Samsung Electronics Stock Rises 31% This Year Amid Record Foreign Buying

Q4 Operating Profit Forecasts Diverge Between -1.2 Trillion and 1.4 Trillion KRW

No Disagreement on Major Trend of Returning to Profit from Next Year Onward

Foreign investment in Samsung Electronics surpassed 12 trillion won in the first half of this year, marking the largest scale ever recorded. The market's hopeful expectation that the memory semiconductor industry has bottomed out is now turning into certainty. In the securities industry, there are even rosy forecasts that Samsung Electronics' stock price will surpass 90,000 won again in the second half of the year.

Foreign Investors Account for 82% of Total Net Purchases on KOSPI

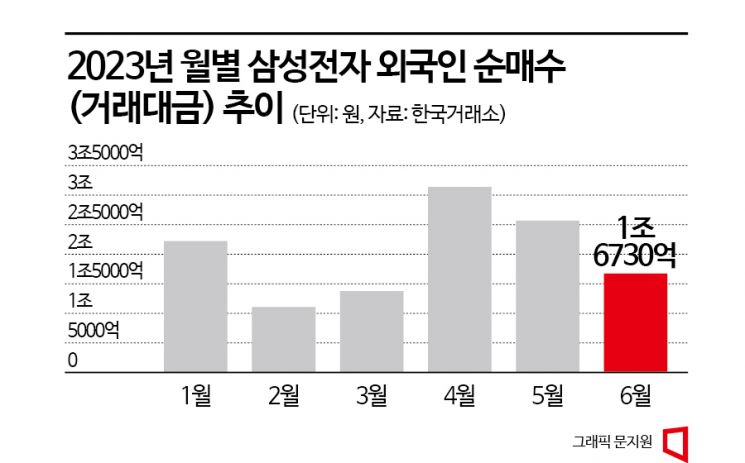

According to the Korea Exchange, the net foreign purchase (transaction amount) of Samsung Electronics this year totaled 12.079 trillion won (from January 2 to June 30). This figure accounts for about 82% of the total net foreign purchases (14.743 trillion won) across all 940 listed stocks on the KOSPI market. Foreign investors who sold 8.715 trillion won worth of Samsung Electronics shares last year have repurchased about 1.4 times last year’s annual sales volume in just half a year. Accordingly, Samsung Electronics' foreign ownership ratio, which was 49.7% at the beginning of the year, increased by about 3.1 percentage points to 52.8% as of the end of last month.

Supported by foreign buying, Samsung Electronics' stock price rose about 31% in the first half of this year alone. This far exceeds the KOSPI's rise of about 15%. As of the end of last month, Samsung Electronics' market capitalization was 431.018 trillion won, an increase of 100.889 trillion won compared to the end of last year.

The market strongly believes that the semiconductor industry has passed its bottom point starting from the second quarter. Following Samsung Electronics, Micron, the second-largest player in the global DRAM market based in the U.S., recently announced surprisingly strong earnings that exceeded market expectations, reinforcing this confidence. Micron reported sales of $3.75 billion (approximately 4.95 trillion won) in the third quarter of fiscal year 2023 (March to May). The key factor is the resolution of DRAM oversupply, which is attributed to major companies, including Samsung Electronics, cutting production to resolve excessive inventory, leading to a rapid stabilization of supply and demand. Micron's strong performance is being interpreted as a signal of a rebound in the semiconductor industry.

