Joint Seminar Hosted by Jusanyeon and Assemblyman Park Jeongha's Office

Urgent Need to Resolve Large Local Inventory Backlog

Jusanyeon: "CR REITs as a Solution... Restore Tax and Financial Support Measures"

Analysis shows that the nationwide unsold housing units exceed 100,000, rather than the approximately 70,000 units announced by the government. Accordingly, concerns are growing that if the unsold housing issue prolongs, it could trigger a chain bankruptcy not only in the construction industry but also in the secondary financial sector.

Deputy Research Fellow Choi Deok-cheol of the Korea Housing Institute is giving a presentation on "Measures to Revitalize Unsold Housing REITs for Housing Market Stabilization." [Photo by Korea Housing Institute]

Deputy Research Fellow Choi Deok-cheol of the Korea Housing Institute is giving a presentation on "Measures to Revitalize Unsold Housing REITs for Housing Market Stabilization." [Photo by Korea Housing Institute]

The Korea Housing Industry Research Institute (KHIRI) estimated at a seminar co-hosted with the office of Park Jeong-ha, a member of the People Power Party, on the 5th, titled “Activation Plan for Unsold Housing REITs to Stabilize the Housing Market,” that the actual number of unsold units exceeds 100,000, contrary to government statistics.

Choi Deok-cheol, a senior research fellow at KHIRI, said, “The government’s unsold housing statistics are compiled by inquiring housing project implementers and stand at about 71,000 units as of the end of April. However, during housing market downturns, respondents tend to report 30-50% fewer unsold units based on actual subscription and contract standards. Therefore, we believe the real number of unsold units currently exceeds 100,000.”

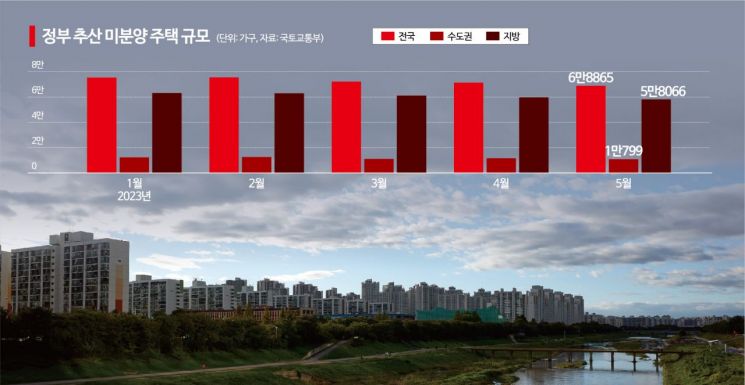

According to Ministry of Land, Infrastructure and Transport statistics, the nationwide unsold housing units stood at 68,865 as of the end of May, marking a decline for the third consecutive month. The trend in unsold housing units was ▲75,438 in February ▲72,104 in March ▲71,365 in April ▲68,865 in May.

KHIRI emphasized the urgent need to resolve the unsold housing stock in provincial areas, where long-term accumulation is highly likely. In particular, unsold units in provincial regions may prolong the unsold housing crisis due to low demand. This is analyzed to have a high possibility of leading to insolvency in both the construction industry and the secondary financial sector. Among the approximately 70,000 unsold units identified by the government, only about 35,000 units are located in the metropolitan area and major cities, accounting for just half. The rest are in other provincial areas.

Senior Research Fellow Choi argued, “If extraordinary measures are not taken for the provincial unsold housing with high long-term accumulation risk, there is concern about a chain bankruptcy in the construction industry and the secondary financial sector, so urgent countermeasures are needed.”

As a countermeasure, he proposed utilizing 'Corporate Restructuring REITs (CR REITs).' Corporate Restructuring REITs refer to raising funds from multiple investors to invest in real estate or real estate-related securities of companies undergoing restructuring and distributing the profits to investors. In fact, right after the 2008 financial crisis, construction companies with unsold projects were facing losses of at least 30% before implementing CR REITs, but they reduced losses to around 10%, investors earned about 5% profit, lending financial institutions recovered both principal and agreed interest, and tenants lived at rents cheaper than surrounding areas, resulting in a win-win situation for all parties involved. It is analyzed that CR REITs, which were implemented to resolve unsold housing after the last financial crisis, could be a solution this time as well.

KHIRI stressed the need to promptly restore government support measures such as credit enhancement, tax, and financial support for CR REITs, which were abolished during the housing market activation period. This means reinforcing credit by committing to public purchase at the reduced price when housing prices fall by more than 30%, and restoring abolished tax and financial support measures. In particular, they called for preparing supplementary measures for holding taxes and other issues that appeared as shortcomings during past implementations.

Park Jeong-ha, the lawmaker who hosted the seminar, said, “The main reasons for the sharp decline in housing demand in the housing market are the prolonged high interest rates and difficulties in raising funds for housing construction.” She pointed out, “Especially, construction companies building houses in non-metropolitan areas with relatively lower market prices tend to set higher prices to cover costs, which leads to prolonged accumulation of unsold housing in these regions.” Park added, “It is necessary to prepare practical measures such as simplifying public offering procedures, tax support, and special tax treatment by utilizing CR REITs, which were implemented as a measure to ease unsold housing during the 2008 financial crisis.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.