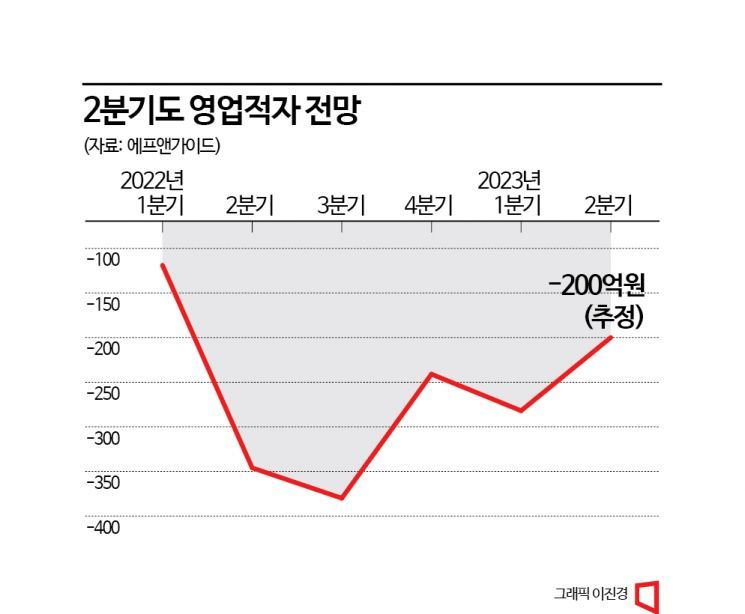

Operating Profit Loss for 5 Consecutive Quarters Since Q1 Last Year

Credit Rating Agencies Forecast Unfavorable Game Industry Outlook... Differentiation Based on New Release Performance

Last year, Netmarble's credit rating dropped from AA- to A+, and now another warning light has turned on for its creditworthiness. The mobile game business has deteriorated, resulting in five consecutive quarters of operating losses since the first quarter of last year, compounded by increased financial burdens due to mergers and acquisitions (M&A). With more money going out than coming in, the stock price trend is also lackluster.

According to the credit rating industry, NICE Credit Rating has changed Netmarble's long-term credit rating outlook from A+ (stable) to A+ (negative). The main reasons are deteriorating performance and low financial stability due to borrowing burdens. Last year, NICE Credit Rating downgraded Netmarble's credit rating from AA- to A+, and now believes another rating adjustment is necessary within a year. A negative outlook means there is a possibility of a one-notch downgrade in the next credit rating evaluation. Korea Ratings did not adjust the rating in the first half of the year but warned that Netmarble's borrowing burden is increasing, so a rating adjustment could occur in the second half.

If the credit rating falls, the cost of financing rises, increasing the company's interest burden. This can lead to worsening profitability and further credit rating downgrades. It is a vicious cycle. Unless strong self-help measures break this cycle, downward pressure on creditworthiness will inevitably continue.

Netmarble's biggest problem is the prolonged operating losses. Since recording an operating loss of 11.9 billion KRW in the first quarter of 2022, it has posted losses for five consecutive quarters through the first quarter of this year (28.2 billion KRW). An operating loss in the 20 billion KRW range is expected in the second quarter as well. The cause is the sluggish mobile game business. Delays in new game releases in the first half and a decline in existing game users had a negative impact. The low competitiveness of games using proprietary intellectual property (IP), which results in higher proportions of platform fees and IP usage fees compared to other companies, also negatively affected performance.

As performance deteriorates, the stock price is heading toward the bottom. Due to securities firms' assessments that performance improvement is difficult, Netmarble's stock price has fallen about 15% over the past month. There is also analysis that operating cash flow, which measures a company's cash-generating ability, will remain negative this year. Last year, there was a net outflow of 408.4 billion KRW, and in the first quarter of this year, it was still negative at 50.5 billion KRW.

The aftereffects of acquiring the global social casino game company ‘SpinX’ are expected to continue for some time. In October 2021, Netmarble raised 1.6 trillion KRW from financial institutions to acquire SpinX for about 2.6 trillion KRW. Although it has been steadily repaying the borrowed money, as of the first quarter, the additional amount to be repaid is about 1.38 trillion KRW. The net debt ratio (the proportion of net debt to total assets) has gradually increased since the acquisition and now approaches the 20% range. Song Young-jin, senior researcher at NICE Credit Rating's corporate evaluation division, said, “Following SpinX, the expansion of borrowings and rising interest rates have increased financial costs, and in the second half, there will be funding needs related to the construction of the new Gwacheon headquarters building, which will cost more than 360 billion KRW.” He added, “By 2025, 20% of the acquisition funds are scheduled to be paid additionally, so more time is needed until the financial condition stabilizes.”

"In the second half, the success of new releases and Chinese market entry game companies must be confirmed"

Korea Ratings adjusted the outlook for the game industry environment to unfavorable in its regular evaluation in the first half. It also assessed that the possibility of rating downgrades for game companies is high. This concern arises from the uncertainty of new game release performance in the second half, combined with increased marketing costs and labor burdens acting as a poison. Major game companies plan to release many new titles targeting the summer peak season in the second half. NCSoft will release ‘TL Global’, Nexon Games will launch ‘China Blue Archive’, ‘First Descendant’, Kakao Games will introduce ‘Ares’, ‘Godis Order’, and Netmarble will present ‘Arthdal Chronicles’, ‘Seven Knights Raising’, and ‘China’s Second Country’.

Choi Joo-wook, a researcher at Korea Ratings, analyzed, “The initial performance of new releases and the establishment of popular content will be key variables determining the overall improvement in the industry's operating results.” He added, “Companies planning game releases in the Chinese market in the second half could show differentiated performance depending on their success.”

However, it is uncertain whether the momentum of Chinese authorities issuing game licenses (approval for game service in China) will bring warmth to stock prices and credit ratings overall. In December last year and March this year, licenses were issued to some game companies, raising expectations that a three-month issuance cycle would be established, but no further license issuance news has been reported since. Additionally, the intensifying competition due to the penetration of Chinese games into the domestic market is another factor to watch regarding whether good performance can be achieved.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.