Corporation Subject to 20 Billion Won Paid-in Capital Increase Has Capital of Only 10 Million Won

Issuer of CB ‘InnovationBio1hoJoHab’ GP and LP Also Unknown

TS Trillion, the seller of ‘TS Shampoo,’ has initiated a capital raising effort worth 40 billion KRW. It plans to raise 20 billion KRW through a paid-in capital increase and another 20 billion KRW via convertible bonds (CB). However, questions arise regarding the feasibility of the fundraising and the source of funds, as the paid-in capital increase target is a newly established corporation with only 10 million KRW in capital, rather than a regulated financial institution.

Funding from a Newly Established Corporation and Investment Association... What Is the Reality?

According to the Financial Supervisory Service’s electronic disclosure, TS Trillion announced on the 21st that it had decided on a third-party allotment paid-in capital increase worth 20 billion KRW. The capital increase target is a limited company called ‘JY Holdings.’ JY Holdings was established in April with a capital of 10 million KRW. Its business purposes include management consulting, real estate development, and leasing. The company’s headquarters is located at 318 Oncheon-ro, Paltan-myeon, Hwaseong-si, Gyeonggi-do.

The CEO of JY Holdings is Mr. Jeong Chang-ho, born in 1986. Director Kim Je-tae, born in 1987, is also involved; the two are understood to be high school classmates from the Hwaseong area in Gyeonggi-do. Both hold 50% of JY Holdings’ shares, having each invested 5 million KRW to establish the limited company.

The payment date for this paid-in capital increase is September 7. By then, JY Holdings must raise 20 billion KRW. As a newly established corporation, JY Holdings will need to increase its capital or borrow funds to raise the capital increase amount. However, since it is a limited company, increasing capital is difficult, so it is presumed that the investment funds for TS Trillion will be raised through borrowings. This method resembles the use of a paper company to conceal the source of funds. According to the investment banking (IB) industry, regulated financial institutions do not favor such methods.

Along with the paid-in capital increase, TS Trillion will also issue convertible bonds worth 20 billion KRW. The CB issuance target is the ‘Innovation Bio No.1 Association.’ The general partner (GP) and limited partners (LP) of this investment association have not been disclosed. TS Trillion stated in a corrected disclosure the day before that “the maximum number of association investors will be composed of fewer than 49 people, and once the investors are confirmed, a further corrected disclosure will be made.” This is interpreted to mean that investors have not yet been recruited.

During last year’s National Assembly audit of the Financial Supervisory Service, cases such as Bithumb and Ssangbangwool were mentioned, highlighting situations where convertible bonds and other instruments were issued to anonymous investment associations to conduct money games. At that time, Rep. Yoon Chang-hyun of the People Power Party pointed out, “The subjects acquiring CBs and bonds with warrants (BW) from listed companies embroiled in the ‘Bithumb chairman’ controversy are all associations, raising suspicions that they transferred bonds to specific groups and then created favorable conditions when converting to stocks to grant special benefits.” In response, Financial Supervisory Service Governor Lee Bok-hyun said, “We will carefully monitor market disruption activities such as creating private investment associations to evade regulations.”

BW Issuance Also Failed... Will Borrowings Be Repaid?

If the total 40 billion KRW fundraising succeeds, most of the funds are expected to be used to repay borrowings. As of the end of Q1 this year, TS Trillion’s borrowings due within one year amounted to 37.2 billion KRW. In contrast, current assets stand at 10.3 billion KRW. Moreover, most current assets consist of inventory and accounts receivable. Cash equivalents amount to only 300 million KRW. The debt ratio is also at about 288.47%.

Because of this, TS Trillion previously considered issuing bonds with warrants (BW) worth 15 billion KRW in April but ultimately failed. At that time, NICE Credit Rating pointed out TS Trillion’s ▲very high dependence on a single brand ▲potential sales decline due to reduced consumer exposure through TV home shopping ▲excessive borrowings and insufficient ability to cover financial costs ▲continued deterioration of financial stability.

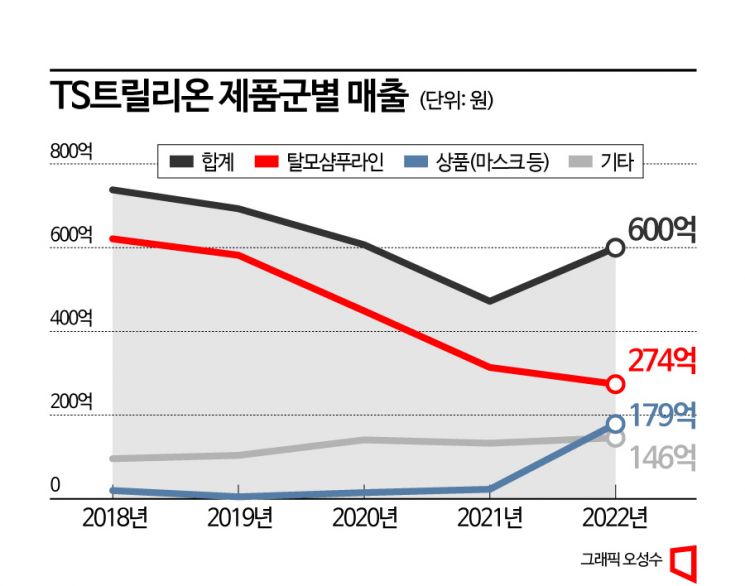

In fact, TS Trillion’s shampoo product sales shrank from 62.1 billion KRW in 2018 to 27.4 billion KRW last year. A NICE Credit Rating official said, “The liquidity risk is also considered high,” adding, “Aggressive funding policies relying on external financing are negative factors for creditworthiness.”

Korea Credit Rating also pointed out TS Trillion’s ▲inferior business stability ▲significant performance deterioration due to intensified competition ▲excessive financial burden. Regarding these fundraising matters, a TS Trillion representative said, “We will disclose details through future public announcements.”

Meanwhile, if the capital increase and CB issuance followed by stock conversion proceed, the shareholding ratio of TS Trillion CEO Jang Ki-young and related parties will drop from the current 70% to the 40% range. However, since the CB includes a 50% call option, exercising it would raise CEO Jang’s shareholding ratio back to the 50% range.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["I'd Rather Live as a Glamorous Fake Than as a Poor Real Me"...A Grotesque Success Story Shaking the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)