Samsung Biologics Target Price Highest at Average 1.09 Million Won

LG Chem and Samsung SDI Also Show Bright Mid- to Long-Term Earnings Outlook

The stock price of EcoPro, a secondary battery company, has recently hovered around 1 million KRW, drawing significant public attention to the emergence of a so-called 'emperor stock.' After EcoPro briefly surpassed 1 million KRW during trading hours and then retreated, the securities industry is now viewing Samsung Biologics as the most likely candidate for the emperor stock title.

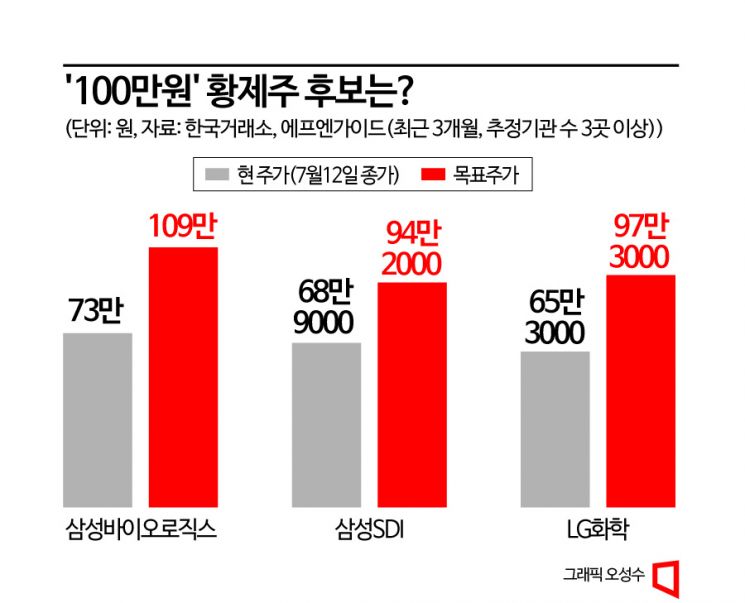

According to financial information provider FnGuide's aggregation of target prices from at least three estimating institutions over the past three months, Samsung Biologics has the highest target price at 1.09 million KRW. The current stock price of Samsung Biologics is 730,000 KRW (as of the closing price on the 12th), indicating an estimated upside potential of about 50%.

Hana Securities, in a report released on the 11th, set the target price for Samsung Biologics at 1.15 million KRW, the highest among target prices proposed in the last three months. This is based on expectations that Samsung Biologics' performance this year will exceed previous forecasts. Hana Securities estimated that Samsung Biologics' annual operating profit this year will reach 1.1889 trillion KRW, about a 23% increase compared to last year. The basis for this estimate is that Samsung Biologics' fourth plant, which began full operation last month, is expected to contribute to performance faster than anticipated. Researcher Park Jae-kyung of Hana Securities explained, "According to the International Financial Reporting Standards (IFRS), which allow revenue recognition from commercial production, the fourth plant's performance will be reflected from the third quarter. The performance qualification production (PPQ) batch will be recognized as revenue along with commercial production volume, so the initial operating rate is expected to rise quickly," adding, "We expect sales from the fourth plant to reach 148.6 billion KRW this year."

Samsung Biologics' outlook is bright not only for this year but also for next year. Its subsidiary, Samsung Bioepis, has long been working on entering the biosimilar market for 'Humira,' known as the world's best-selling pharmaceutical, and the results are expected to materialize fully next year. Samsung Bioepis is the only company to have received approval from the U.S. Food and Drug Administration (FDA) for both high-concentration and low-concentration formulations of Humira biosimilars. Hana Kang, a researcher at Ebest Investment & Securities, said, "The insurance listing status of Hadlima, the most competitive drug in the Humira biosimilar market, will be confirmed in 2024, driving external growth," and set a target price of 1.1 million KRW.

Following Samsung Biologics, the company with the second-highest target price among securities firms is LG Chem, with a recent three-month average of 973,000 KRW. Samsung SDI follows with 942,000 KRW. Their current stock prices (as of the closing price on July 12) are 653,000 KRW and 689,000 KRW, respectively. LG Chem's all-time high was 1.05 million KRW (January 14, 2021), and Samsung SDI's was 828,000 KRW (August 13, 2021).

LG Chem's naphtha prices have fallen to historically low levels, and its second-quarter performance is expected to fall significantly short of estimates due to sluggishness in its subsidiaries LG Energy Solution and battery materials. However, the medium- to long-term outlook is positive as the company is restructuring its petrochemical division, which is facing a downturn, and focusing investments on the battery materials sector, a new growth business. Yoon Yong-sik, a researcher at Hanwha Investment & Securities, set a target price of 1 million KRW for LG Chem in a report published yesterday, stating, "Even excluding battery performance from this year, advanced materials are expected to already surpass petrochemicals, and the gap is likely to widen further," adding, "The relative undervaluation may gradually be resolved with the expansion of the battery materials segment."

Samsung SDI has recently posted solid results, and with the U.S. electric vehicle startup Rivian, to which it supplies batteries, showing strong sales, its second-half performance is anticipated to be favorable. Looking further ahead, attention is also focused on the growth potential of all-solid-state batteries, with a pilot line scheduled to start operation in the second half of this year. Kang Dong-jin, a researcher at Hyundai Motor Securities, set a target price of 1 million KRW for Samsung SDI and said, "It is expected to record the best performance in the second half," adding, "Although the all-solid-state battery market will not grow rapidly until 2030, securing technological standards is important."

The highest-priced stock in the domestic market recently is undoubtedly EcoPro. It recorded a closing price of 920,000 KRW yesterday and even surpassed 1 million KRW intraday on the 10th. However, no domestic securities firms have issued target prices for EcoPro in the past two months. The last report was a 'sell' recommendation from Hana Securities on May 19. At that time, Hana Securities lowered EcoPro's target price to 450,000 KRW and recommended selling. However, with the current stock price more than doubling, that outlook has become obsolete.

Meanwhile, EcoPro is highly likely to be included in the Morgan Stanley Capital International (MSCI) Korea Index next month. This has raised expectations for an influx of foreign capital.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.