Continued Growth in Sparkling Wine Imports... Contrasted with Overall Wine Decline

Aligned with Recent Alcohol Consumption Trends Like Low-Alcohol and Luxury

Expected Segmentation and Premiumization Beyond Champagne with Various Sparkling Wines

Office worker Han Ye-in (31) recently prepares a bottle of champagne whenever she has a home party with friends. The crisp sound of popping the champagne cork and the rising bubbles perfectly elevate the atmosphere of the drinking occasion. Han said, “Even if it’s not a wine-drinking occasion, starting with a glass of champagne or sparkling wine has become our own culture,” adding, “Although champagne is expensive, since we don’t drink it every day and even friends who don’t usually enjoy alcohol like it without any strong preference, my affection for champagne keeps growing.”

Despite the wine market, which grew rapidly during the COVID-19 pandemic, experiencing adjustments this year, sparkling wine continues to grow without losing momentum. Among wines that can be enjoyed according to taste, sparkling wine has relatively lower alcohol content, making it less burdensome, and its luxurious image, represented by champagne, aligns well with recent consumer trends.

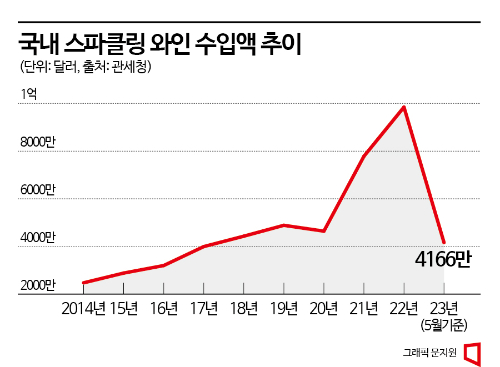

According to customs export-import trade statistics on the 7th, the import value of domestic sparkling wine reached $41.664 million (about 54.2 billion KRW) by May this year, a 4.3% increase compared to the same period last year ($39.936 million). This contrasts with the overall domestic wine import value, which decreased by 9.1% from $251.08 million to $228.35 million during the same period.

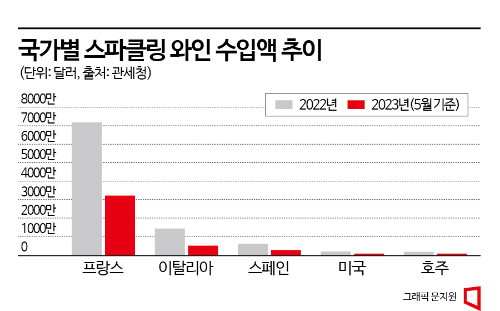

The import value of domestic sparkling wine, which was around $46.43 million in 2020, increased to $77.82 million in 2021 and $98.44 million last year, more than doubling in two years. This year, it is expected to easily surpass $100 million. By country of origin, France, which produces champagne, accounted for more than 70% of the total with $71.74 million last year, followed by Italy ($14.35 million) and Spain ($6.16 million). French sparkling wine imports accounted for 77% of the total import value with $32.21 million by May this year.

Sparkling wine contains carbonation, unlike regular still wine. Among these, only wines produced in the Champagne region of France using traditional methods are called champagne. Industry insiders analyze that sparkling wine is currently the best fit for recent alcoholic beverage consumption trends, showing ‘solo growth’ among wines. A Lotte Chilsung Beverage official said, “During the COVID-19 pandemic, drinking habits shifted from soju and beer to a wider variety of alcoholic beverages, expanding choices. Sparkling wine, with its moderate carbonation and relatively low alcohol content, fits the trend of enjoying alcohol lightly.”

The luxurious image of champagne combined with the trend of sharing experiences through social networking services (SNS) has also driven increased sales. A HiteJinro official explained, “Since COVID-19, the image of enjoying champagne at joyful parties has become a culture that can be enjoyed at home, not just outside, leading to increased consumption. Among the wine brands imported by HiteJinro, the champagne brand ‘Taittinger’ ranks at the top in sales.” In fact, as of May this year, despite an increase in the import value of sparkling wine compared to the previous year, the import volume was 3,143 tons, a 4.1% decrease compared to the same period last year.

As the domestic wine market moves past its introductory phase and enters maturity, the sparkling wine market is also expected to continue its growth. First, the sparkling wine market is anticipated to diversify into various categories according to segmented tastes. For about ten years from 2010, the domestic sparkling wine market was dominated by Italian spumante such as ‘Moscato d’Asti.’ Recently, champagne, the representative of authentic sparkling wine, has led growth, and demand for ‘Cava,’ a Spanish sparkling wine known for its cost-effectiveness, is also increasing.

A Shinsegae L&B official said, “Previously, most consumption was limited to categories like champagne and cava, but going forward, various new styles of sparkling wine such as Franciacorta, ‘Pet Nat’ (sparkling natural wine), and light alcohol options are expected to be sold.”

Regarding price, the trend of polarization between low-priced and ultra-high-priced products is expected to intensify. An industry insider explained, “As wine experience accumulates and tastes become more refined, preference for premium champagne with complex flavors inevitably increases. Additionally, the fact that champagne pairs well with almost all foods, often called a ‘cheat key,’ is another reason to be optimistic about its future.” On the other hand, demand is also expected to grow among consumers seeking cost-effectiveness, who lightly enjoy relatively affordable sparkling wines such as cava, spumante, French ‘Cr?mant,’ and German ‘Sekt.’

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.