The Bank of Korea announced on the 21st that it will improve the regular auction operation method for Monetary Stabilization Bonds and implement the changes starting from the 1st of next month.

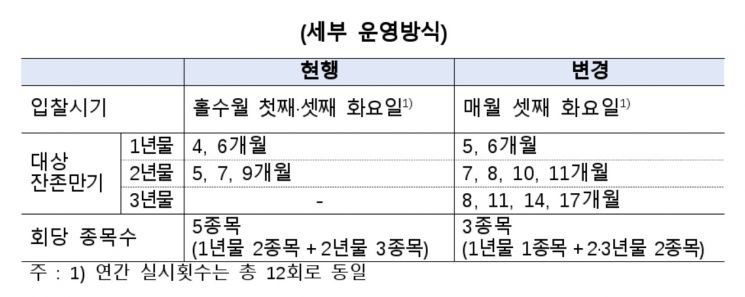

The Bank of Korea will include 3-year bonds as eligible for repurchase and adjust the remaining maturity and the number of eligible items for repurchase of the existing 1-year and 2-year bonds.

Early repurchases will be conducted once a month on the third Tuesday, targeting three items per session (one 1-year bond and two bonds from the 2-year and 3-year categories).

Additionally, the regular auction target items for Monetary Stabilization Bonds will be defined as coupon bonds, and the regular auction bidding time will be adjusted to 11:00 AM to 11:10 AM.

The announcement date for the Monetary Stabilization Bonds issuance plan will be changed to the next business day following the regular auction bidding day.

A Bank of Korea official stated, "The early repurchase conducted in July will also include target items based on the previous criteria," adding, "The improvement of the regular auction operation method for Monetary Stabilization Bonds will enhance the efficiency of open market operations, making liquidity management smoother."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.