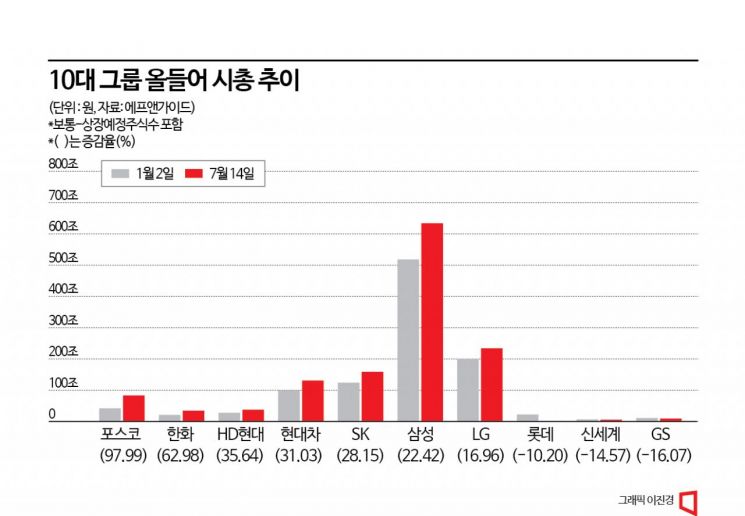

Analysis of Market Capitalization Changes of Top 10 Groups Compared to Early Year

POSCO Group Up 97.99%... Hanwha (63%), HD Hyundai (35%), Hyundai Motor (31%) Follow in Order /

Among the top 10 domestic conglomerates, POSCO, which has been leading with secondary batteries, showed the largest increase in market capitalization (market cap) this year. Due to the aftermath of poor construction quality and other issues, GS Group's market cap shrank the most.

According to financial information provider FnGuide, as of the 14th, POSCO Group's market cap was 83.0364 trillion KRW, marking a 97.99% increase compared to 41.9388 trillion KRW at the beginning of the year. This was the largest increase among the top 10 groups.

The strong performance of secondary battery stocks this year played a significant role. Expectations for the secondary battery materials business were reflected, leading to a sharp rise in the stock prices of POSCO affiliates. Since the beginning of the year until the 14th, POSCO M-TECH's stock price rose by 329.31%, POSCO DX by 318.85%, POSCO International by 219.84%, POSCO Future M by 109.40%, POSCO Steelion by 104.47%, and POSCO Holdings by 64.34%, showing a rapid surge.

At the 'Secondary Battery Materials Business Value Day' event held on the 11th, POSCO Holdings presented a growth target for the secondary battery materials sector of total sales amounting to 62 trillion KRW by 2030. This figure is a 51% upward revision from the target set last year. POSCO Group's secondary battery division consists of six sectors: lithium, nickel, recycling, cathode materials, anode materials, and next-generation materials. POSCO Group plans to establish a complete value chain through upstream investments focusing on cathode materials, which account for 43% of battery costs, and anode materials, which account for 7%. Hyunwook Lee, a researcher at IBK Investment & Securities, stated, "Regarding cathode materials, the key to POSCO Group's secondary battery materials business, a significant portion of the lithium needed by 2030 can be internalized," adding, "The high level of internalization of lithium and precursors compared to competitors will be POSCO Group's strongest weapon in the secondary battery materials sector."

The group with the second-largest increase in market cap after POSCO was Hanwha Group. Hanwha Group's market cap increased by 62.98% this year. The strength of Hanwha Ocean (formerly Daewoo Shipbuilding & Marine Engineering), which was incorporated into Hanwha Group, was significant. Hanwha Ocean's market cap surged by 415.61% this year, showing the highest growth rate among affiliates of the top 10 groups. Youngsoo Han, a researcher at Samsung Securities, explained about Hanwha Ocean, "It is one of the large-cap stocks that outperformed the KOSPI the most, and the related uncertainties were resolved as the incorporation into Hanwha Group was completed." Hanwha Aerospace also contributed to the group's market cap increase with an 84.51% rise in stock price during the same period.

Additionally, HD Hyundai's market cap increased by 35%, recording the third-largest growth rate. Hyundai Motor (31%), SK (28%), Samsung (22%), and LG (17%) followed.

Samsung Electronics, the KOSPI's leading stock, saw its stock price rise by 32.25% this year. Its market cap increased from 331.3229 trillion KRW at the beginning of the year to 438.182 trillion KRW, an increase of over 100 trillion KRW. Consequently, Samsung Group's market cap also rose from 518.0824 trillion KRW at the start of the year to 634.2447 trillion KRW.

Among the top 10 groups, seven groups saw their market caps increase, but Lotte, Shinsegae, and GS experienced declines. Lotte's market cap fell by 10.20%, Shinsegae's by 14.57%, and GS's by 16.07%. The sluggish stock prices of retail stocks due to the economic downturn appear to have affected the market caps of related group stocks. In particular, GS's market cap shrank the most among the top 10 groups as GS Construction's stock price plummeted following the poor construction quality of apartments in Geomdan New Town. GS Retail's stock price dropped by 20% this year, and GS Construction's fell by 29.33%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.