Survey of 500 Self-Employed Individuals Conducted in the First and Second Half of the Year

Five out of ten self-employed individuals expected their sales to decline in the second half of the year compared to the first half. Although COVID-19 quarantine regulations have been lifted, there are assessments that the recovery of local commercial districts may be slow.

The Federation of Korean Industries (FKI) announced on the 2nd that these results came from the 'Self-Employed 2023 First Half Performance and Second Half Outlook Survey' conducted by market research firm Monoresearch. This survey targeted 500 self-employed individuals operating in various industries such as restaurants, lodging, wholesale and retail, and educational services.

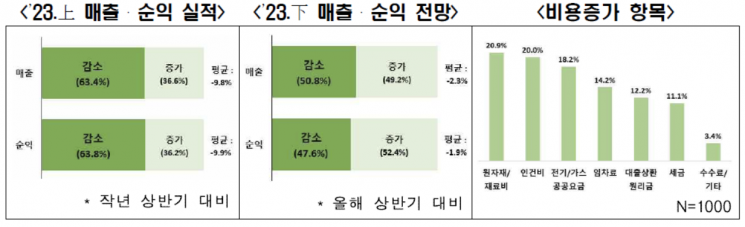

According to the survey, 63.4% of self-employed respondents said their sales in the first half of the year decreased compared to the same period last year. The response indicating a decrease in net profit was 63.8%. On average, sales decreased by 9.8% and net profit fell by 9.9% compared to the same period last year. Based on the results of the same survey conducted last year, the FKI evaluated that "self-employed individuals have been experiencing poor performance for two consecutive years."

The sales outlook for the second half of the year was also not optimistic. 50.8% of self-employed respondents expected their sales in the second half to decline compared to the first half. The most burdensome cost increases this year were identified as raw materials and supplies (20.9%), labor costs (20.0%), public utility fees such as electricity and gas (18.2%), and rent (14.2%).

The average loan amount among surveyed self-employed individuals was approximately 83 million KRW. 75.4% reported having loans under 100 million KRW. Those who had loans exceeding 150 million KRW accounted for 13.4%.

51.2% of self-employed respondents said their loan amounts have increased recently compared to the beginning of this year. The main reason for the increase in loans was fixed cost expenditures such as rent, labor costs, and public utility fees (46.9%). Repayment of existing loan interest (25.0%) and expenses for raw materials and supplies (15.2%) were also factors contributing to the loan increase.

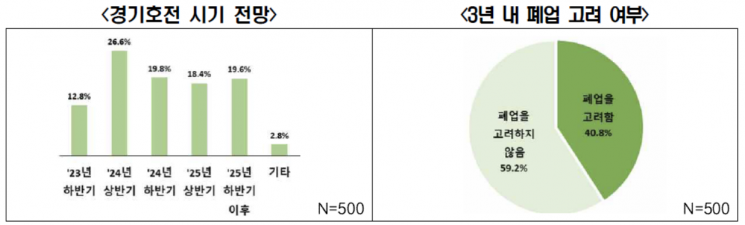

When asked about the timing of economic recovery, 84.4% chose after 2024. Responses anticipating recovery in the first half (26.6%) and second half (19.8%) of next year were higher than those expecting recovery in the first half (18.4%) and second half (19.6%) of 2025. Only 12.8% believed the economy would revive in the second half of this year.

Additionally, 40.8% of self-employed individuals considered closing their businesses within the next three years. The reasons cited included continued deterioration of business performance (29.4%), worsening financial conditions and loan repayment burdens (16.7%), and unclear prospects for economic recovery (14.2%). The biggest management difficulties this year were identified as rising rent and various fees and tax burdens (21.1%).

59.2% responded that they were not considering closure. However, among them, 53.1% gave negative reasons such as having no special alternatives (22.3%), which was twice the proportion citing positive reasons like expectations for economic recovery (25.5%).

Regarding government support policies for the self-employed, respondents saw the need to curb or reduce increases in public utility fees such as electricity and gas (19.0%). They also requested expanded financial support such as low-interest loans (18.5%) and support for consumption promotion to revive consumer sentiment (16.6%).

Choo Kwang-ho, head of the Economic and Industrial Headquarters at the FKI, said, "In the face of a bleak economic outlook, self-employed individuals find it difficult to consider closure due to lack of alternatives or burdens such as loan repayments and rent. It is necessary to actively consider policies that alleviate the burdens on the self-employed, such as promoting domestic demand revitalization."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.