The apartment pre-sale outlook index for the metropolitan area in July recorded the highest level this year. There are expectations that the nationwide pre-sale market will improve compared to last month. However, in regions with significant concerns about unsold units, such as Sejong, apartment pre-sales are still expected to be sluggish.

On the 12th, according to a survey conducted by the Korea Housing Industry Association targeting housing developers, the apartment pre-sale outlook index for the metropolitan area this month rose by 11.3 points from last month (91.4) to reach 102.7, the highest this year. This is the first time in 14 months since May last year (102.9) that the index has exceeded the baseline of 100. This index is a quantified indicator based on a survey of about 500 housing developers conducted by the Korea Housing Industry Association, assessing the conditions of complexes that are about to be pre-sold or are currently being pre-sold. The index ranges from 0.0 to 200.0. A value above 100.0 indicates a positive pre-sale outlook, while below 100.0 indicates the opposite.

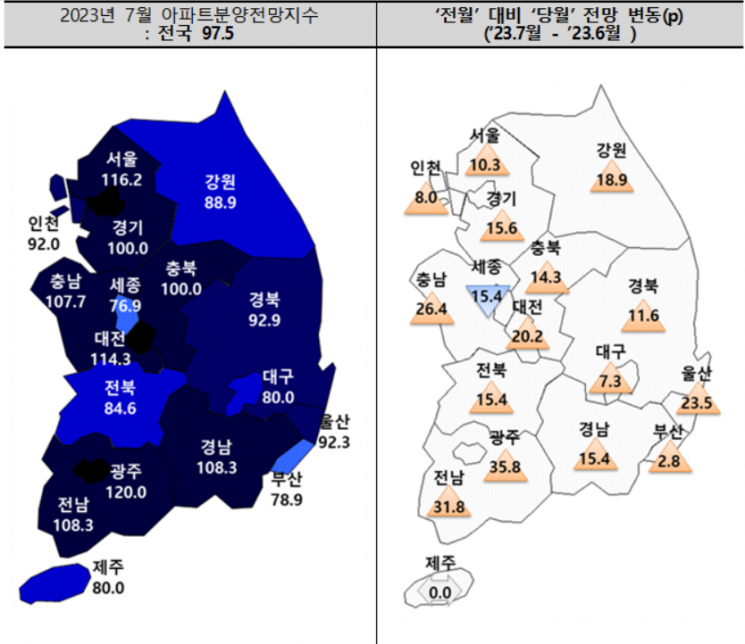

This month’s apartment pre-sale outlook index recorded 97.5, up 14.3 points from the previous month. Seoul rose by 10.3 points to 116.2 compared to the previous month. Following were Gwangju with a 35.8-point increase (84.2→120.0), Jeonnam with 31.8 points (76.5→108.3), Chungnam with 26.4 points (81.3→107.7), Ulsan with 23.5 points (68.8→92.3), Daejeon with 20.2 points (94.1→114.3), Gangwon with 18.9 points (70.0→88.9), Gyeonggi with 15.6 points (84.4→100.0), Gyeongnam with 15.4 points (92.9→108.3), Jeonbuk with 15.4 points (84.6→100.0), Chungbuk with 14.3 points (85.7→100.0), and Gyeongbuk with 11.6 points (81.3→92.9). Most regions are expected to see an increase of more than 10 points.

On the other hand, Sejong showed a decline of 15.4 points from last month to 76.9, the only region nationwide with a downward outlook. Busan (76.2→78.9) and Daegu (72.7→80.0) showed outlooks similar to the previous month. While nationwide pre-sale volumes are expected to increase, regions with significant concerns about unsold units such as Sejong, Busan, and Daegu still appear to be cautious about advancing apartment pre-sale projects.

The Korea Housing Industry Association analyzed, “Thanks to government revitalization measures, supply volume adjustments, and developers’ self-help measures such as discounted pre-sales, subscription competition rates have improved mainly in the metropolitan area, and positive perceptions of the pre-sale market have also increased. However, as polarization is intensifying depending on location and price competitiveness, careful consideration of pre-sale timing and price levels will be necessary when advancing projects.”

This month’s pre-sale price outlook index rose by 14.6 points to 117.7, marking the highest index this year. An index above 100 means that more respondents expect pre-sale prices to rise. The association stated, “The biggest factor is the increase in construction costs, but the rise in subscription competition rates and pre-sale feasibility have driven the index up. Developers who had postponed pre-sales due to economic downturns, financing difficulties, and unsold unit risks are starting to resume pre-sales, so pre-sale volumes are expected to increase.”

The pre-sale volume outlook index also rose by 10.6 points to 95.2, recovering to the '90s range for the first time since June last year, and the unsold unit outlook decreased slightly by 0.1 points to 98.4 compared to the previous month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.