The risk of youth loans in savings banks has increased. This is due to the rise in loan amounts to vulnerable borrowers, mainly among the younger generation. Expanding to the secondary financial sector, the loan volume for real estate and construction industries by savings banks and mutual financial cooperatives has increased, leading to a decline in overall loan soundness.

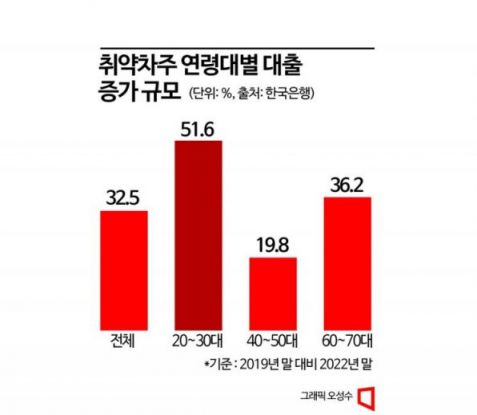

According to the Bank of Korea's Financial Stability Report on the 24th, the volume of loans to vulnerable borrowers in savings banks increased by 32.5% at the end of last year compared to the end of 2019. Among these, the increase was largest for those in their 20s and 30s, at 51.6%. This was followed by those in their 60s and 70s (36.2% increase) and those in their 40s and 50s (19.8% increase).

The loan volume for real estate and construction industries by savings banks and mutual financial cooperatives also increased. In the case of Saemaeul Geumgo, the volume of real estate project financing (PF) loans rose by KRW 12.6 trillion (from KRW 2.9 trillion to KRW 15.5 trillion) at the end of 2022 compared to the end of 2020. The proportion of real estate PF loans in total loans jumped from 2.0% to 9.2%.

The situation is similar for savings banks. During the same period, the real estate PF loan volume increased by KRW 3.7 trillion (from KRW 6.9 trillion to KRW 10.6 trillion). The loan proportion also rose from 8.9% to 9.2%.

During the same period, the delinquency rate for real estate PF loans increased, centered on Saemaeul Geumgo (from 0.0% to 0.4%). Savings banks saw a slight decrease (from 2.3% to 2.1%).

The Bank of Korea analyzed, "Even if credit and market risks of non-bank deposit-taking institutions materialize, the possibility of these risks transferring to systemic risk is limited," adding, "Considering downside economic risks, stress tests showed that capital adequacy in all sectors exceeded regulatory standards even under negative scenarios."

Examining the risk of losses from credit and market risks in non-bank deposit-taking institutions transferring to other sectors, the rate was 1.2% as of the end of 2022. This was lower than the overall sector average of 6.6%.

Since the large-scale deposit withdrawal incident at Silicon Valley Bank in the U.S. last April, concerns about liquidity in non-bank deposit-taking institutions have emerged.

Regarding this, the Bank of Korea advised, "The proportion of non-face-to-face deposits in savings banks has rapidly increased since the third quarter of last year," and added, "Some savings banks have funding channels concentrated in non-face-to-face deposits or retirement pensions, so they should be cautious about liquidity risks arising from deposit outflows."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.