Additional Won Exchanges Open Implicitly Prohibited

'Their Own League' Won Exchange Market Share 99%

US and China Fiercely Compete to Gain Market Leadership

"We have had losses exceeding 10 billion won over the past two years. More than the money, the uncertain future is what frightens me the most. As a CEO, I am truly sorry for not being able to give hope and vision to my employees."

On the 12th, the expression of Dohyeonsoo, CEO of Oceans, whom I met at an office in Gangnam, Seoul, was gloomy. CEO Do was a successful financial lawyer. After working at Kim & Chang law firm for 14 years, he challenged himself in a different field. Oceans first launched the cryptocurrency exchange Probit in 2019. It was among the top in the industry. During the period when hundreds of exchanges were proliferating, it was ranked within the top ten. In April 2021, it even surpassed one million users.

However, currently, its sales are close to 'zero.' Since the enforcement of the Act on Reporting and Using Specified Financial Transaction Information (commonly known as the Special Financial Transactions Act or "Spec Act") in September 2021, exchanges like Probit that previously used corporate accounts (so-called "beehive accounts") have been blocked from KRW trading. KRW trading means buying and selling cryptocurrencies using Korean won (KRW). The Spec Act only allows KRW trading for exchanges that have signed real-name account contracts with banks. Exchanges that have not obtained real-name accounts can only trade cryptocurrencies with other cryptocurrencies such as Bitcoin. From the user's perspective, there is no reason to use such exchanges. Probit has not overcome the barrier to obtaining a real-name account and is effectively in a state of suspended operation.

Annual 80 Billion Won Losses... Risk of Mass Bankruptcies

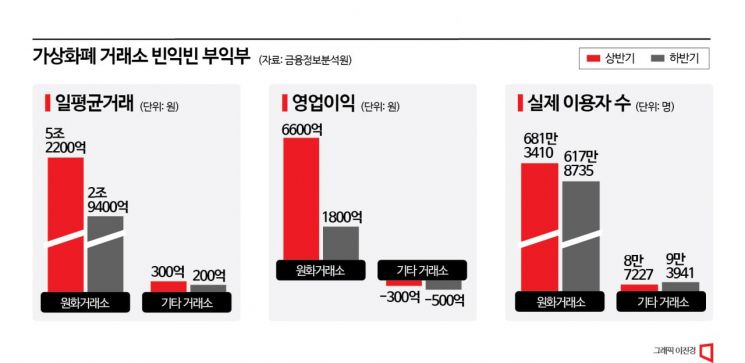

Probit is not the only one. Among 27 domestic cryptocurrency exchanges, 22 are unable to conduct KRW trading. Last year, these exchanges collectively recorded operating losses of 80 billion won. They have virtually no revenue but continue to incur expenses. They are barely surviving on existing investment funds. At this rate, mass bankruptcies are only a matter of time. In fact, Huobi Korea has not reopened since closing in February under the pretext of a 'service renewal.' On the other hand, the combined operating profit of the five so-called 'KRW exchanges' such as Upbit and Bithumb, which can conduct KRW trading, was 840 billion won last year.

To become a KRW exchange, one must first obtain a real-name account issuance confirmation from a bank and then pass a review by the FIU (Financial Intelligence Unit) under the Financial Services Commission. Since the enforcement of the Spec Act nearly two years ago, dozens of exchanges have requested banks to create real-name accounts. However, except for Gopax, all have been rejected. Although financial authorities have never officially stated this, the industry perceives an implicit atmosphere of not opening new real-name accounts. An industry insider said, "When you go to the bank, they say, 'You know this is not possible, so why are you doing this?'"

'Their Own League'... Falling Behind in Competitiveness

The domestic cryptocurrency market, where new entries are virtually blocked, is described as a 'league of their own.' The five KRW exchanges hold nearly 100% market share. The remaining 22 are practically nonexistent. The 'Coin Gate' scandal involving former Democratic Party lawmaker Kim Nam-guk and the Terra-Luna incident all occurred at KRW exchanges. However, as accidents happen and the negative image of cryptocurrencies strengthens, the monopolistic structure created by the exchanges within the league only solidifies. Financial authorities inevitably become more cautious about opening new KRW exchanges.

The global competition to dominate the cryptocurrency market is fierce. In the U.S., the exchange EDXM, a joint venture of Wall Street financial firms, has launched. China has also created an NFT exchange under state leadership. However, South Korea's status is steadily declining. It has already been five years since Bithumb and Upbit were the world's number one. The deterioration of exchanges also causes 'national wealth outflow.' It is said that over 10% of Binance's users are Korean. Binance is proceeding with the acquisition of Gopax, which supports KRW trading, eyeing the domestic market as well.

Dohyeonsoo, CEO of Probit, said, "Stagnant water inevitably becomes foul, and new competitors must enter for the domestic market to develop. Our only wish is to lower the barrier to real-name account issuance so that we can compete on an equal footing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)