Growth through Shared Electric Scooter Business... Aiming to Become a Comprehensive Mobility Company

Negotiation Difficulties with Socar, the Second Largest Shareholder of Tada, and the Challenge of Normalizing the Loss-Making Tata

The Swing is on the verge of acquiring VCNC, the operator of Tada. As VCNC's valuation decreased, discussions between the two parties progressed rapidly. The Swing, which operates a shared electric scooter business, plans to leap into a comprehensive mobility company covering everything from two-wheelers to four-wheelers through the acquisition of Tada.

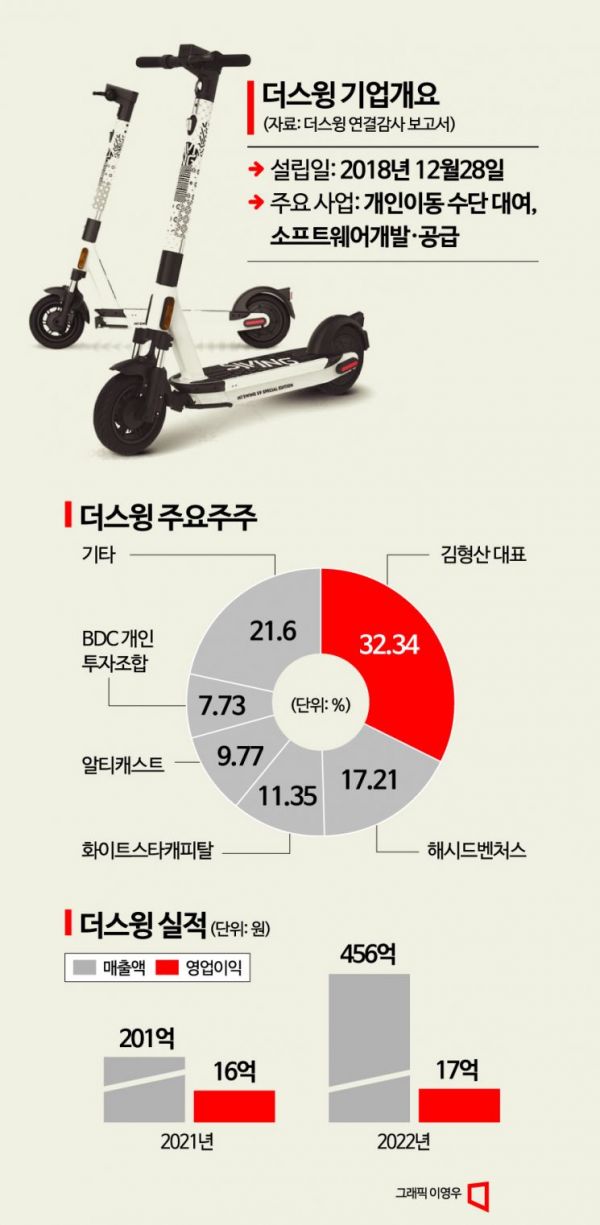

The Swing was launched on December 28, 2018. The largest shareholder is CEO Kim Hyung-san, holding 32.34% of the shares. Following are Hashed Ventures (17.21%), Whitestar Capital (11.35%), and RTicast (9.77%), in that order.

Although The Swing started as a latecomer in the shared electric scooter service market, it grew rapidly. When it first launched the shared mobility service 'Swing' in May 2019, it operated about 600 electric scooters mainly in university areas such as Seongsu, Sillim, and Hoegi. By the time it received Series A investment in 2021, it had grown into a company with over 15,000 vehicles across more than 50 regions nationwide. Notably, the number of electric scooters increased from about 35,000 at the beginning of last year to 85,000 by the end of the year. Currently, The Swing owns more than 100,000 vehicles in total, including electric scooters, electric bicycles, and electric scooters.

The company is also expanding its business areas. First, the shared service expanded to electric bicycles and electric scooters starting last year. In 2021, it launched 'Ally' (formerly 'Today is Rider'), an unlimited scooter usage service exclusively for delivery riders. This year, it introduced the motorcycle lease brand 'Swing Bike' and the delivery agency brand 'Swing Delivery.' Swing Bike, which started in March, surpassed 500 lease products in less than three months. The company has entered all businesses possible with two-wheelers such as electric scooters, electric bicycles, and electric scooters. Moreover, it has expanded overseas, launching services in Japan in July 2022, focusing on Tokyo.

The company's scale has also grown rapidly. Swing, which officially started business in 2019, raised an initial investment of 1 billion KRW. In 2021, it secured Series A funding totaling 7.5 billion KRW, with existing investors Humax, BDC Labs, and Primer Sazepartners participating, and new investors Hashed and M Capital joining. Then, in 2022, it raised 30 billion KRW in Series B funding. Global venture capital Whitestar Capital led the investment, with new investors MC Partners, Smilegate Investment, ST Leaders Private Equity, and existing investors Hashed and Humax participating. Additionally, it was selected as a prospective unicorn company by the Ministry of SMEs and Startups. Currently, it is also pursuing Series C funding. Based on this, it plans to go public (IPO) by 2026.

The Swing's most notable feature is that it is profitable. Unlike most startups struggling with losses, it is generating earnings. In 2022, it recorded consolidated sales of 45.6 billion KRW and an operating profit of 1.6 billion KRW. Compared to 2021 sales (20.8 billion KRW), sales increased by 119%, and operating profit (1.5 billion KRW) rose by 6.7%. However, the operating profit scale is relatively small compared to the sales growth, due to aggressive investments. A company official said, "Operating profit was low relative to sales because many devices were introduced last year."

The Swing, poised to acquire Tada, has seized the opportunity to become a comprehensive mobility service company. The Swing has agreed to acquire a 60% controlling stake in VCNC, the operator of Tada, from Viva Republica (Toss). Only the final contract remains. The acquisition price is estimated to be around 24 billion KRW. It is known that VCNC lowered Tada's valuation from the 80 billion KRW range to the 40 billion KRW range, which was a key factor. The Swing plans to fund the acquisition with its own reserves and Series C funding.

However, negotiations with Socar, the second-largest shareholder holding 40% of VCNC shares, are expected to be difficult. Socar has demanded repayment of a 7 billion KRW loan it extended to VCNC. Additionally, Socar is reportedly requesting The Swing's shares equivalent to the short-term loan and interest, as well as conditions such as participation in the board of directors. A company official said, "We rejected Socar's demands and proposed a compromise, but it was not accepted," adding, "We hope for a smooth agreement with Socar on a magnanimous level before the acquisition decision."

Post-acquisition, normalization of Tada is also necessary. VCNC recorded sales of 4.1 billion KRW and an operating loss of 26.2 billion KRW last year. Its financial situation has worsened, with accumulated deficits reaching 59.23844 billion KRW. The Swing expects that 'supply-driven operation,' which efficiently manages assets directly to achieve both profitability and economies of scale, will be the solution. For example, Uber grew rapidly by adding delivery services to its taxi business. The Swing also plans to improve performance by expanding its business portfolio and enhancing operational efficiency. A company official said, "We are considering ways to create synergy with current Tada personnel," and added, "Once supply-driven operation is established, users will naturally flock."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)