In June, the consumer price inflation rate entered the 2% range for the first time in 21 months, but the burden on low-income households' grocery bills remains significant. It is pointed out that prices that people actually feel, such as electricity and gas charges, as well as food and dining expenses, are still high. In particular, since the slowdown in inflation was decisively influenced by the decline in petroleum prices, there is an analysis that the rate of increase could rise again depending on external factors.

According to the National Statistical Office's National Statistical Portal (KOSIS) on the 7th, the core inflation rate excluding agricultural products and petroleum products recorded 4.1% year-on-year last month. This is 0.2 percentage points lower than the previous month, and compared to the consumer price inflation rate during the same period (3.3% → 2.7%), the slowdown is relatively slow. Core inflation consists mainly of items with less price volatility over time, so it better reflects the underlying trend of inflation.

The problem is that the gap between the consumer price inflation rate and the core inflation rate is widening. While the consumer price inflation rate fell by 2.5 percentage points from 5.2% in January this year to 2.7% last month, the core inflation rate only slowed by 0.9 percentage points from 5.0% to 4.1% during the same period. The gap in inflation rates between the two indicators widened from 0.2 percentage points in January to 1.4 percentage points last month.

Processed Food Prices Still in the 7% Range

The living cost index, which consists of items with high purchase frequency and expenditure share and reflects perceived inflation, rose 2.3% compared to a year ago. Although this is a significant slowdown compared to January this year (6.1%), 116 out of 144 surveyed items, accounting for about 80%, are still on the rise. The items with the highest increases are city gas (29%), electricity charges (28.8%), carrots (22.1%), onions (20.5%), and fish cakes (19.7%), all still showing inflation rates around 20-30%.

Processed foods also rose by 7.5% last month, showing a slow deceleration. Among 73 surveyed items, 69 increased in price. Jam recorded the largest increase at 31.0% year-on-year, followed by cheese (22.3%), crab sticks (21.7%), chocolate (18.5%), and mixed seasonings (17.7%), all showing significant increases. Only three items decreased during the same period: probiotics (-1.4%), health supplements (-1.0%), and baby food (-0.9%). Notably, the price increase of ramen, mentioned by Deputy Prime Minister and Minister of Economy and Finance Choo Kyung-ho last month, was 13.4%, marking the highest in 14 years and 4 months.

This divergence between consumer prices and actual perceived prices is because petroleum prices showed the largest decline ever, pulling down overall inflation. Diesel prices fell by 32.5%, gasoline by 23.8%, automotive LPG by 15.3%, and kerosene by 13.7%. Petroleum prices lowered overall inflation by 1.47 percentage points. Excluding petroleum products, grocery prices remain high.

Concerns Over Increased Inflation Rate by Year-End Persist

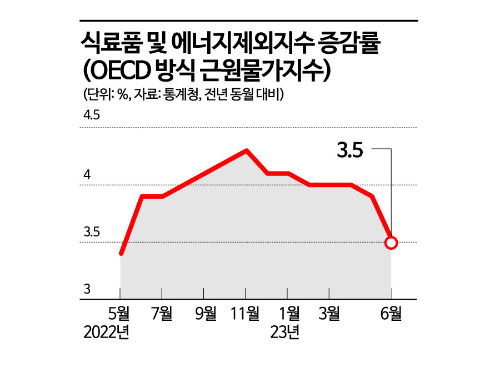

Concerns are growing that consumer prices could rise again to around 3% by the end of the year. The food and energy-excluded index, another indicator of core inflation, recorded 3.5% last month, only 0.4 percentage points lower than the previous month's increase (3.9%). Since core inflation remains in the 3% range, it is difficult to expect further price declines.

Above all, it is uncertain whether the base effect of petroleum prices will continue in the second half of the year. The government is considering ending the fuel tax reduction scheduled to expire at the end of next month, and the justification for extending it is diminishing. Recently, gasoline prices have fallen for nine consecutive weeks, and diesel prices for ten consecutive weeks, as international oil and energy prices show a downward stabilization trend. If the fuel tax reduction is discontinued next month, it will inevitably have a direct impact on inflation.

Pressure from next year's minimum wage increase is also a burden. The Korea Economic Research Institute recently estimated that if the labor sector's proposed minimum wage of 12,210 won for next year is confirmed, the gross domestic product (GDP) will decrease by 1.33%, and the price index will rise by 6.84 percentage points. The larger the minimum wage increase, the greater the negative impact on the economy, directly leading to higher dining-out costs. The government stated, "Although the inflation slowdown trend is expected to continue, uncertainties such as volatility in international raw material prices and climate conditions remain. We will closely monitor supply and price trends of major items to ensure that the inflation stabilization trend takes hold."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.