Average Target Price of Samsung Electronics at 90,000 Won by 8 Research Centers

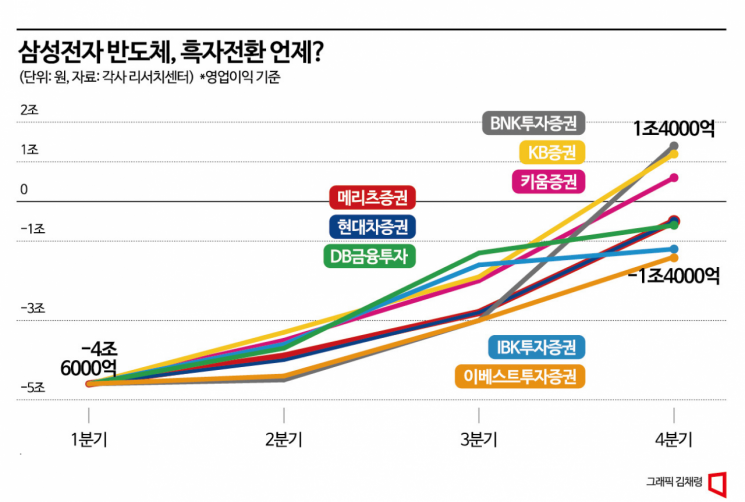

Samsung Electronics' semiconductor (DS) division, which recorded a historic loss of 4.6 trillion won in the first quarter alone, is expected to improve rapidly in the second half of the year. Opinions vary among securities firms regarding the timing of the return to profitability, with some pointing to the fourth quarter of this year and others expecting it to be after the first quarter of next year.

Looking at forecasts from eight major domestic securities research centers over the past month, BNK Investment & Securities provided the most optimistic outlook, predicting that Samsung Electronics' semiconductor division will record an operating profit of 1.4 trillion won in the fourth quarter. Researcher Minhee Lee of BNK Investment & Securities explained, "The AI investment boom is increasing demand for high-capacity DRAM," adding, "The memory market has bottomed out." KB Securities also expects the semiconductor division to return to profitability in the fourth quarter, forecasting an operating profit of 1.2 trillion won. This is based on the observation that the second quarter DRAM shipment growth rate reached 20%, surpassing the market expectation of 10%, leading to faster-than-expected inventory reduction and cost structure improvement. Researcher Dongwon Kim of KB Securities stated, "The increase in DRAM shipments will reduce inventory valuation losses, acting as an additional profit-up factor for the memory semiconductor business in the second half."

The most conservative forecast for Samsung Electronics' semiconductor division came from eBest Investment & Securities. They expect the division to post a loss of 1.4 trillion won in the fourth quarter and continue to record losses until the end of the year. Researcher Daejong Nam of eBest Investment & Securities pointed out, "The actual effect of semiconductor production cuts will begin in earnest from the third quarter," adding, "Memory manufacturers will try to minimize semiconductor price declines, but there is room for variation depending on demand forecasts from set manufacturers and cost-cutting policies." IBK Investment & Securities also expects the semiconductor division to record an operating loss of 1.2 trillion won in the fourth quarter.

Although forecasts vary among securities firms, there is no disagreement on the major trend that Samsung Electronics' semiconductor performance will significantly reduce losses from the third quarter and return to profitability next year. The basis for this is the improvement in DRAM supply and demand, along with Samsung Electronics' planned full-scale supply of the AI server semiconductor 'HBM3' mainly to the North American market starting in the fourth quarter of this year. HBM3 is expected to account for only 6% of Samsung Electronics' total DRAM sales this year but is projected to grow to 18% next year. Notably, HBM3 prices are more than five times higher than existing memory semiconductors. Considering the growth potential of the AI server market, significant profitability improvement can be expected.

Target prices for Samsung Electronics are also rising one after another. The highest target price recently presented in securities reports related to Samsung Electronics was 97,000 won by Meritz Securities. KB Securities set it at 95,000 won. IBK Investment & Securities forecasted 90,000 won, and eBest Investment & Securities predicted 80,000 won. The average target price among these eight securities firms is 90,000 won.

Long Road Ahead to Achieve '100,000 Won Samsung Electronics'

Nevertheless, for investors who bought Samsung Electronics shares in the 80,000 to 90,000 won range during the market boom in the second half of 2020, when expectations for the so-called '100,000 won Samsung Electronics' were high, there is still a long way to go. Although the stock price had been steadily rising since the beginning of the year, it has been sideways since last month. Foreign investment continues to flow in trillions of won, but it has decreased for three consecutive months after peaking at 3.136 trillion won in April, dropping to 2.567 trillion won in May and 1.673 trillion won in June. Researcher Unho Kim of IBK Investment & Securities said, "Recognition of the semiconductor industry's bottom is spreading, and expectations for AI demand are high," but added, "Samsung Electronics' recent stock price seems to fully reflect these factors, so further price increases will depend on the scale of performance improvement in the second half." Researcher Sunwoo Kim of Meritz Securities said, "The period of performance deterioration and the need for responsible management are expected to lead to the return of the owner family as registered executives," adding, "Despite judicial risks, there is a need to enhance shareholder value through performance improvement." He also added, "It is a time when the shareholder return policy, which ends in 2023, needs to be extended without retreat."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.