Defense stocks erupted in unison in line with President Yoon Suk-yeol's overseas tour. Recently, defense stocks had shown sluggish trends as they lost ground to semiconductors and secondary batteries, but they rebounded as expectations for orders grew with President Yoon's trip. The securities industry expects that the entry into a new Cold War system due to U.S.-China conflicts will act as a positive factor for Korea's defense industry, anticipating further stock price increases.

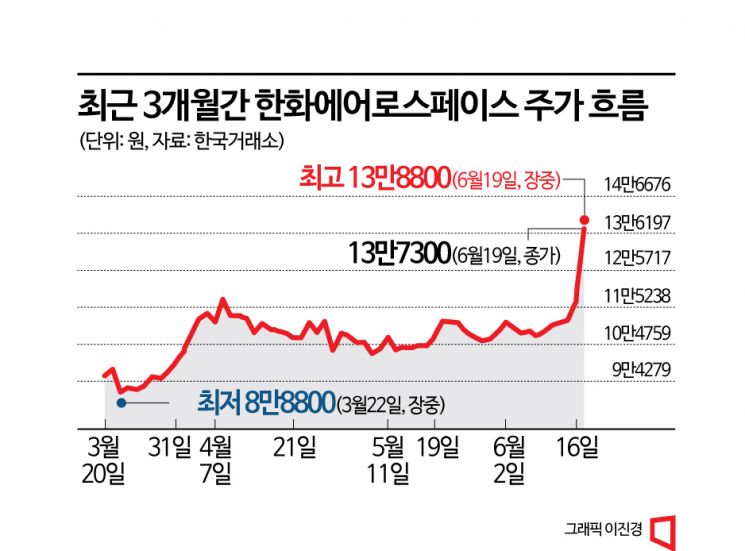

According to the Korea Exchange, on the 19th, Hanwha Aerospace, considered the leading defense stock, closed at 137,300 KRW, up 17.55% from the previous trading day. During the session, Hanwha Aerospace reached a new 52-week high of 138,800 KRW (up 18.84%). In addition, Korea Aerospace Industries (KAI) and Hyundai Rotem also closed up 6.11% and 10.95%, respectively.

Defense Exchange-Traded Funds (ETFs) also showed strength. Hanwha Asset Management's 'ARIRANG K Defense Fn' closed at 13,390 KRW, up 8.91% from the previous day, marking its highest price since its listing on January 5 this year.

The unified rally in defense stocks was driven by growing expectations for overseas orders by domestic defense companies. On the day, President Yoon embarked on a 6-day, 4-night tour to France and Vietnam. The Vietnam delegation included the largest economic envoy since the Yoon administration, with 205 members, including Kim Dong-kwan, Vice Chairman of Hanwha Group; Shin Hyun-woo, President of Hanwha Aerospace; and Kang Gu-young, President of KAI.

The defense industry expects active discussions on orders for domestic defense companies during this tour. The Vietnamese government plans to invest a budget of about 3 trillion KRW over 5 to 7 years to modernize its military. In March, Phan Van Giang, Vietnam's Minister of National Defense, visited Hanwha Aerospace during his trip to Korea and showed interest in domestic weapon systems such as the K-9 self-propelled howitzer. Taking advantage of President Yoon's visit to Vietnam, Hanwha Aerospace plans to discuss the export of the K-9 self-propelled howitzer with the Vietnamese government.

The securities industry sees further upside potential for defense stocks. With the prolonged Russia-Ukraine war and intensifying U.S.-China conflicts leading to a new Cold War, military competition is intensifying, highlighting the competitiveness of Korean defense companies. In fact, global defense spending increased by 3.7% in 2022 compared to 2021. According to Jane’s, a UK-based private military intelligence consulting firm, major countries' defense budgets are expected to grow by more than 5% annually until 2025.

The increase in national defense budgets worldwide is a positive factor for Korea's defense industry. Contracts for Korean defense companies' weapon exports began to surge from 2021. The average annual order amount from 2013 to 2020 was 3.14 billion USD (about 4 trillion KRW), which rose to 7.25 billion USD (about 9.3 trillion KRW) in 2021, and reached a record high of 17.3 billion USD (about 22.2 trillion KRW) last year.

Lee Jae-kwang, a researcher at NH Investment & Securities, analyzed, “Military competition led by the U.S. and China continues, and with the post-pandemic era opening, demand for air transport is recovering, sustaining the recovery of commercial aircraft. The full-scale onset of the new Cold War era will enable structural growth in aerospace and defense industries.” Lee Dong-heon, a researcher at Shinhan Investment Corp., also said, “The stock prices of 11 defense and machinery sector companies rose 18% from the beginning of the year, outperforming the KOSPI average return of 11% during the same period. Diplomatic tensions are unlikely to ease easily, and with overseas sales increases such as Poland’s K9 and Cheonmu, defense stocks’ performance is expected to trend upward.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.