, Vice President of Mirae Asset Securities; Wangrak Kang, Vice Chairman of the KOSDAQ Association. Photo by Korea Exchange

Fil Energy caused confusion among investors from the very beginning of its listing due to a large-scale convertible bond (CB) stock conversion disclosure. Just a few days after listing, the company announced that a large volume of shares would be released into the market, but then issued a correction a few days later stating that the shares were under a lock-up period. The company explained that the correction was made to reduce the overhang issue.

According to the Financial Supervisory Service's electronic disclosure system, Fil Energy corrected the convertible bond exercise right disclosure submitted on the 14th on the 19th. The correction added additional information for investors' reference.

The added part states, "The lock-up release date for 945,939 shares (78.8%) of the converted common stock is August 14, 2023." With the correction, it was changed that 79% of the relevant shares will be released starting from the 14th of next month.

On the 14th, the first day of listing, Fil Energy announced after market close that it would convert 16 billion KRW worth of first tranche CB into shares. The volume to be converted into shares is 1,200,029 shares, accounting for 12.7% of the total issued shares. In terms of freely tradable shares, this represents a large volume of 45.9%. The conversion price is 13,333 KRW per share.

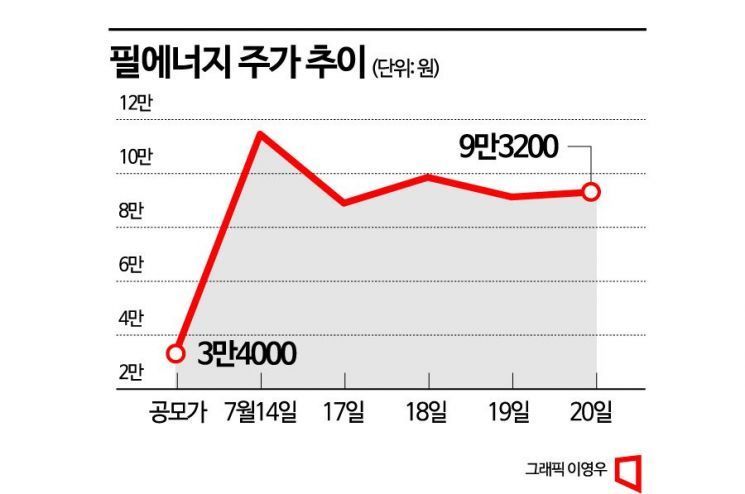

On the first day of listing, the 14th, Fil Energy's stock price closed with a 237.06% increase compared to the opening price of 34,000 KRW, but it plunged the very next day, the 17th. It recorded 89,000 KRW, down 22.34% from the previous trading day. The news of a large volume being released into the market had a negative impact. Since then, the stock price has shown sharp fluctuations, and its direction remains unclear.

Fil Energy explained that the reason for issuing the correction was "to prevent investor confusion." A company official said, "It is true that the shares are being released, but we wanted to inform that they will be released additionally after the market has somewhat absorbed the initial volume, so we issued the correction. This is to reduce the overhang issue as much as possible."

Fil Energy, engaged in secondary battery equipment business, was established in February 2020 through a spin-off of the energy business division from Philoptics. Fil Energy operates equipment business for the laser notching process, which cuts the anode and cathode plates during the secondary battery manufacturing process, and the stacking process, which places processed tabs between separators and stacks them layer by layer. Fil Energy is the only company in Korea that builds and mass-produces integrated laser notching and stacking equipment. Samsung SDI is also an investor, holding a 20% stake in the company.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.